Trump team dumps $500M in TRUMP tokens, retains 85% supply

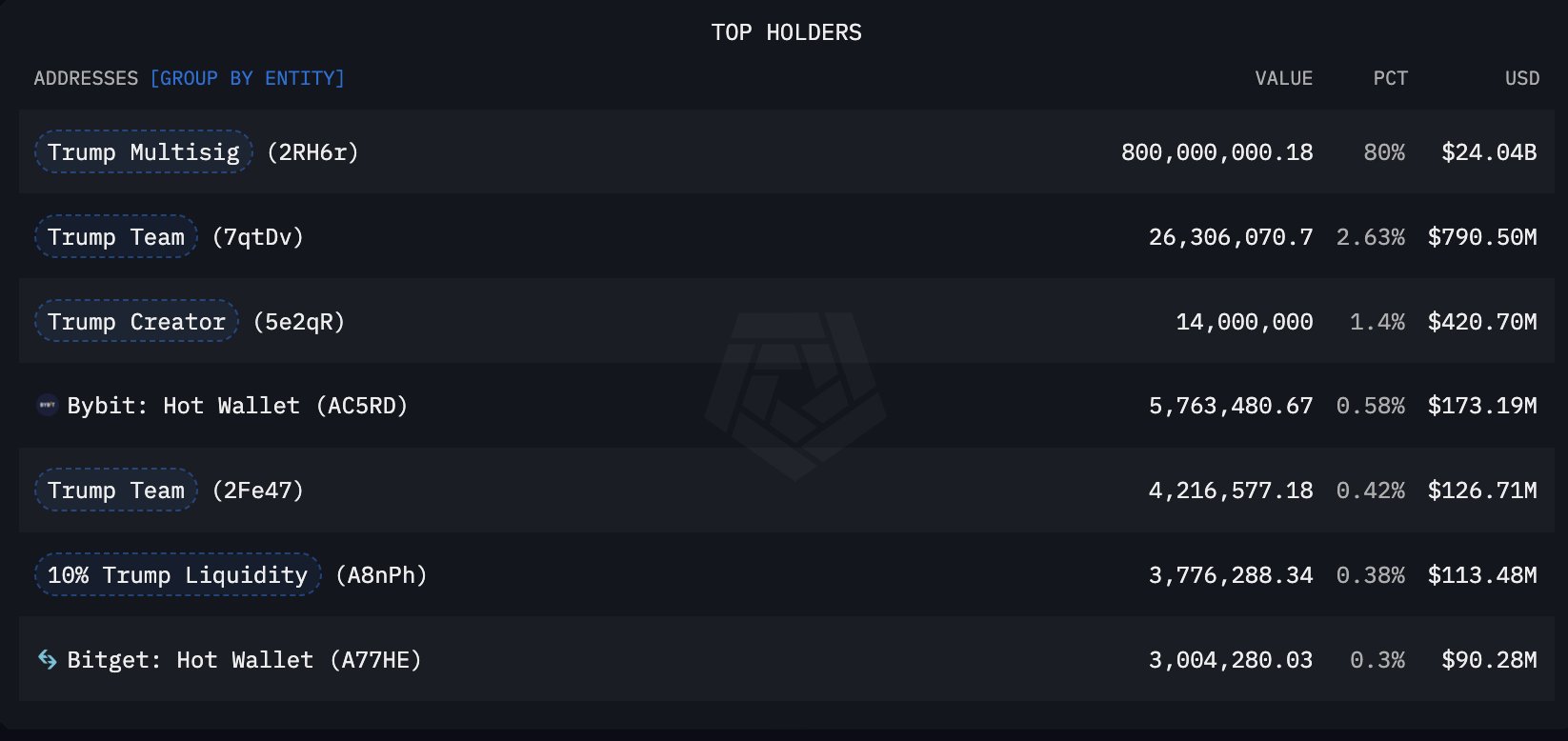

The Trump team has offloaded $500 million worth of their newly launched TRUMP tokens, holding on to 85% of the total supply, according to blockchain analyst Conor.

“From what I can see on-chain, Trump has sold approximately $500 million of tokens so far,” Conor said, adding that every single circulating token has either been sold or provided as liquidity.

Data shows $20 million worth of TRUMP tokens were sent to Bybit in just seven hours, while most of the USDC reserves tied to these transactions were funneled into liquidity provision on Meteora.

How TRUMP tokens are controlled and distributed

This aggressive token dump comes hot on the heels of the TRUMP token’s debut, which the self-proclaimed “crypto president” Donald Trump announced on Truth Social late Friday. Trump described the memecoin as a celebration of “WINNING” the election and his upcoming inauguration.

Since its launch, TRUMP’s price has surged by over 11,000%, hitting an all-time high of $35 just an hour earlier. It has since corrected to $26 as of press time. It has a market capitalization of nearly $6 billion, according to data from CoinMarketCap.

