Bitcoin Price Forecast: BTC slightly recovers after sharp sell-off following Fed rate cut decision

Bitcoin price today: $102,000

- Bitcoin price recovers slightly, trading around $102,000 on Thursday after dropping 5.5% due to the Fed’s hawkish rate-cut decision the previous day.

- Whales, corporations, and institutional investors bought BTC’s recent dips.

- Traders should remain cautious as the Bitcoin NPL metric shows signs of profit-taking.

Bitcoin (BTC) recovers slightly, trading around $102,000 on Thursday after dropping 5.5% the previous day. Whales, corporations, and institutional investors saw an opportunity to take advantage of the recent dips and added more BTC to their holdings. However, traders should remain cautious as Bitcoin’s Network Realized Profit/Loss (NPL) metric shows signs of profit-taking.

Bitcoin dips below $100K, whales, corporations and institutional investors continue buying

Bitcoin price recovers slightly, trading around $102,000 on Thursday after declining 5.5% the previous day.

The recent decline in Bitcoin was fueled by the hawkish rate-cut decision by the US Federal Reserve (Fed) during Wednesday’s Federal Open Market Committee (FOMC) meeting. The Fed reduced the federal funds rate to a lower range of 4.25% to 4.50%, as expected, but signaled a slowdown in interest rate cuts in 2025, leading risky assets like Bitcoin to decline.

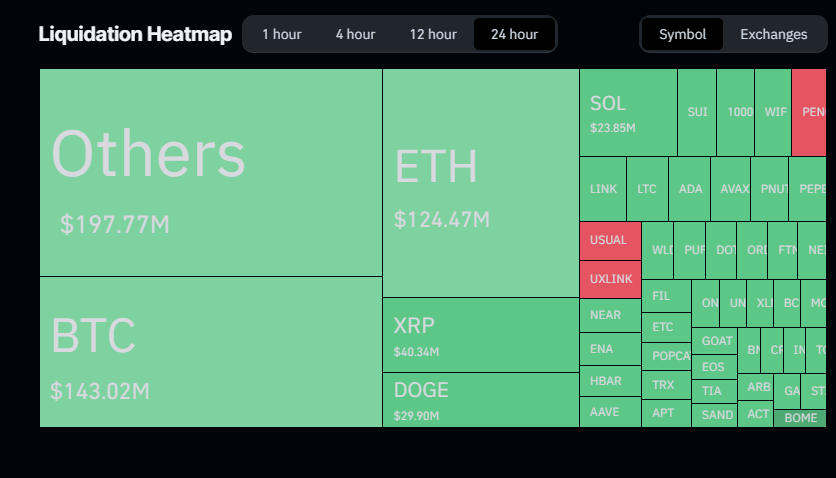

The correction in Bitcoin’s price on Wednesday triggered a wave of liquidations, resulting in over $780.32 million in total liquidations and more than $143 million specifically in BTC, according to data from CoinGlass.

Liquidation chart. Source: Coinglass

Moreover, during the meeting, Fed Chair Jerome Powell said, “We’re not allowed to own Bitcoin”.

JUST IN: Fed Chair Jerome Powell says "we're not allowed to own #Bitcoin" pic.twitter.com/SQnNfqnTni

— Bitcoin Magazine (@BitcoinMagazine) December 18, 2024

“Fed policy indirectly impacts the cryptocurrency market,” said Ruslan Lekha, Chief of Markets at YouHodler, a Swiss-based Web3 platform, told FXStreet.

Lekha explained that cryptocurrencies have become increasingly integrated into traditional finance due to the growing correlation between crypto and traditional financial instruments.

“While the administration can directly influence the crypto market through policy decisions and regulatory actions, the Fed’s role is limited to managing monetary policy, which indirectly affects crypto via its impact on liquidity and investor sentiment in the financial ecosystem,” Lekha added.

Despite Bitcoin’s recent dip below the $100K mark, whales and corporates added more holdings to their portfolios. According to Lookonchain data, Marathon Digital (MARA) added 1,627 BTC worth $166 million on Wednesday. Additionally, three whale wallets bought 1,153 BTC worth $120 million after the price pullback.

On-chain data shows that Marathon Digital(@MARAHoldings) has accumulated 1,627 $BTC($166M) in the past 8 hours.https://t.co/9DlN5ZPsBz pic.twitter.com/3KQUfyJnJY

— Lookonchain (@lookonchain) December 19, 2024

3 whales bought 1,153 $BTC($120M) after the $BTC price pullback.

— Lookonchain (@lookonchain) December 18, 2024

bc1qkv...t44v withdrew 501 $BTC($52.24M) from #Bitfinex 30 minutes ago.

bc1pjq...sjpc withdrew 551.5 $BTC($57.28M) from #Binance in the past 2 hours.

1L7gnf...xeTs withdrew 100 $BTC($10.42M) from $Binance 1 hour… pic.twitter.com/FEyp8BvwI6

Hut 8 Corp (HUT), an energy infrastructure and Bitcoin miners company, announced that it purchased 990 BTC worth $100 million at an average price of $101,710 per Bitcoin on Wednesday. Combined with the Bitcoin held before this purchase, Hut 8’s strategic Bitcoin reserve now totals 10,096 BTC with a market value of more than $1 billion.

