What Crypto Whales Are Buying for Potential Gains in January 2025

It’s the first few days of another year, and as usual, investors want to know what cryptos are whales buying. True to form, crypto whales, known for their ability to influence the market significantly — are already making strategic moves that could set the tone for 2025.

According to BeInCrypto’s findings, these whales are accumulating established tokens. They also appear to be scouting undervalued altcoins with the potential to break out. That said, these are the top altcoins that crypto whales are buying for potential gains in January 2025.

Hyperliquid (HYPE)

Top of this month’s list is HYPE, the native token of decentralized perpetual exchange Hyperliquid. In the last 90 days, HYPE’s price has increased nearly 600%, making it one of the best-performing altcoins in the top 100.

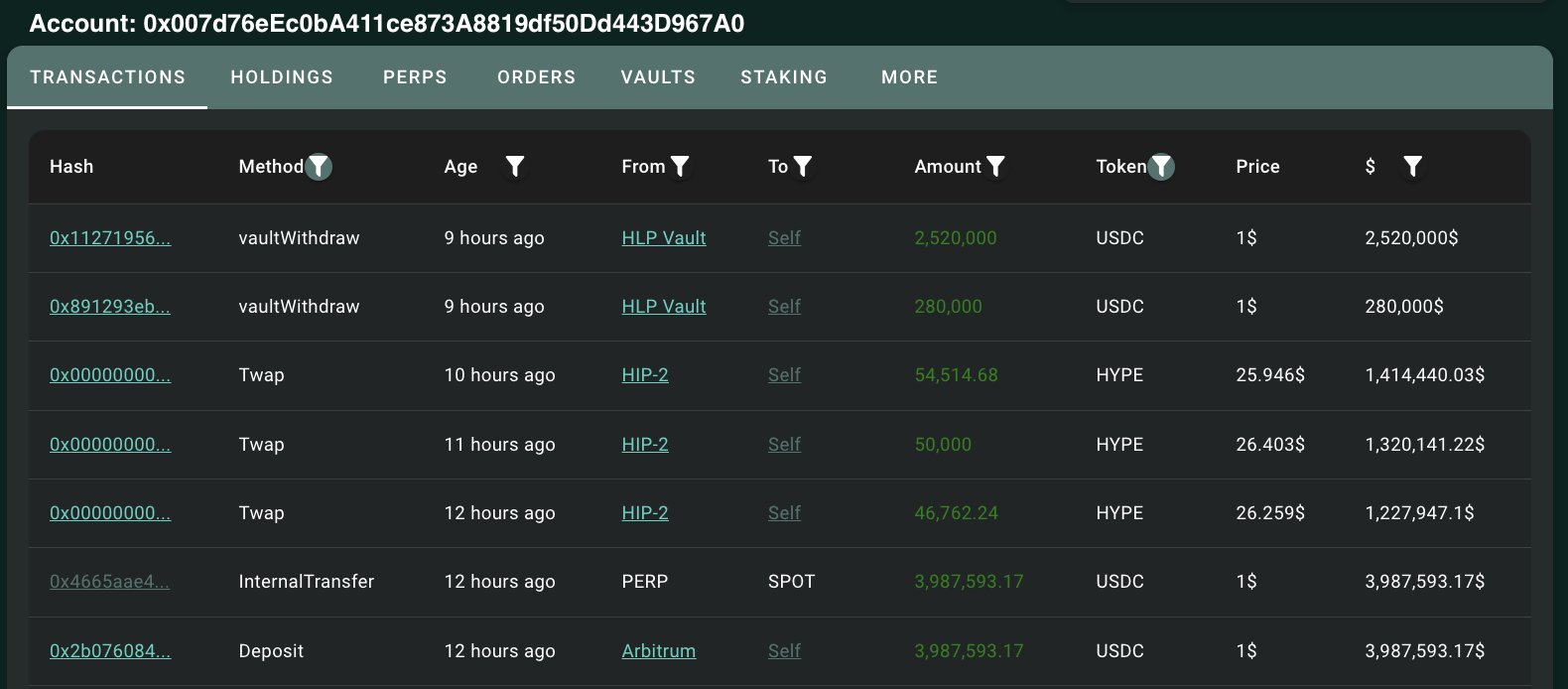

However, in the last 24 hours, the token has dropped nearly 15%. This suggests that the token may have provided an unexpected “buy the dip” opportunity. Following the decline, data from Spot On Chain shows that crypto whales have taken advantage of the chance to scoop HYPE in large volumes.

