Gold holds steady near $3,390 as Fed projects two cuts in 2025

- Fed leaves rates unchanged at 5.25%–5.50%, as expected, citing solid economic growth.

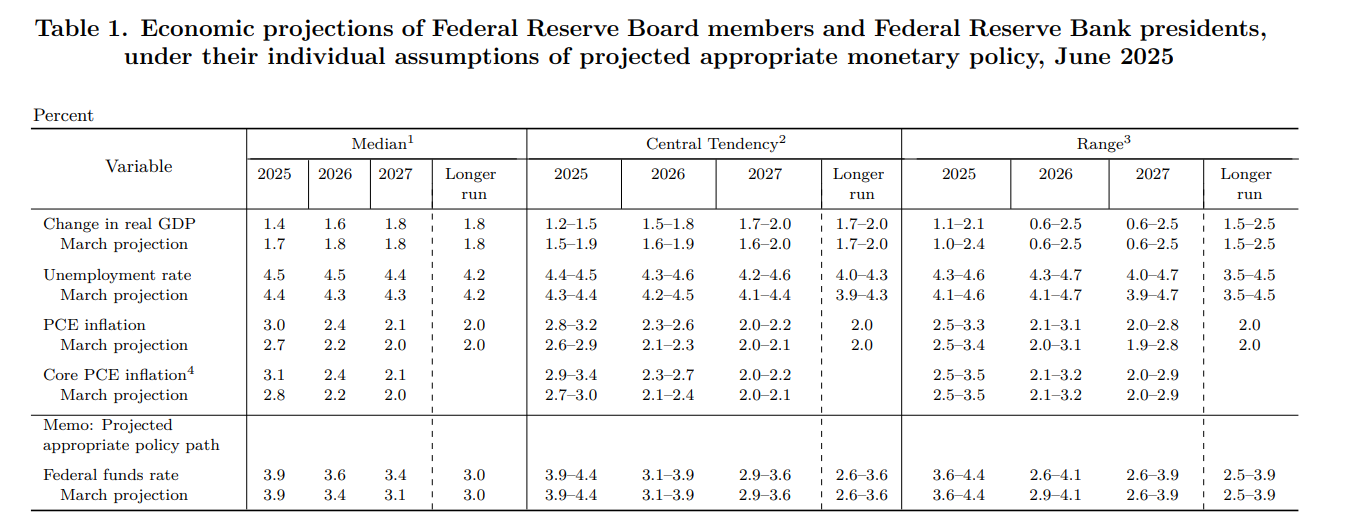

- Summary of Economic Projections shows two rate cuts in 2025, GDP outlook trimmed.

- Gold trades flat as markets digest dovish tilt despite sticky core inflation forecast.

Gold price holds firm near $3,390 as the Federal Reserve decided to hold rates unchanged at the June 18 meeting. The Summary of Economic Projections (SEP) reveals that officials are still eyeing 50 basis points of easing in 2025. At the time of writing, the XAU/USD trades with minimal losses of 0.08%.

XAU/USD shrugs off minimal losses as Fed keeps rates steady and signals 50 bps of easing next year.

The Fed kept the fed funds rate at 4.25%-4.50% as expected and said that the economy continued to expand solidly, that the unemployment rate remains low, and labor conditions remain solid. The Committee noted that it “is attentive to the risks to both sides of its dual mandate,” and that it will continue to reduce its holdings of Treasuries.

The SEP revealed that Fed officials expect 2025 Gross Domestic Product (GDP) slightly lower from March’s 1.7% to 1.4%, and the Unemployment Rate a tenth up at 4.5%. The core PCE inflation was upwardly revised from 2.8% to 3.1%, and the Federal funds rate remained unchanged at 3.9%. This suggests that policymakers are considering two 25-basis-point rate cuts this year.

Source: Federal Reserve Summary of Economic Projections

Gold’s reaction

XAU/USD remained within familiar levels, as traders await Fed Chair Powell's press conference. The first key resistance level to consider is $3,400, followed by the June 16 high of $3,452, and then $3,500. On the flip side, the $3,350 is up next, followed by the 50-day SMA at $3,301, with an additional downside seen at May 29 low of $3,245.