Altcoin Season Returns: Index Hits January High as Bitcoin Trails 38 Cryptos

Today, 38 out of the top 50 cryptocurrencies have performed better than Bitcoin (BTC) over the last 90 days. As a result, the altcoin season index has hit its highest level since January.

This development has sparked widespread optimism in the market, with many speculating that the prices of these altcoins could go much higher over the next few months. But could this be feasible?

Altcoins Take Over, but Analysts Differ on Reason for Surge

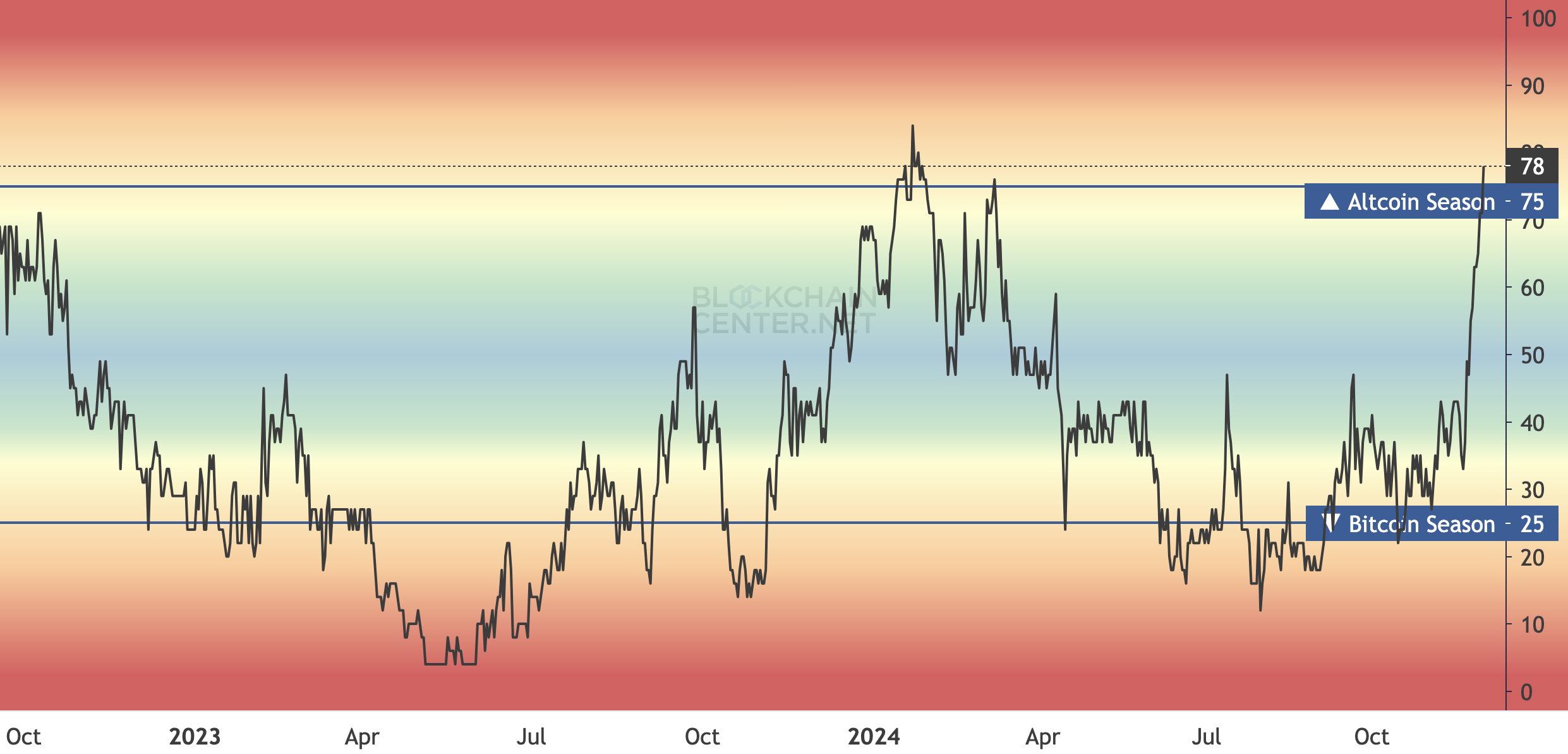

For those unfamiliar, the altcoin season index provides real-time insights based on the performance of the top 50 cryptos relative to Bitcoin. Typically, when the index is 25, it means that Bitcoin has the upper hand. It also indicates that it has outperformed at least 75% of the top 50 coins.

On the other hand, when the Altcoin Season Index hits 75 or higher, it signifies the start of an altcoin season. In this instance, most of the top 50 assets outperform BTC. As of now, the index stands at 78, confirming speculation that altcoins could continue to outpace BTC in the coming months.

This level marks the highest reading since January 22. During that period, altcoins maintained strong performance until March, when their dominance waned. In the current cycle, BeInCrypto notes that Stellar (XLM), Hedera (HBAR), and Ripple (XRP) are leading the charge.

Altcoin Season Index. Source: Blockchaincenter

Altcoin Season Index. Source: Blockchaincenter

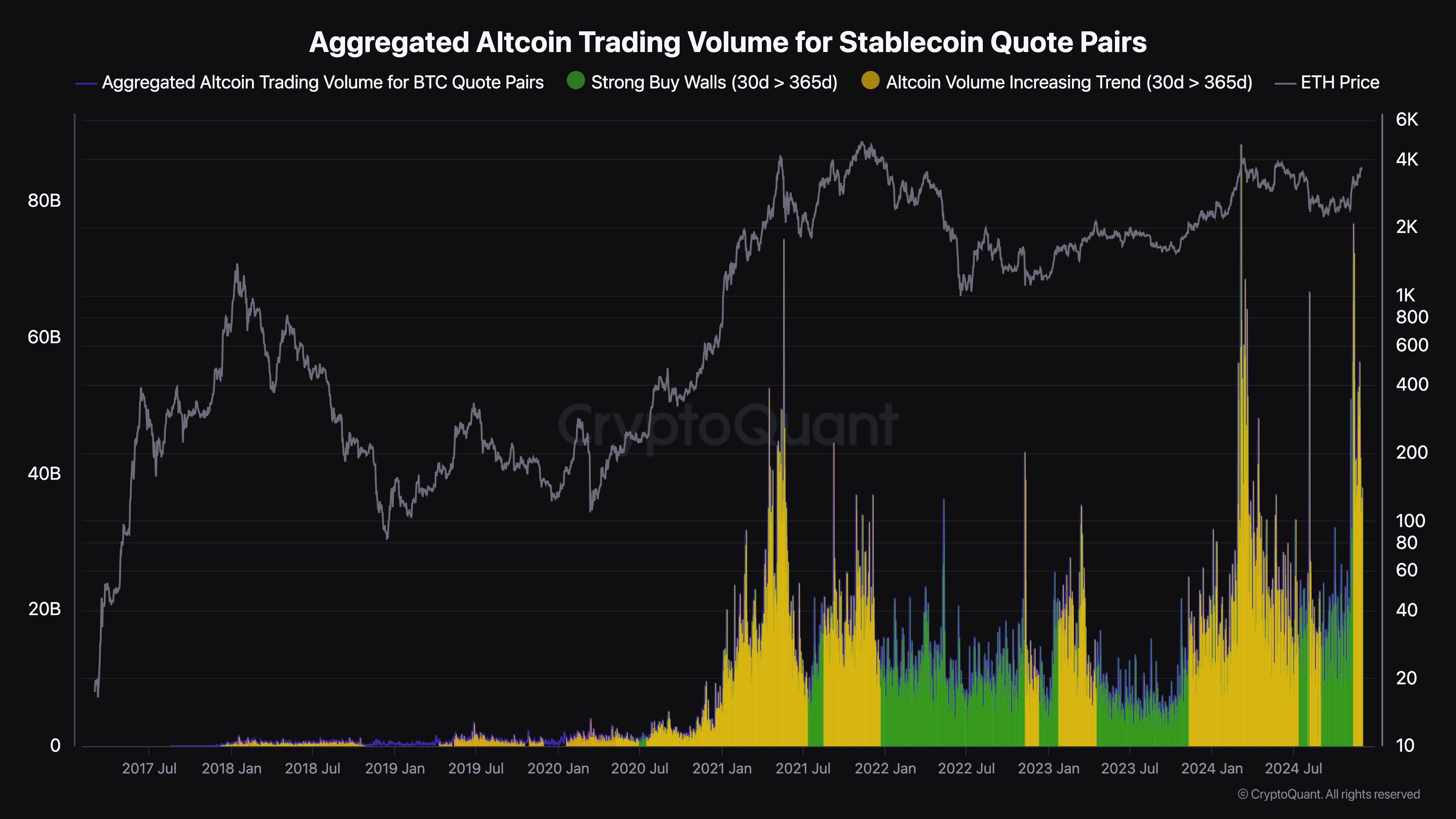

However, Ki Young Ju, CEO of CryptoQuant, offered a different perspective on the current altcoin season. According to him, this phase isn’t primarily fueled by a rotation of liquidity from Bitcoin.

He, however, noted that the major driver is the increased accessibility and usage of stablecoins and fiat pairs. This shift suggests that new capital entering the market might be significantly driving altcoins’ performance.

“Alt season is no longer defined by asset rotation from Bitcoin. The surge in altcoin trading volume isn’t driven by BTC pairs but by stablecoin and fiat pairs, reflecting real market growth rather than asset rotation,” Ki Young Ju emphasized on X.

Altcoin Trading Volume for Stablecoin Pairs. Source: CryptoQuant

Altcoin Trading Volume for Stablecoin Pairs. Source: CryptoQuant

But crypto analyst Rekt Capital seemed to have a different opinion. On November 30, the analyst highlighted that the drop in Bitcoin dominance, which is currently around 56%, indicates that money is flowing into Ethereum (ETH) and other altcoins.

“Bitcoin ranging between $91,000 and $100,000 may very well be a recipe for Ethereum to take the lead and enable money flow into smaller Altcoins,” Rekt Capital wrote.

Analysis Hints at Higher Highs for Alts Market Cap

Analysis of TOTAL2, an indicator that measures the market cap of the top 125 altcoins, shows a bull flag forming on the 3-day chart.

A bull flag is a bullish chart pattern characterized by two rallies separated by a short consolidation phase. It begins with a steep price surge, known as the “flagpole,” as buyers overpower sellers. This is followed by a pullback, creating a “flag” with parallel upper and lower trendlines, indicating a potential continuation of the uptrend.

With this pattern in place, TOTAL2 is likely to rise much higher than $1.45 trillion. If that is the case, then many altcoin prices might surpass their all-time highs.

TOTAL2 3-Day Analysis. Source: TradingView

TOTAL2 3-Day Analysis. Source: TradingView

However, if Bitcoin dominance climbs back to 60%, altcoin season could step back, and this forecast could be invalidated.

Meanwhile, Doctor Profit, a prominent crypto analyst, agrees that an altcoin season is on the horizon. In a recent post on X, he predicted that the remainder of this year and the first quarter of 20245 could bring higher prices for altcoins.

Beyond the technical outlook, the analyst pointed to strong institutional inflows into Ethereum as a bullish signal. He also highlighted circulating rumors suggesting that asset managers BlackRock and JP Morgan may be planning an XRP ETF — a development that could further accelerate the altcoin season.

“Now, huge rumors are circulating that BlackRock and JPMorgan are planning to launch an XRP ETF, and this is not just big, it’s very BIG. We’re at the beginning of Altseason, and anyone who isn’t paying attention is going to get left behind,” Doctor Profit explained.