MAGA Coin Drops 35% After Trump’s US Election Victory

The Donald Trump-linked meme coins saw their prices skyrocket in anticipation of the 2024 US election results. However, following Trump’s declaration as the winner, the values of these assets have plunged.

Leading politfi token MAGA (TRUMP) has seen its price nosedive by 35% following Trump’s victory announcement. Its technical setup suggests that the MAGA coin price may extend these losses. Here is how.

MAGA Witnesses Selloffs

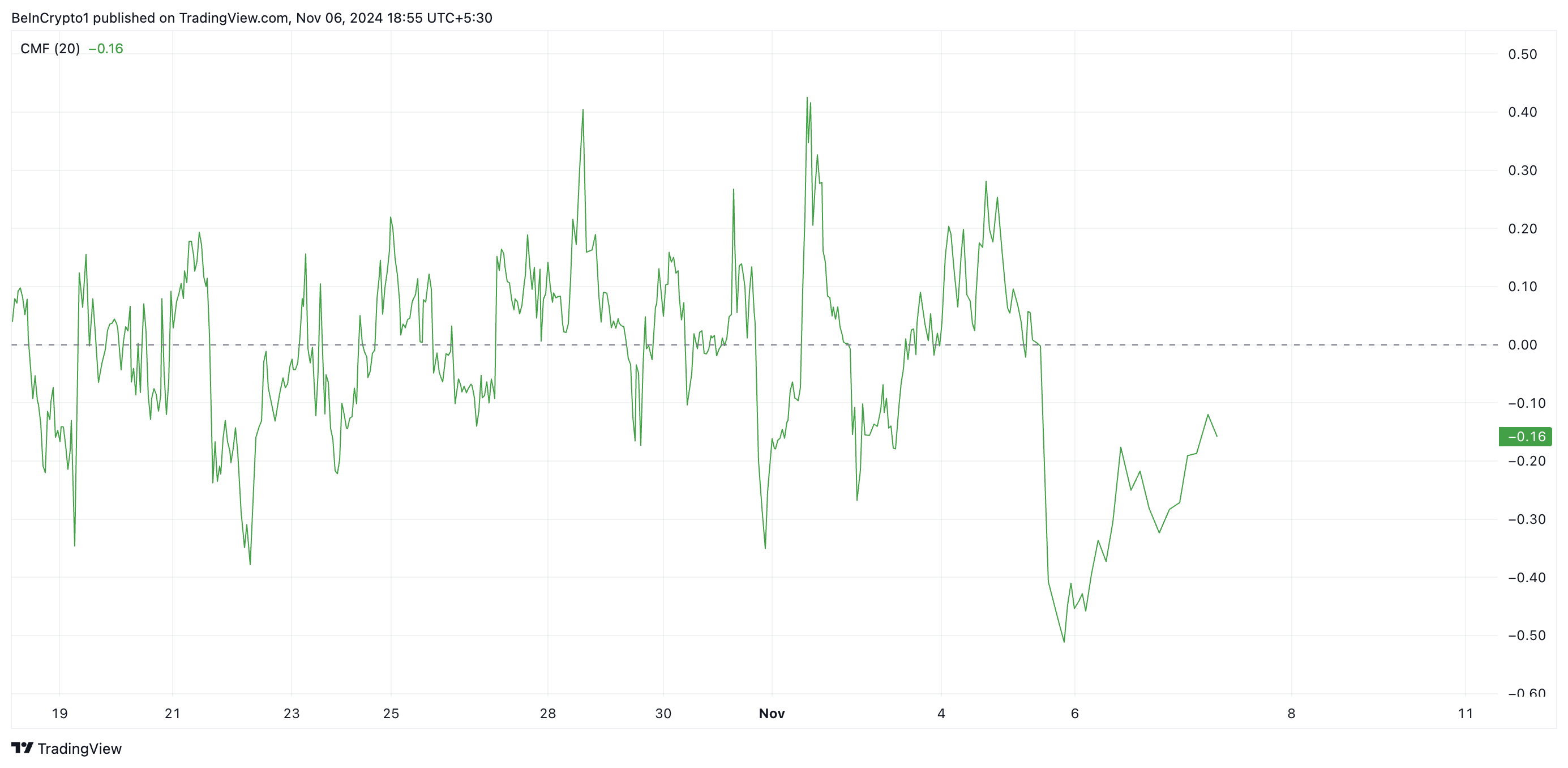

An assessment of the TRUMP/USD hourly chart has revealed significant outflows from the meme coin’s market. For example, its Chaikin Money Flow (CMF), which tracks money flows into and out of the market, is below zero at -0.16 at press time.

When an asset’s CMF is below zero, it indicates that it is experiencing more selling pressure than buying interest. This shows there is a net outflow of money from the market, as the value of the asset is being driven down by larger volumes of selling than buying.

Read more: 11 Top Solana Meme Coins to Watch in November 2024

TRUMP CMF. Source: TradingView

TRUMP CMF. Source: TradingView

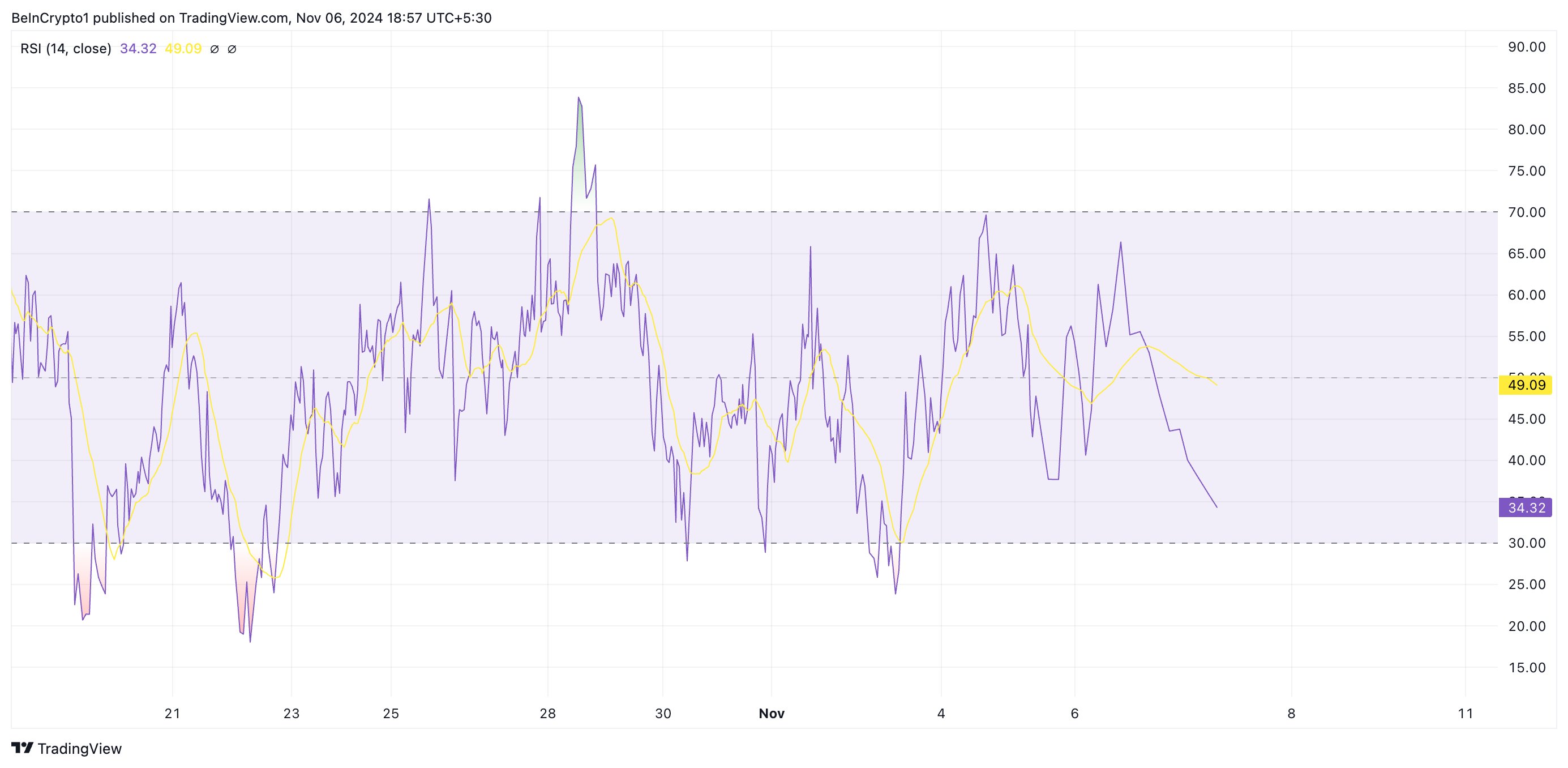

Moreover, TRUMP’s Relative Strength Index (RSI) is in a downward trend and below the 50 neutral line, confirming the surge in selling pressure in the meme coin’s market. At 34.32, TRUMP’s RSI, which measures its overbought and oversold market conditions, indicates that selling activity outweighs buying volume among market participants.

TRUMP RSI. Source: TradingView

TRUMP RSI. Source: TradingView

TRUMP Price Prediction: Will Meme Coin Regain Momentum?

TRUMP trades at $2.43 at press time, slightly above its year-to-date low of $1.67. If the current market trend persists, the meme coin’s price may revisit this low.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

TRUMP Price Analysis. Source: TradingView

TRUMP Price Analysis. Source: TradingView

However, if market sentiment shifts from bearish to bullish, TRUMP may witness a rebound and attempt a rally toward $4. A succesful breach of this resistance level will set MAGA coin price on the path to reach $5.47.