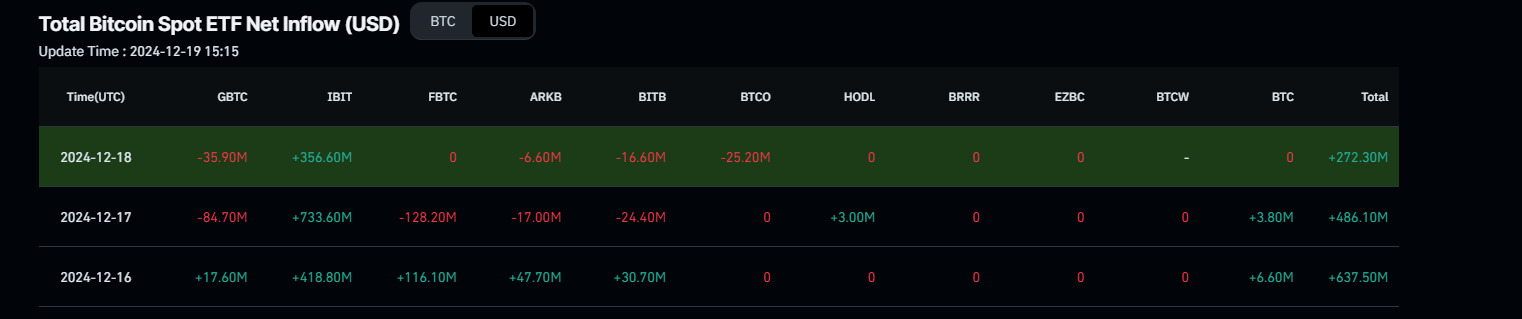

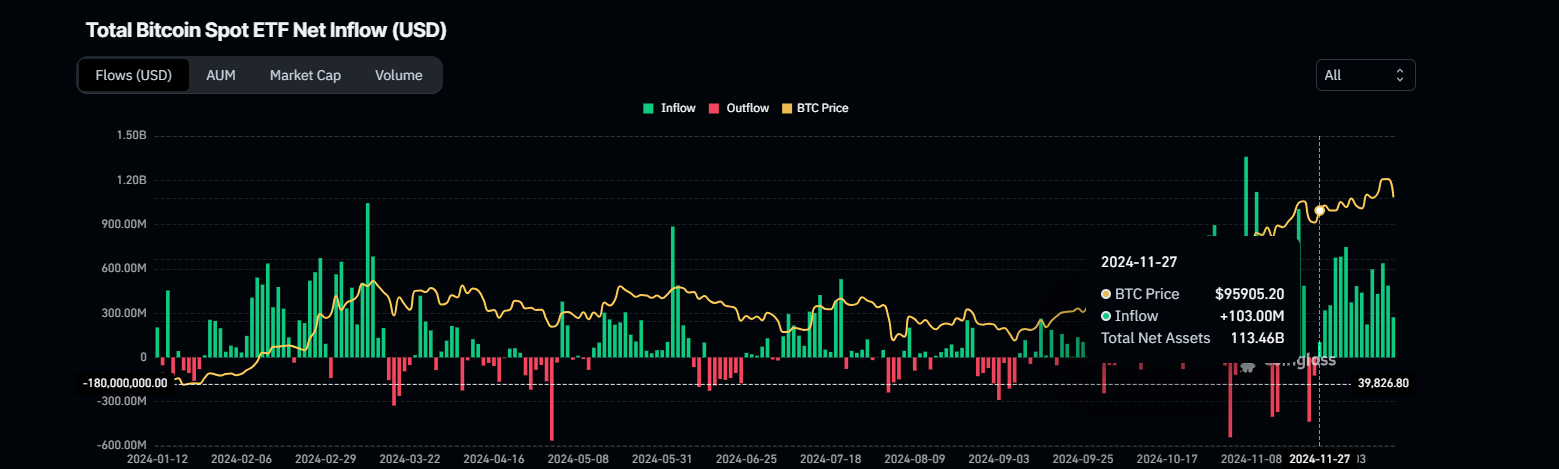

Institutional demand also remains strong. According to Coinglass, Bitcoin spot Exchange Traded Funds (ETF) data recorded a $272.30 million inflows on Wednesday, continuing its streak of inflows since November 27. If the inflow trend persists or accelerates, it would act as a cushion for Bitcoin price drops.

Total Bitcoin Spot ETF Net Inflow chart. Source: Coinglass

However, traders should remain cautious as the Bitcoin Network Realized Profit/Loss (NPL) metric shows recent spikes indicating signs of profit-taking. If this trend continues or intensifies, Bitcoin could see a correction in the upcoming days.

[14.43.08, 19 Dec, 2024]-638702150843009083.png)

Bitcoin NPL chart. Source: Santiment

Bitcoin Price Forecast: BTC recovers as it retests $100K support level

Bitcoin price declined 5.5% on Wednesday, reaching a daily low of $100,000 and closing just above $100,200. On Thursday, BTC dipped below the $100k level during the early Asian session but recovers and trades around $102,000 while writing in the European session.

If BTC closes below the $100,000 psychological support level, it could extend the decline by 10% to retest the $90,000 support level.

The Relative Strength Index (RSI) momentum indicator in the daily chart hovers just above the neutral level of 50, indicating indecisiveness among traders. However, the Moving Average Convergence Divergence (MACD) indicator showed a bearish crossover on Wednesday, suggesting a downward trend.

BTC/USDT daily chart

If BTC continues its recovery and closes above its all-time high (ATH) of $108,353, it could extend the rally to test $119,510. This level aligns with the 141.4% Fibonacci extension line drawn from the November 4 low of $66,835 to the December 5 high of $104,088.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.