Ethereum (ETH) Return to $4,000 Imminent Once It Clears This Resistance

Since Ethereum’s (ETH) price fell below $4,000 on December 17, it has struggled to reclaim that level, fueling speculation that ETH might not return to the zone before the end of 2024.

However, a 5% price increase in the last 24 hours suggests sentiment might be shifting. For Ethereum to retest the $4,000 mark, several key factors must align. Here’s what needs to happen.

Ethereum Holders Get Set to Break the Hurdle

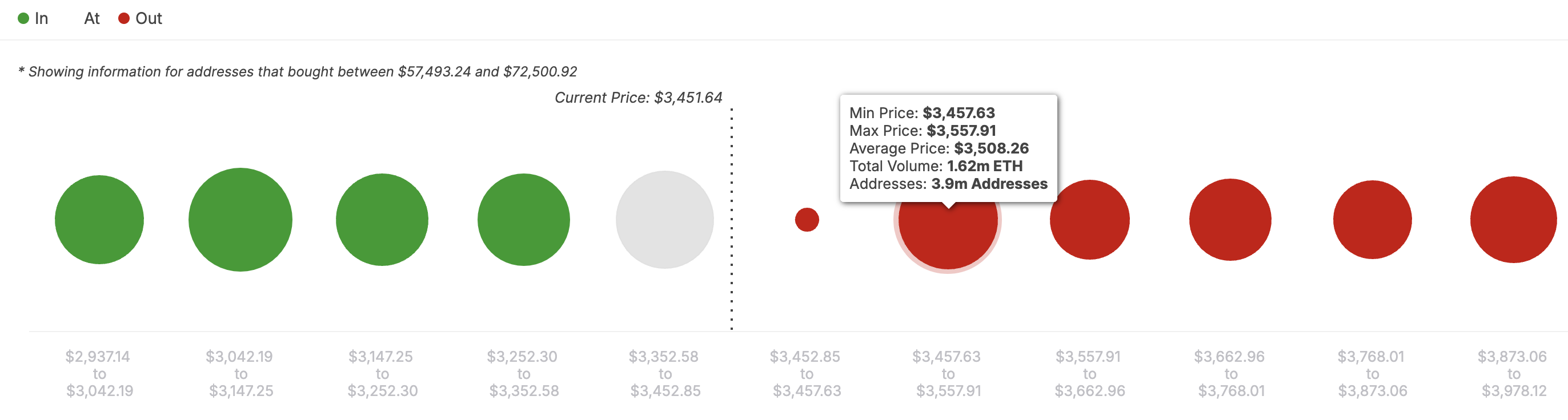

According to the In/Out of Money Around Price (IOMAP), Ethereum price holds strong support at $3,352. At this point, 3.34 million Ethereum addresses hold 3.18 million coins and are in profit.

The IOMAP classifies addresses based on unrealized profits, losses, or breakeven points. The larger the volume or addresses at an accumulation range, the stronger the support or resistance. Therefore, a higher volume out of the money signals stronger resistance, while a higher volume in the money indicates stronger support.

As seen below, the major resistance for Ethereum price to surpass lies at $3,508. Here, 3.90 million Ethereum addresses purchased 1.62 million ETH. Therefore, if buying pressure increases, the cryptocurrency’s value might surpass this hurdle and trade closer to $4,000.

Ethereum In/Out of Money Around Price. Source: IntoTheBlock

Ethereum In/Out of Money Around Price. Source: IntoTheBlock

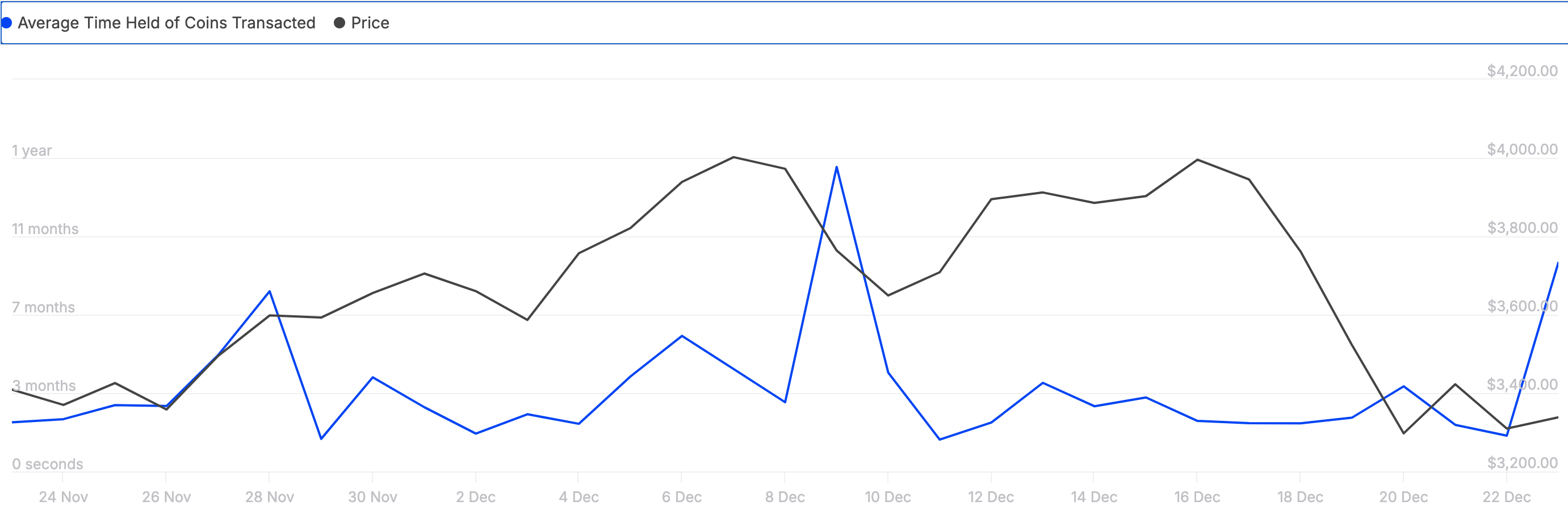

Another indicator supporting the bullish bias is the Coins Holding Time. As the name states, the coin holding Time measures the period a cryptocurrency has been held without being sold or transacted.