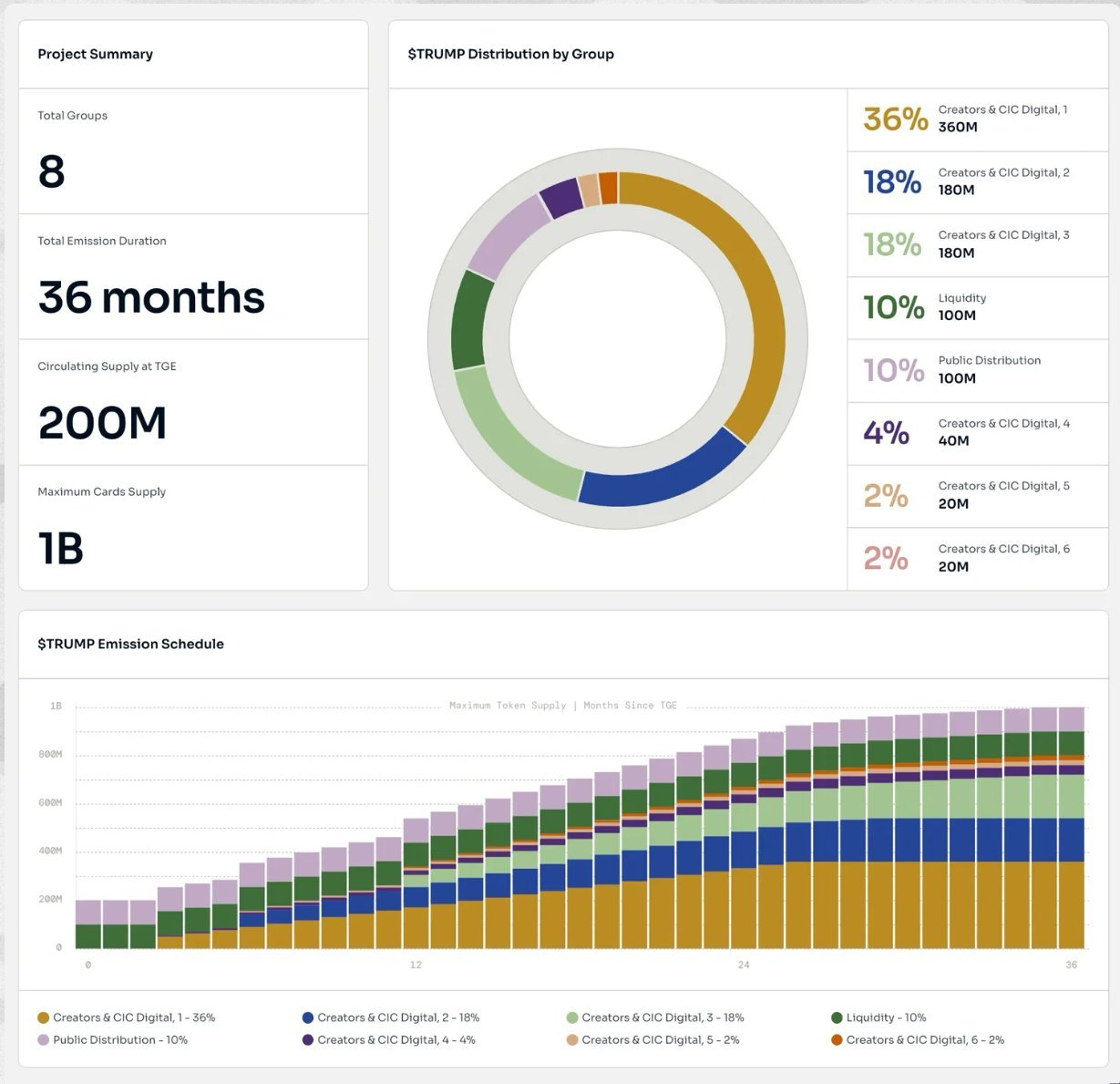

The token was developed on the Solana blockchain and launched with an initial supply of 200 million coins. However, the overall supply is planned to expand to 1 billion over the next three years, as stated on its official website.

Right now, 80% of the tokens remain locked away under the control of two entities: CIC Digital LLC, a Trump Organization affiliate, and Fight Fight Fight LLC, a Delaware-based company registered on January 7.

Both companies will receive undisclosed revenues from the token’s trading activity. Conor pointed out that the terms “public distribution” and “liquidity” listed on the TRUMP website appear to mean “we’re going to sell.”

The token’s website also comes with a disclaimer that reads:

“Trump Memes are intended to function as an expression of support for, and engagement with, the ideals and beliefs embodied by the symbol “$TRUMP” and the associated artwork, and are not intended to be, or to be the subject of, an investment opportunity, investment contract, or security of any type. GetTrumpMemes.com is not political and has nothing to do with any political campaign or any political office or governmental agency.”

Meanwhile, Moonshot said that in the last 12 hours, they were featured on the website as THE way to buy the token. They have since processed nearly $400m in volume, crushed fiat onramp records by orders of magnitude, and brought over 200,000 new people on-chain.

Meteora, Moonshot, Wintermute, and Jupiter may have coordinated with the TRUMP token team in advance.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap