Crypto Today: Bitcoin dominance hits highest level since 2021, BTC and Ethereum steady while XRP gains

- Bitcoin dominance climbs to 58.85% on Thursday, the highest level since April 2021.

- BTC and Ethereum hold steady above $67,000 and $2,600, key price levels for the top two cryptocurrencies.

- XRP gains on Thursday and trades above $0.5500.

Bitcoin, Ethereum and XRP updates

- Bitcoin holds above $67,000 on Thursday. The largest cryptocurrency by market capitalization erases less than 1% of its value on the day. With four consecutive days of positive flows, Bitcoin Spot Exchange Traded Funds (ETFs) see a revival in demand from institutional investors.

- Bitcoin’s dominance climbed to 58.85%, over a three-year high for the token. Typically, rising Bitcoin dominance signals capital inflow to BTC. When capital rotation is taken into account, traders are either pulling capital away from altcoins to pour into Bitcoin or there is a general lack of interest in alts. Bitcoin dominance is therefore considered “bad news” for altcoin prices.

- Crypto investor and analyst Coach K Crypto tells his followers on X that BTC dominance has likely peaked this cycle and could soon decline, paving the way for altcoin gains.

GM FAM.#Bitcoin dominance (BTC.D) has touched an ATH for this cycle.

— Coach K Crypto (@Coachkcrypto) October 15, 2024

IT HASN'T BEEN THIS HIGH SINCE 2021

We need to let #Bitcoin rip before anything else can happen.

Soon enough, there's going to be a breakdown in BTC.D.

This will lead to memes and other major alts getting… pic.twitter.com/V73ZhVRt04

- Ethereum changes hands at $2,617. Creator of the second largest cryptocurrency, Vitalik Buterin, shared possible futures for the Ethereum protocol in an official tweet on X. Buterin explains how Layer 2 chains and the use of Ethereum’s blockchain as a base layer was one possible future for Ether.

Possible futures for the Ethereum protocol, part 2: The Surgehttps://t.co/DdEUpV4zQN

— vitalik.eth (@VitalikButerin) October 17, 2024

- XRP gains over 1% on Thursday, the altcoin trades at $0.5530. XRP traders are digesting the aftermath of a confusion over the appeals deadline in the Securities & Exchange Commission (SEC) lawsuit against the payments firm.

Chart of the day: Injective (INJ)

Injective protocol’s token (INJ) is trending on Binance’s spot market as one of the top gainers in the 24-hour timeframe. A listing announcement by South Korean exchange Upbit is likely the catalyst behind recent gains in INJ.

INJ could potentially extend its gains by over 10% and rally toward $24.14, a key level for the token. This coincides with the upper boundary of the Fair Value Gap (FVG) between $24.14 and $23.62.

The Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) momentum indicators in the daily chart support the bullish thesis. MACD flashes green histogram bars above the neutral line, signalling a positive underlying momentum in the INJ price trend.

Meanwhile, the RSI reads 56.80, above the neutral level of 50 and far below the overbought zone. RSI is sloping upwards, typically a sign of positive momentum in the INJ price trend.

INJ/USDT daily chart

However, a daily candlestick close under $20.33 could invalidate the bullish thesis. This level coincides with the upper boundary of an imbalance zone, between $20.33 and $19.79, that could act as support for INJ.

Market updates

- Ethereum blockchain targets 100,000 Transactions Per Second (TPS) through a new plan for Ether’s future. Founder Vitalik Buterin shares details of “the surge,” a phase in Ethereum’s development and scaling where the project grows the number of transactions it can process and scales it to 100,000 from 12-15 TPS.

- Upbit, South Korea’s largest exchange, has announced that the platform will list Injective on Thursday in the Korean Won (KRW) and USD Tether (USDT) markets, according to an official blog.

- Coinbase, one of the largest crypto exchanges and the custodian for the majority of the Bitcoin ETFs in the US, integrates ZetaChain mainnet as a default network within its ecosystem. The exchange has also joined the network as a validator, enabling staking and rewards in ZETA for users.

