XRP gains as Ripple files cross-appeal in lawsuit, derivatives exchange slams SEC for regulatory overreach

- XRP climbs above $0.53 on Friday, Ripple confirms cross-appeal against SEC in four-year long legal battle.

- Derivatives exchange Bitnomial sued the SEC for regulatory overreach and claim that XRP is a security.

- XRP could gain nearly 5% and recover from recent losses.

Ripple (XRP) holds steady above key support at $0.5300. The altcoin gains as the payment remittance firm confirms the filing of a cross-appeal in the Ripple lawsuit with the Securities & Exchange Commission (SEC). Ripple is gearing up to introduce new features for its custody solutions for institutional investors.

XRP trades at $0.5370, early on Friday.

Daily Digest Market Movers: XRP gains as Ripple fights SEC’s appeal in lawsuit

- Ripple announced on Thursday that the payment remittance firm is filing a cross-appeal in response to the SEC contesting the final ruling in the four-year long legal battle.

- The US financial regulator challenged the ruling where Ripple was fined $125 million for its institutional XRP sales.

- Ripple’s Chief Legal Officer, Stuart Alderoty, says the SEC appeal does not affect the legal clarity of XRP.

- The firm’s cross-appeal has boosted the sentiment among XRP holders — the social sentiment is positive, while the Fear & Greed Index on CFGI.io shows neutral sentiment.

- Bitnomial, a derivatives exchange, filed a lawsuit against the SEC for its “regulatory overreach” and lack of clarity on XRP.

Bitnomial Exchange, LLC has filed suit against SEC to prevent them overreaching their statutory authority and asserting joint jurisdiction over Bitnomial’s $XRP futures contracts, which are under the sole jurisdiction of the @CFTC.

— Bitnomial (@Bitnomial) October 11, 2024

Read about the complaint here:…

Technical analysis: XRP prepares for nearly 5% gain

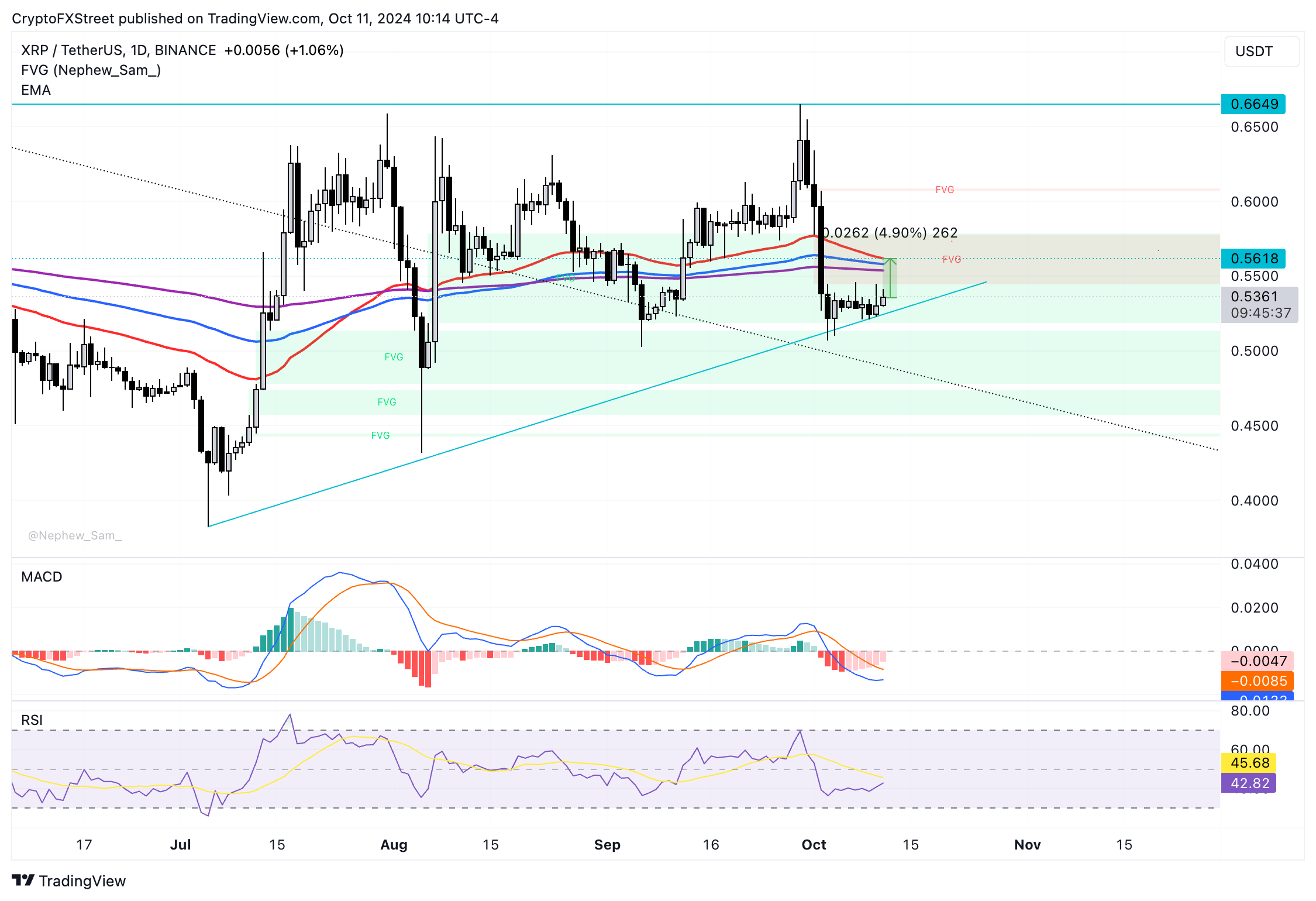

XRP has been in an upward trend since July of this year. The altcoin could extend its gains and rally toward the 10-day Exponential Moving Average (EMA) at $0.5618, nearly 5% above the current level.

XRP faces resistance in the Fair Value Gap (FVG) between $0.5778 and $0.5445. The Moving Average Convergence Divergence (MACD) indicator shows red histogram bars, consecutively smaller in size, signaling a declining negative momentum in the XRP price trend.

The Relative Strength Index (RSI) reads 42.82, which is under the neutral level and signals declining momentum.

XRP/USDT daily chart

Ripple could sweep liquidity at the October 10 low of $0.5228 if there is a correction in the altcoin.