Solana Price Forecast: SOL risks 12% drop as bankrupt FTX exchange offloads holdings

Solana price today: $151.69

- Solana’s price erases nearly 4% value on Tuesday, back close to $151.

- Bankrupt FTX exchange’s staking address redeemed nearly $28 million in SOL on Tuesday.

- The unstaked tokens could flow to exchange wallets, increasing selling pressure and pushing SOL price lower.

Solana (SOL) sees a volatile trade on Tuesday, with a whipsaw move in the early American session. After recovering initial daily losses and extending its recent upward move aiming to recapture the $160 level, SOL’s price sharply declined in the last hour. At the time of writing, SOL trades at $151.69, erasing nearly 4% value in the day.

The native token of the Ethereum-alternative smart contract platform could suffer a decline if the selling pressure on SOL increases.

On-chain data shows that the bankrupt FTX exchange unstaked a large volume of SOL tokens on Tuesday. As seen in previous instances, the tokens will likely be transferred to Coinbase or a centralized exchange platform, increasing the volume of SOL available on exchanges and contributing to selling pressure on the token.

Solana price could dip lower if FTX exchange offloads its SOL tokens

FTX exchange went bankrupt in November 2022. Since then, the platform has consistently offloaded its crypto token holdings, transferring unstaked Ethereum (ETH) and other tokens to centralized crypto exchange platforms.

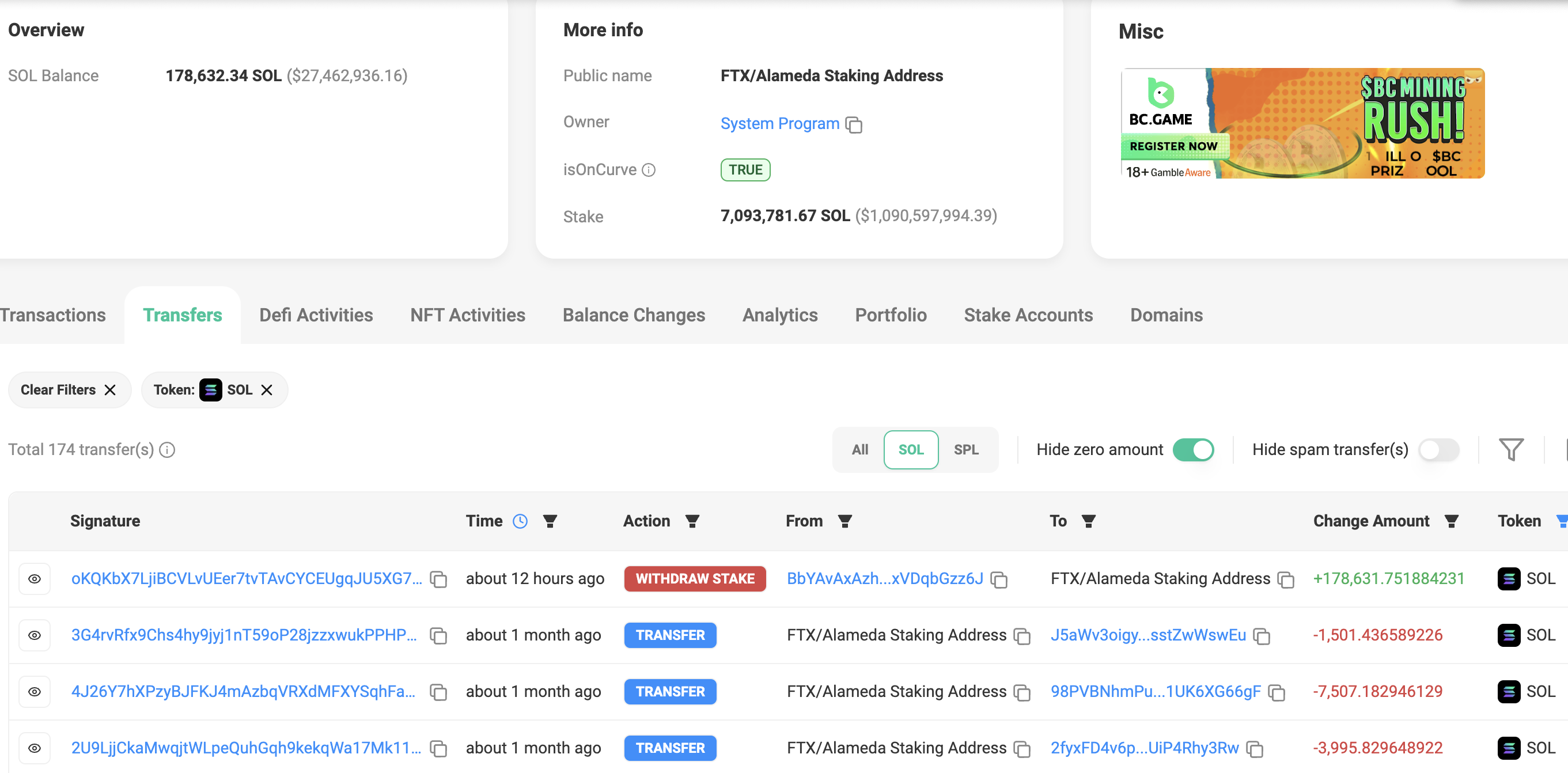

The SOL staking addresses of the exchange redeemed 178,631 SOL tokens worth $28 million early on Tuesday, according to on-chain data from Solscan. Most of the unstaked tokens are expected to flow back to one of the top centralized exchanges. Previous transactions from the address show that 170,000 SOL is unstaked typically between the 12th and 15th of the month.

FTX exchange currently holds another 7.09 million SOL worth $1.107 billion, staked at the time of writing.

Solana unstaked by FTX exchange

Solana Price Forecast: SOL risks a 12% drop

Solana (SOL) is stuck within a range between $210.18 (March 18 high) and $110 (August 5 low) for over six months now. Solana erases part of its Monday’s gains and is likely to dip lower on Tuesday after increasing selling pressure. The altcoin could drop by nearly 12% and sweep liquidity at the $134.27 support level, the September 19 low.

On the way down, SOL’s price can find interim support at the $144.71 level, the October 13 low.

The Relative Strength Index (RSI) reads 56.16, pointing downwards on the SOL/USDT daily chart, and signaling the easing of bullish momentum. A downward sloping RSI typically represents a downward trend in a token’s price.

SOL/USDT daily chart

A daily candlestick close above the September 29 high of $161 could invalidate the bearish thesis, and SOL could test resistance at $169.43. Further up, SOL’s target is $193.98, the July 29 peak.