The higher the holding time rises, the longer holders have refrained from selling. Also, when the holding time decreases, it indicates that investors are selling.

Based on IntoTheBlock’s data, Ethereum’s holding time has increased by 332% in the last seven days. Should this trend continue, then Ethereum’s bullish thesis mentioned above might be validated.

Ethereum Coins Holding Time. Source: IntoTheBlock

Ethereum Coins Holding Time. Source: IntoTheBlock

ETH Price Prediction: Higher Values Soon?

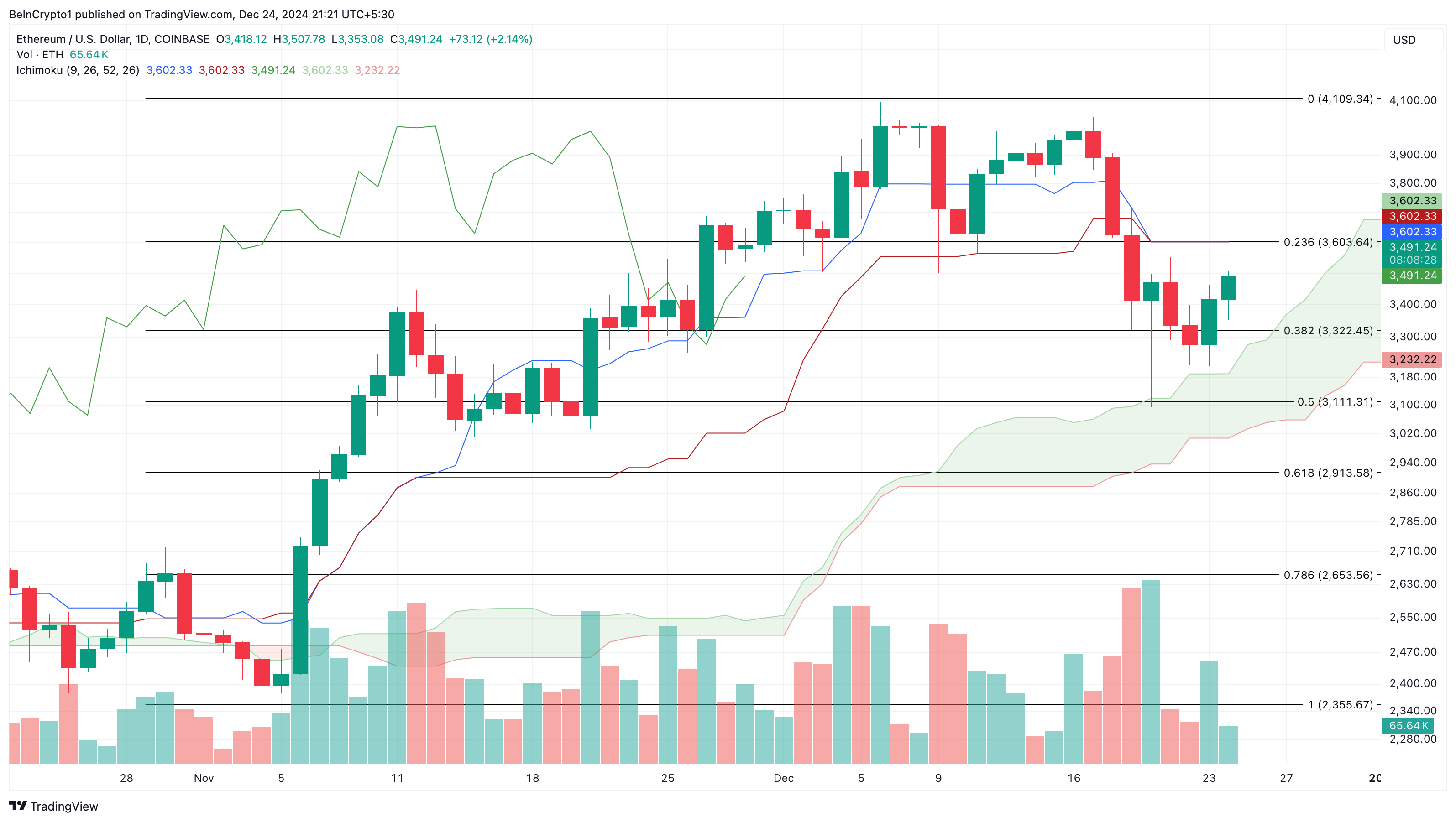

From a technical outlook, ETH has risen above the Ichimoku cloud. The Ichimoku Cloud is an indicator that spots support and resistance. When the cloud is above the price, it indicates resistance.

But when the price is above the cloud, it indicates support, which could drive the price higher. Therefore, for ETH, the cryptocurrency’s value might climb to $4,109. If bulls hold the line above $4,000, the value could rise as high as $4,500.

Ethereum Daily Analysis. Source: TradingView

Ethereum Daily Analysis. Source: TradingView

However, if bears take over, this might not be the case. In that scenario, Ethereum’s price could decline to $3,111. Should selling pressure intensify, the price might decrease below $3,000.