$9.9 Trillion AUM Charles Schwab’s Crypto ETF Plan Awaits Trump-Era Reforms

Charles Schwab, the financial behemoth with over $9.9 trillion in assets under management (AUM), is preparing to venture into the spot crypto ETF (exchange-traded fund) market.

However, the move hinges on regulatory clarity in the US, according to incoming CEO Rick Wurster, who made the revelation in a Thursday interview with Bloomberg Radio. Wurster, who is set to take over in January, cited the potential for favorable regulatory changes under President-elect Donald Trump’s administration.

Charles Schwab Eyes Spot Crypto ETF Market

Schwab has been actively exploring the crypto space through ETFs and futures. Its Crypto Thematic ETF (STCE) focuses on businesses engaged in cryptocurrency mining, trading, and blockchain technology.

Nevertheless, STCE does not directly invest in digital assets. However, the firm’s readiness to offer direct trading signals a significant shift. This reflects the growing pressure on Wall Street to meet the retail and institutional demand for crypto products.

“We will get into spot crypto when the regulatory environment changes,” Wurster said.

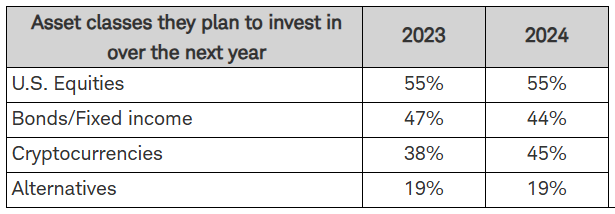

The statement mirrors Schwab’s cautious yet ambitious approach. The firm’s internal surveys conducted in October revealed strong client interest. Specifically, nearly half of respondents said they plan to invest in crypto-related ETFs over the next year. The survey caught the attention of both Eric Balchunas and Nate Geraci, experts in the ETF space.

Charles Schwab Internal Survey. Source: October 2024 Press Release

Charles Schwab Internal Survey. Source: October 2024 Press Release

Trump Administration’s Pro-Crypto Agenda

The anticipation of regulatory clarity stems from Trump’s campaign promises. The president-elect made a range of promises, including establishing a Bitcoin reserve, safeguarding crypto mining, and implementing industry-friendly policies. Trump’s pledge to fire SEC Chair Gary Gensler was a key part of his crypto-focused platform.

In a surprise announcement on Thursday, Gensler confirmed he would resign by January 20, 2025. In his farewell speech, he defended his tenure while admitting that crypto regulation remains a work in progress. Gensler acknowledged that changing the SEC’s approach to digital assets would be crucial for maintaining investor trust.

Under Trump’s leadership, experts predict a significant shift in the US regulatory environment. Trump’s policies aim to align the country with global crypto hubs, fostering innovation while addressing security and compliance concerns. Analysts suggest that these changes could attract more institutional players like Schwab, positioning the US as a leader in the crypto space.

Wurster expressed optimism about these developments, emphasizing that regulatory clarity would enable Schwab to offer a broader range of crypto products. While acknowledging his personal lack of crypto investments, he recognized the market’s appeal.

Rick Wurster, Incoming Schwab CEO, Says He Anticipates Crypto Regulation Will Change“Crypto has certainly caught many’s attention, and they’ve made a lot of money doing it. I have not bought crypto, and now I feel silly,” he admitted.

The push for spot crypto offerings has also attracted external interest. VanEck’s head of digital assets research, Matthew Sigel, revealed that a crypto asset manager has approached Schwab for potential collaboration, signaling the industry’s eagerness to align with established financial giants.

“Hearing a certain crypto asset manager went into Schwab today pitching a partnership,” Sigel said.

This interest aligns with the broader trend of traditional finance (TradFi) embracing crypto. Schwab’s entry into the spot market would represent a milestone for the firm and for the mainstream adoption of digital assets.

Despite the positive momentum, Schwab faces challenges, including operating within a competitive crypto playing field. Platforms like Robinhood have gained significant traction among retail investors, offering seamless crypto trading experiences. Schwab’s ability to differentiate itself through strong offerings and trust built over decades will be critical.

Moreover, regulatory uncertainties still loom. While Trump’s administration promises a more supportive environment, the murky waters of crypto regulation in the US may take time to resolve. Schwab’s cautious approach reflects an understanding of these challenges, ensuring that its foray into the crypto market aligns with long-term client interests.