According to the on-chain data provider, one whale purchased 151,277 HYPE on January 2. On the same day, another crypto whale purchased $2.76 million worth of the altcoin, with a third buying 37,017 HYPE.

Hyperliquid Whales Accumulation. Source: Spot On Chain

Hyperliquid Whales Accumulation. Source: Spot On Chain

Should this kind of accumulation continue this month, then HYPE’s price is likely to bounce from the recent lows. However, traders might need to watch out. If whales decide to stop accumulating, a significant uptick might not happen.

Cardano (ADA)

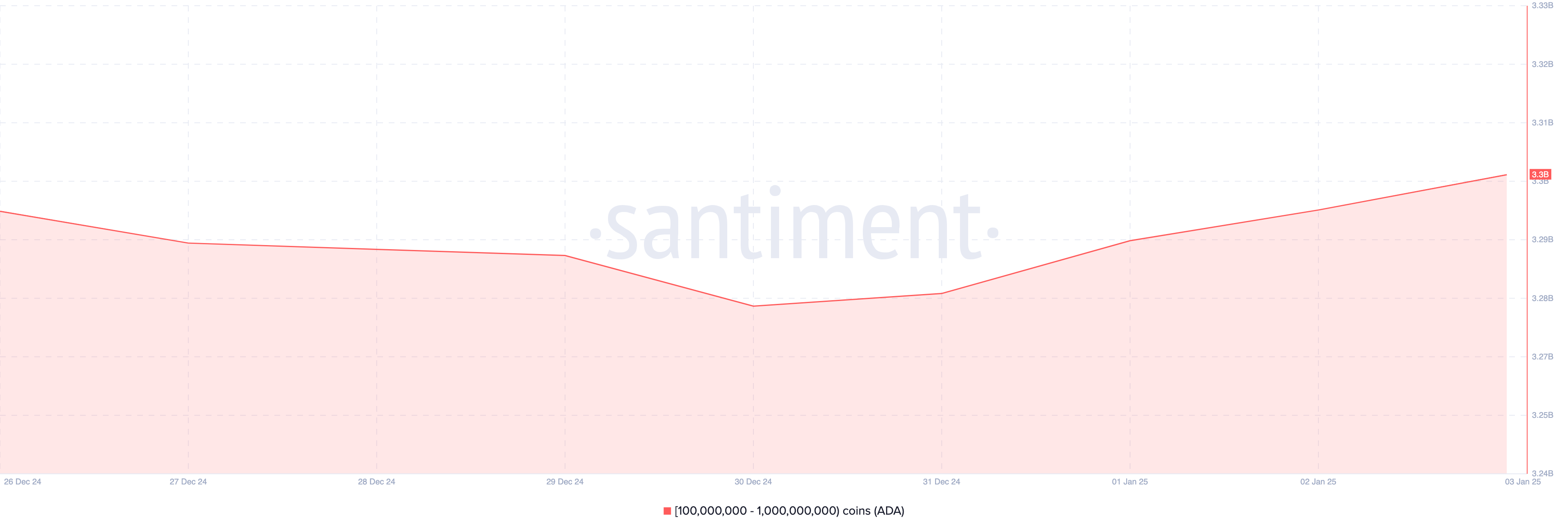

Second on the list of what cryptos are whales buying is ADA, whose price has increased by 12.04% in the last 24 hours while trading at $1.04. On December 30, 2024, the number of ADAs held by Cardano addresses with 100 million to 1 billion tokens in the wallets was 3.28 billion.

