Bybit releases 15th proof of reserves, user Bitcoin assets up over 4.6% from September

Cryptocurrency exchange Bybit has published its fifteenth proof of reserves report, revealing major changes in user asset holdings across various cryptocurrencies.

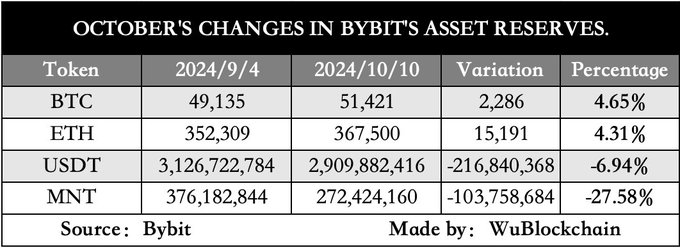

The snapshot of the asset holding was taken on October 1, 2024. The report shows notable increases in Bitcoin (BTC) and Ethereum (ETH) assets, while Tether (USDT) holdings have declined a bit.

Bitcoin and Ethereum assets show growth

According to the report, Bybit’s user Bitcoin assets have grown to 51,421 BTC, marking a 4.65% increase from the previous snapshot on September 4, 2024. This growth indicates a rising interest in Bitcoin among Bybit users.

Similarly, Ethereum holdings have seen a positive trend, with user assets reaching 367,500 ETH, up 4.31% from the last report.

While BTC and ETH assets grew, Tether (USDT) holdings on Bybit experienced a decrease. User USDT assets dropped to 2.91 billion, representing a 6.94% decline from the previous report.

Interestingly, the report also shows a considerable decrease in Mantle (MNT) holdings. As per the report, user assets fell by 27.58% to 272,424,160 MNT. The exact reason for the drop in MNT reserves is unclear.

Reserve ratios across multiple cryptocurrencies

Bybit’s proof of reserve report also provides insights into the reserve ratios for various cryptocurrencies. These ratios indicate the proportion of assets held in Bybit’s wallets compared to user assets:

- Bitcoin (BTC): 106% reserve ratio

- Ethereum (ETH): 106% reserve ratio

- Dogecoin (DOGE): 113% reserve ratio

- Polkadot (DOT): 114% reserve ratio

- Mantle (MNT): 132% reserve ratio

- Optimism (OP): 115% reserve ratio

- PEPE: 108% reserve ratio

- SHIB: 115% reserve ratio

Notable mentions include XRP with a 120% reserve ratio, UNI at 119%, and SHRAP at 118%. These high reserve ratios across multiple assets demonstrate Bybit’s commitment to maintaining robust liquidity and user fund security.

The report also highlights the reserve ratios for various stablecoins:

- USDC: 113% reserve ratio

- USDT: 110% reserve ratio

- USDE: 101% reserve ratio

Bybit released its first proof of reserves report on December 5, 2022. The initiative began after the fallout of the FTX exchange. Ever since, exchanges like Binance, Bybit and a few others have begun releasing their monthly asset holding reports.

This is meant to instill trust for the customers by ensuring that their crypto is not being mishandled by the exchange.