Forex Today: US Dollar remains within weekly range ahead of employment data

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Here is what you need to know on Friday, September 5:

The action in financial markets quiet down early Friday as investors stay on the sidelines ahead of the highly-anticipated August employment report from the US, which will feature Nonfarm Payrolls (NFP), Unemployment Rate and wage inflation figures. Statistics Canada will publish August jobs data as well.

The US Dollar (USD) Index edged higher in the second half of the day on Thursday but lost its traction to close the day with small gains as risk flows dominated the action in the American session. The data from the US showed that the Institute for Supply Management's (ISM) Services Purchasing Managers' Index (PMI) improved to 52 in August from 50.1 in July. This print came in better than the market expectation of 51. Meanwhile, the Automatic Data Processing (ADP) reported that private sector payrolls rose by 54,000 in August, falling short of analysts' estimate of 65,000.

US Dollar Price This week

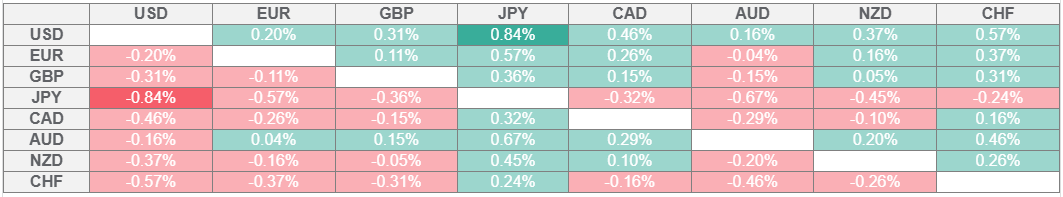

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

In the European morning on Friday, the USD Index fluctuates in a tight range above 98.00. Nonfarm Payrolls in the US are forecast to increase by 75,000 in August and the Unemployment Rate is seen ticking up to 4.3% from 4.2% in July. In the meantime, US stock index futures were last seen rising between 0.15% and 0.45%. US President Donald Trump said late Thursday that his administration would impose 100% tariffs on semiconductor imports from firms not moving production to the US.

The UK's Office for National Statistics (ONS) reported early Friday that Retail Sales rose by 0.6% on a monthly basis in July. This print followed the 0.3% increase recorded in June and came in better than the market expectation of 0.2%. This data failed to trigger a noticeable reaction in GBP/USD, which was moving sideways at around 1.3450 at the time of press.

After closing marginally lower on Thursday, EUR/USD holds its ground and trades in positive territory above 1.1650.

USD/JPY struggles to build on Thursday's gains and declines toward 148.00 in the European session on Friday. US President Trump signed an executive order implementing his trade agreement with Japan, which calls for a maximum 15% tax on most of Japan's imports, including automobiles and parts.

USD/CAD stays in negative territory at around 1.3800 after closing the previous four trading days higher. The Unemployment Rate in Canada is expected to edge higher to 7% in August.

Gold corrected from the record-high it set above $3,570 but found support before testing $3,500. XAU/USD holds steady at around $3,550 in the European morning on Friday.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.