Industry updates

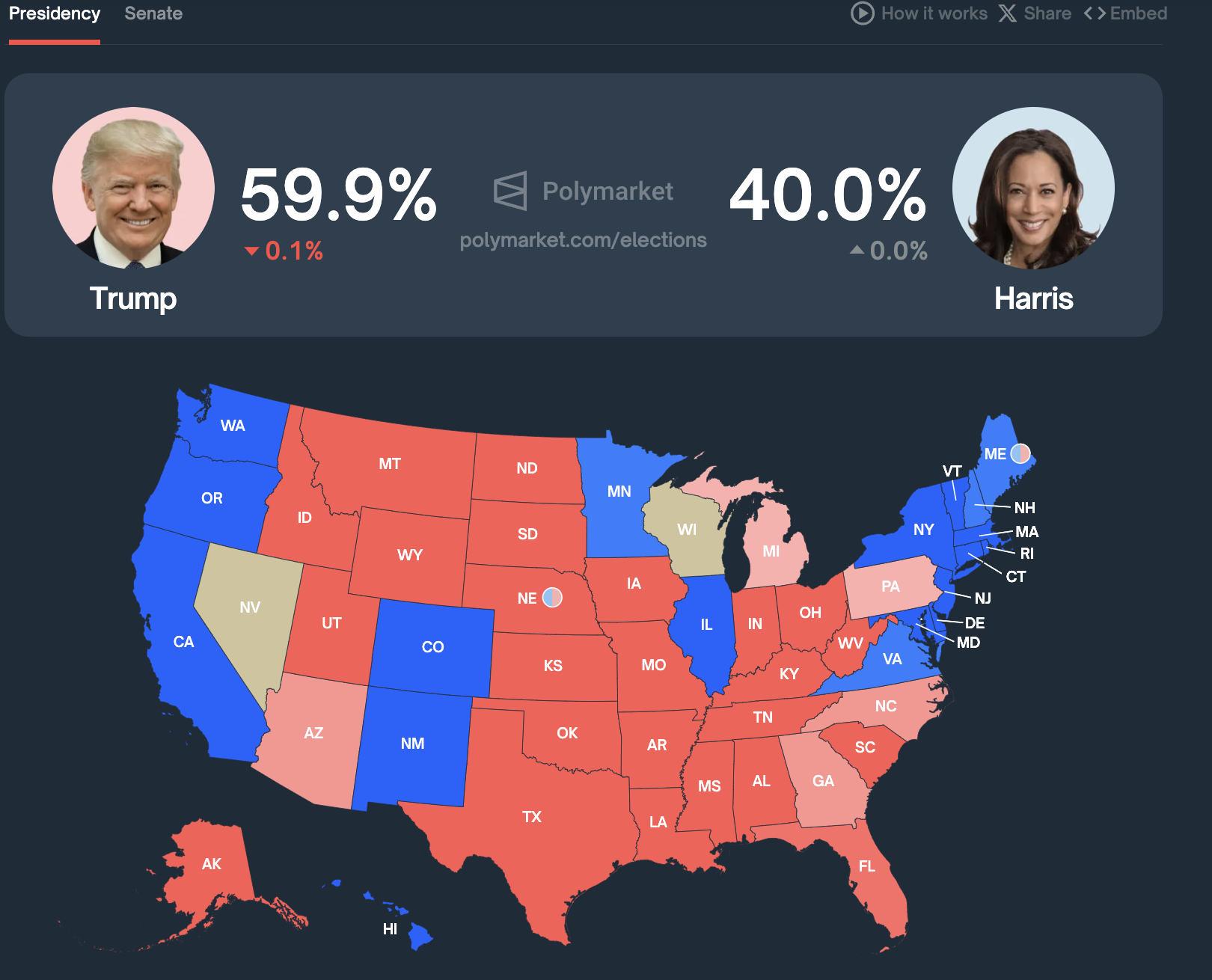

- Polymarket, a crypto prediction market, raises former US President Donald Trump’s chances of winning the November presidential elections to 59.9% early on Thursday. This is relevant to market participants since Trump has expressed interest in supporting Bitcoin and cryptocurrency and promised a pro-crypto stance to traders and attendees at his political rallies in the US.

US Presidential Elections at Polymarket

- Thailand’s Siam Commercial Bank (SCB) is the fourth largest financial institution in the country to offer stablecoin-based cross-border payments and remittances to users.

- In its state of the crypto report, a16z says that as of September 2024, there were about 617 million cryptocurrency holders worldwide and 60 million monthly active users. Stablecoin transaction volume in Q2 2024 was more than twice that of Visa.