Bitcoin Accumulation Ramps Up: Investors Scoop $4.16 Billion In Four Days

The price of Bitcoin has turned in an impressive performance, forging successive all-time highs over the past week. Similarly, other large-cap assets, such as Ethereum, Solana, and Cardano, have been experiencing massive upside movement in the past few days.

Interestingly, the latest on-chain observation suggests that the crypto market — particularly Bitcoin — may not be done just yet. This projection is as investors seem to be doubling down on their positions rather than selling off their assets for some short-term gains.

Bitcoin Investors Continue To Load Their Bags

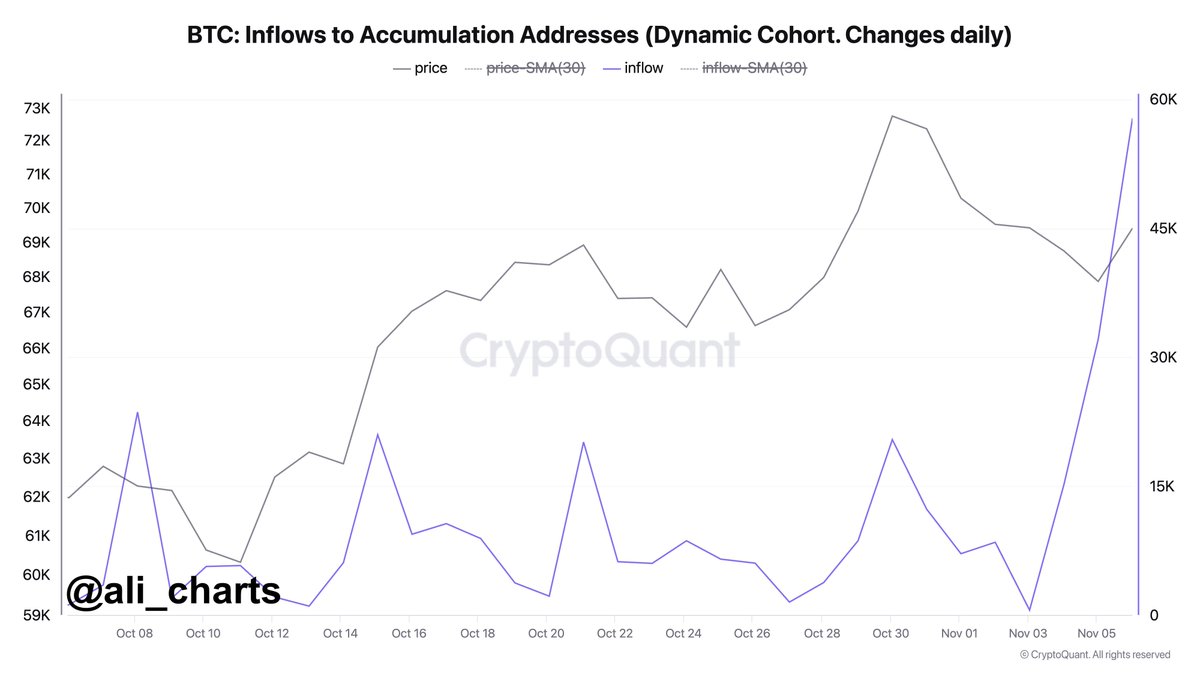

Popular crypto pundit Ali Martinez took to the X platform to reveal that Bitcoin accumulation addresses have been witnessing significant inflows over the last few days. This on-chain revelation is based on the spike in CryptoQuant’s “Inflows to Accumulation Addresses” metric.

Accumulation addresses can be defined as addresses, excluding miners’ and exchange addresses, that have zero outgoing transactions or at least haven’t spent their holdings over a period. Moreover, these addresses must have received at least two incoming transfers and hold more than 10 BTC. These Bitcoin addresses are usually controlled by major entities, including whales, institutional players, and so on.

According to data from CryptoQuant, a whopping 57,800 BTC (equivalent to approximately $4.16 billion) has made its way to these accumulation addresses since November 3. As shown in the chart below, inflows into the Bitcoin accumulation addresses have been on the rise in recent weeks.

Typically, this positive trend is a favorable sign for the price of BTC, which has been on a ride of its own in the past few days. The choice to “hodl” rather than sell for profit also indicates the increased faith in the long-term success of Bitcoin, implying that major investors expect the flagship cryptocurrency to keep rising.

As of this writing, the Bitcoin price stands at around $76,550, reflecting a measly 1% increase in the past 24 hours. However, the market leader is up by more than 10% on the weekly timeframe.

USDT Netflow On Exchanges Surpasses $2 Billion

According to a recent Quicktake post on the CryptoQuant platform, there has been a significant inflow of the USDT stablecoin into centralized exchanges. On-chain data shows that the stablecoin’s net inflows have crossed $2 billion, its highest level since December 2022.

Higher stablecoin balances (which are often used as an indicator of increased liquidity) suggest a high amount of buying power for investors, leading to elevated investor demand. If this rising liquidity on exchanges is correlated with the growing accumulation, it could positively impact the Bitcoin price.