Bitcoin ETFs Surpass Satoshi Nakamoto’s Estimated 1.1 Million BTC Holdings

Spot Bitcoin ETFs in the US now hold more Bitcoin than the estimated 1.1 million BTC associated with Bitcoin’s pseudonymous creator, Satoshi Nakamoto.

This marks a significant milestone as the combined holdings of the US spot Bitcoin ETFs reached 1,105,923 BTC.

A New Milestone for Bitcoin ETFs

BlackRock’s IBIT ETFs in terms of assets under management, followed by Grayscale’s GBTC and Fidelity’s FBTC. Overall, the 12 Bitcoin ETFs in the US have collectively generated over $33 billion in net inflows since their launch in January.

This week alone, the funds saw nearly $2.35 billion net inflow. Bitcoin’s $100,000 milestone has pushed the total assets under management for these ETFs beyond $109 billion.

Bitcoin ETFs Weekly Net Inflow from August to December. Source: SoSoValue

Bitcoin ETFs Weekly Net Inflow from August to December. Source: SoSoValue

Satoshi Nakamoto is believed to have mined approximately 22,000 of Bitcoin’s first blocks, earning 50 BTC per block under the initial subsidy rules, resulting in an estimated 1.1 million BTC. These coins have remained untouched since their creation.

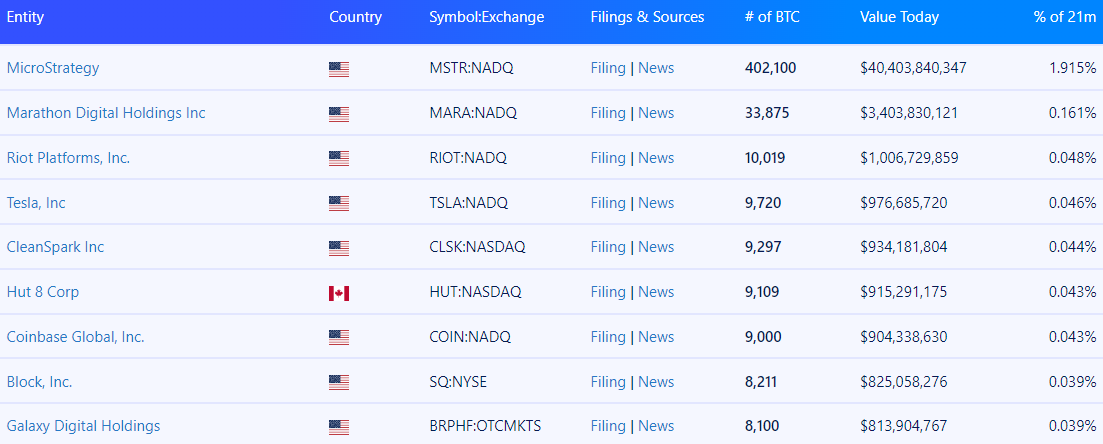

While Satoshi Nakamoto remains the largest individual Bitcoin holder, several entities have significant stakes in the cryptocurrency. MicroStrategy leads corporate holdings with 402,100 BTC, valued at over $40 billion.

The firm, which adopted Bitcoin as its primary treasury asset in 2020, purchased over $13 billion in Bitcoin in November. Other public firms like MARA and Worksport have also adopted a similar strategy of BTC accumulation.

Public Companies that Hold Most Bitcoin. Source: Bitcoin Treasuries

Public Companies that Hold Most Bitcoin. Source: Bitcoin Treasuries

On the national level, the United States holds 208,109 BTC worth $21 billion from seized funds, making it the largest nation-state Bitcoin holder, surpassing China and the UK.

“US spot ETFs have just passed Satoshi in total bitcoin held, now hold more than 1.1m, more than anyone in the world, and they’re not even a year old yet, literally babies still. Mind blowing,” ETF analyst Eric Balchunas wrote on X (formerly Twitter).

Ongoing Speculation Over Satoshi’s Identity

Speculation about Satoshi Nakamoto’s identity continued unabated throughout 2024. Earlier this year, Australian scientist Craig Wright faced legal scrutiny for his repeated claims of being Bitcoin’s creator.

However, a UK court dismissed his evidence and ruled his case as lacking any reasonable prospect of success. A separate controversy occurred following the release of an HBO documentary, Money Electric.

In October, the documentary pointed to Canadian cryptographer Peter Todd as Satoshi Nakamoto. Todd denied the claims and reportedly went into hiding due to unwanted attention and threats.

Adding to the spectacle, a London press conference in late October saw an individual named Stephen Mollah declare himself as Nakamoto. The event quickly unraveled as Mollah failed to provide credible evidence, and technical mishaps cast further doubt on his claims.

Despite persistent theories and public interest, the true identity of Bitcoin’s creator remains a mystery.