Today, the figure has increased to 3.30 billion, indicating that crypto whales accumulated about 20 million ADA within the last four days. Historically, an accumulation like this is a bullish sign, suggesting that the altcoin could see further price acceleration before January 2025 ends.

Cardano Balance of Addresses. Source: Santiment

Cardano Balance of Addresses. Source: Santiment

However, if selling pressure outpaces these purchases, things might change, and Cardano’s price might slide below $1.

XRP (XRP)

XRP’s inclusion as a crypto whale favorite might not surprise market observers. On several occasions, these key stakeholders have resolved to keep buying the token irrespective of the price action. Due to the consistent buying, the price of the third most valuable cryptocurrency, in terms of market cap, has risen by 350% in the last 90 days.

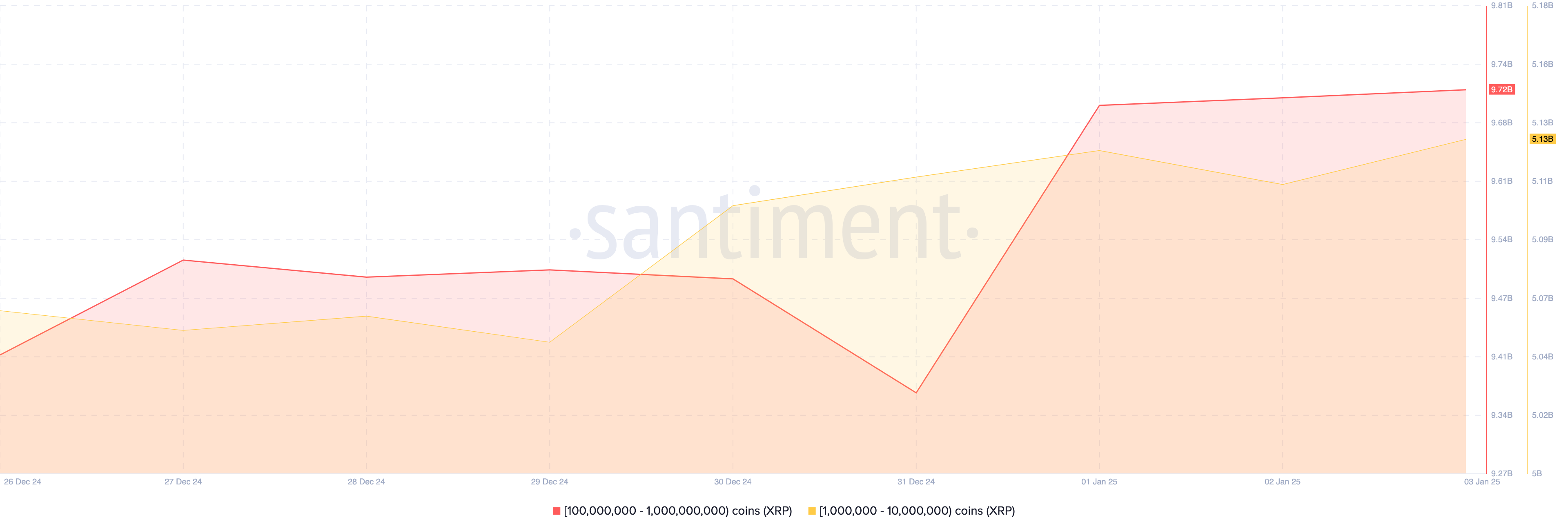

According to Santiment, different XRP cohorts have decided to buy the altcoin for potential gains in January 2025. For instance, addresses holding 1 million to 10 million tokens increased their assets from 5.05 billion to 5.13 billion.

Since December 29, 2024, those holding between 100 million and 1 billion XRP have increased their balance from 9.42 billion to 9.72 billion. In total, crypto whales purchased 380 million tokens valued at $912 million.

XRP Balance of Addresses. Source: Santiment

XRP Balance of Addresses. Source: Santiment

With this buying pressure, the XRP price is likely to surpass $3 before the end of this month. However, if whales begin to sell, this prediction might not come to pass.