Bitcoin ETF Among Assets in Question for Trump’s Treasury Pick Scott Bessent

Scott Bessent, nominated by President-elect Donald Trump as Treasury Secretary, faces a significant financial restructuring if confirmed by Congress.

This process includes divesting several investments to comply with ethical standards for public office.

Bitcoin ETF Stake Under Review for Treasury Nominee

Bessent holds a substantial stake in BlackRock’s Bitcoin exchange-traded fund (ETF), IBIT, valued between $250,001 and $500,000. This ETF manages over $50 billion in assets, making it the largest spot Bitcoin fund globally.

Bessent’s investment aligns with his well-known support for cryptocurrency. The Treasury Secretary nominee has championed as a tool for financial empowerment and a viable option for younger investors seeking alternatives to traditional finance.

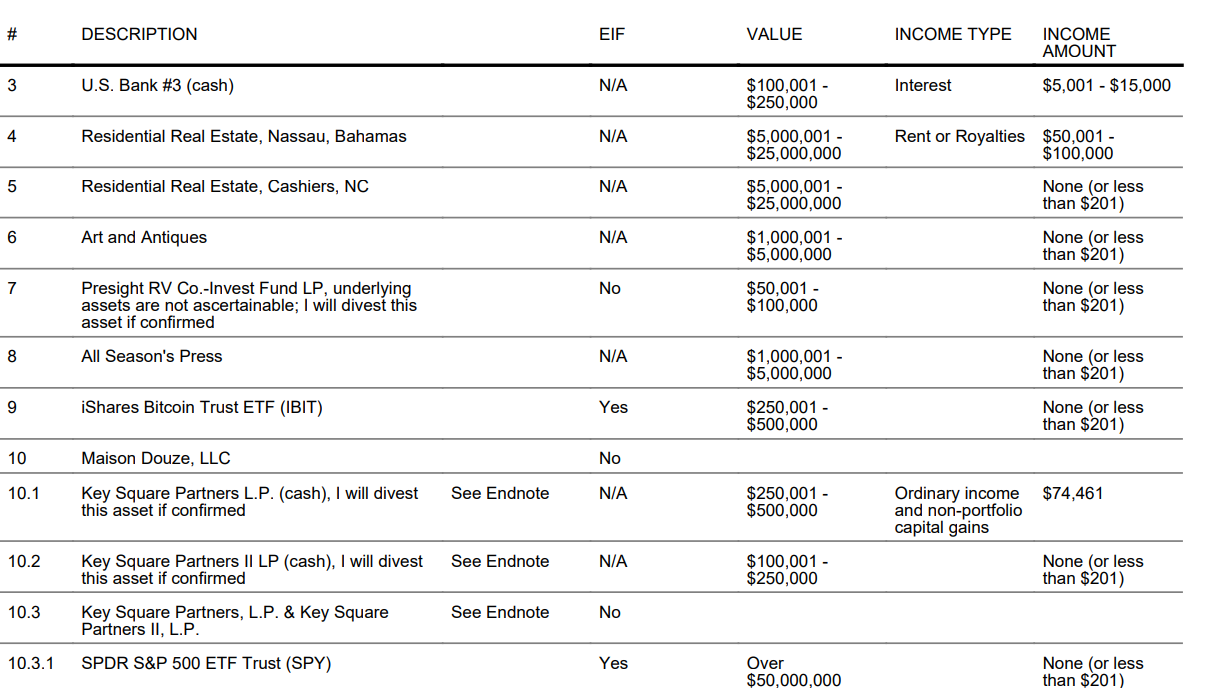

Scott Bessent Bitcoin ETF Holdings. Source: US Office of Government Ethics

Scott Bessent Bitcoin ETF Holdings. Source: US Office of Government Ethics

Beyond his Bitcoin ETF stake, Bessent’s financial disclosures reveal a diverse and expansive portfolio. His assets include major investments in leading ETFs such as the SPDR S&P 500 Trust (SPY), Invesco QQQ Trust (QQQ), and Invesco S&P 500 Equal Weight ETF (RSP). Additionally, he holds smaller stakes in gold and silver trusts, reflecting a broader interest in diversified asset classes.

His total financial assets, as disclosed, are valued at approximately $521 million. The report indicates several high-value holdings, including hedge fund-linked investments, US Treasury bills, and currency market positions.

Bessent must sell some of these assets within 90 days to avoid potential conflicts of interest if Congress confirms him. He will also resign from his role at Key Square Group, the hedge fund he founded, and sell his shares in the company.

Meanwhile, Mathew Sigel, head of research at VanEck, has raised questions about whether Bessent will also need to sell his Bitcoin ETF holdings. Notably, Bessent’s financial disclosures had highlighted the assets he would be divesting.

His confirmation hearing is scheduled for January 16, 2025. As Treasury Secretary, he will play a key role in advancing the economic policies of the incoming administration and shaping strategies for fiscal and financial reform.