Algorand Price Forecast: ALGO bulls aim for double-digit gains

- Algorand price extends its gains on Thursday after rallying more than 19% the previous day.

- The Algo insights report shows that ALGO’s RWA TVL increased 34.6% and 64.5% of the year’s follower growth on X.

- On-chain data paints a bullish picture as ALGO’s open interest rises, and the long-to-short ratio is above one.

Algorand (ALGO) price extends its gains, trading around $0.469 on Thursday after rallying more than 19% the previous day. The Algo insights report shows that ALGO’s RWA TVL increased 34.6% and 64.5% of the year’s follower growth on X. Additionally, on-chain data also paints a bullish picture as ALGO’s open interest rises, and the long-to-short ratio is above one, all hinting at double-digit gains on the horizon.

Algorand price looks promising

Algorand price found support around its 200-day Exponential Moving Average (EMA) at $0.307 on Monday and rallied 27.28% in the next two days, closing above its daily resistance level of $0.423. At the time of writing on Thursday, it continues to trade higher, around $0.469.

If ALGO continues its upward momentum, it could extend the rally by 30% from its current levels to test its December 3 high of $0.615.

The Relative Strength Index (RSI) on the daily chart reads 64, above its neutral level of 50 and points upwards, indicating bullish momentum. The Moving Average Convergence Divergence (MACD) also shows a bullish crossover on Wednesday, giving buy signals and suggesting an upward trend.

ALGO/USDT daily chart

The Algo insights report on Tuesday also projects a bullish outlook for Algorand. According to the report, the Total Value Locked (TVL) in the Real World Asset (RWA) increased by 34.6% from $57 million to $77 million in the second half of last year, driven primarily by expanding asset tokenization on Lofty.

Moreover, Algorand’s social media presence ended 2024 on a particularly strong note. Engagement rates jumped to 7.2% in Q4, significantly outperforming the 4.3% rate in Q1-Q3. Perhaps most notably, 64.5% of the year’s total follower growth for X occurred in Q4, with 13,196 new followers joining the community compared to 7,251 combined in the first three quarters.

2024 ended on a high for Algorand.

— Algorand Foundation (@AlgoFoundation) January 14, 2025

RWA TVL increased by 34.6% from $57 million to $77 million in the second half of last year, driven primarily by expanding asset tokenization on @lofty_ai ️

64.5% of the year’s follower growth on X occurred in Q4, with 13,196 new followers… pic.twitter.com/iG396rVrR1

Algorand on-chain metrics show positive bias

Looking at ALGO’s Open Interest (OI) further boosts the bullish outlook. Coinglass’s data shows that the futures’ OI in ALGO at exchanges rose from $95.10 million on Tuesday to $156.46 million on Friday, the highest level since December 9. An increasing OI represents new or additional money entering the market and new buying, which suggests a rally ahead in the Algorand price.

ALGO Open Interest chart. Source: Coinglass

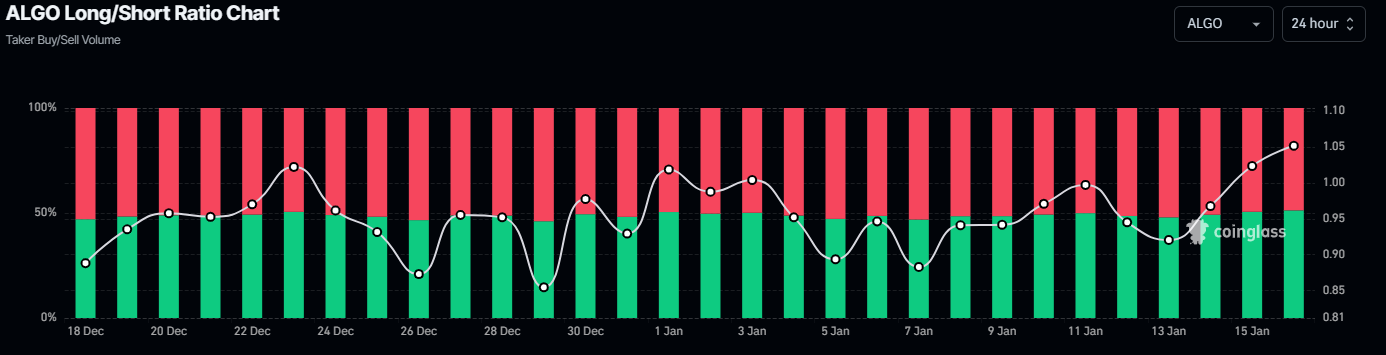

Another bullish sign is Coinglass’s ALGO long-to-short ratio, which reads 1.05, the highest level in over a month. This ratio above one reflects bullish sentiment in the markets as more traders are betting for the ALGO price to rise.

ALGO long-to-short ratio chart. Source: Coinglass