Injective Price Prediction: INJ could rise 15% with multiple on-chain metrics in alignment

- Injective price V-shaped recovery has seen it overcome the 50-day SMA at $36.39.

- INJ could extend the climb 20% to collect sell-side liquidity with technicals and on-chain metrics in support.

- The bullish thesis will be invalidated upon a break and close below $34.09.

Injective (INJ) price is in a recovery mode after a steep rejection from the $43.51 blockade that sent the AI crypto coin down nearly 30%. This time, however, the climb is steered by bullish technical as well as on-chain fundamentals, increasing the upside potential for INJ.

Also Read: Injective Price Prediction: Volan Mainnet Upgrade fails to catalyze recovery after 20% slump

Injective price eyes 15% gains

Injective (INJ) price could rise 15% to tag the $43.51 resistance level, with technical indicators flashing bullish. For one, the 50-, 100-, and 200-day Simple Moving Averages (SMAs) provide downward support at $36.39, $26.13, and $16.88 levels respectively, while pointing north to show this is the path with the least resistance.

The Relative Strength Index (RSI) is also inclined north, suggesting rising momentum after calling a signal to buy INJ when it crossed above the signal line. Traders heeding this call would enhance the climb for Injective price.

Further, the Moving Average Convergence Divergence (MACD) indicator is also teasing with a bullish crossover, accentuated by green histogram bars on the Awesome Oscillator. These add credence to the bullish thesis.

Enhanced buying pressure among the bulls could see Injective price make the 15% climb to the $43.51 barricade. In a highly bullish case, the gains could extend for the price to reclaim the range high at $45.30, potentially clearing as it reaches for the $50.00 psychological level.

INJ/USDT 1-day chart

On-chain metrics supporting bullish outlook for Injective price

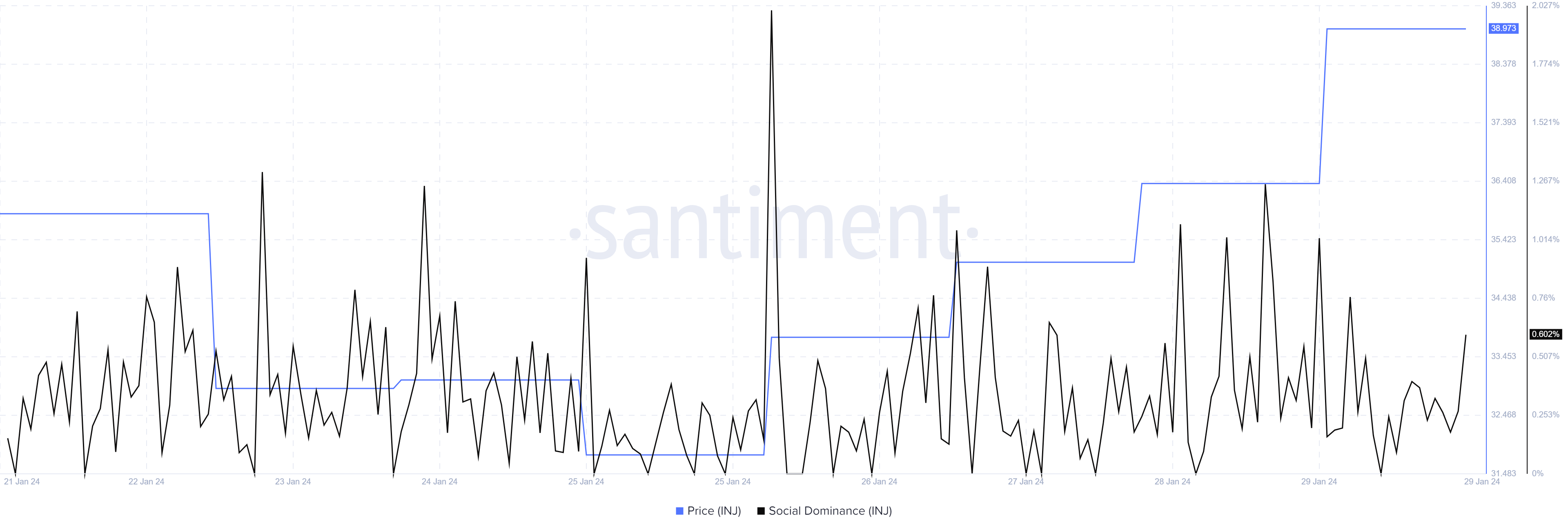

On-chain metrics from Santiment support the bullish thesis. To start with, the social dominance of the AI crypto coin is rising, representing more levels of mentions of the INJ token across a pool of crypto-related social media.

INJ Santiment: Social dominance

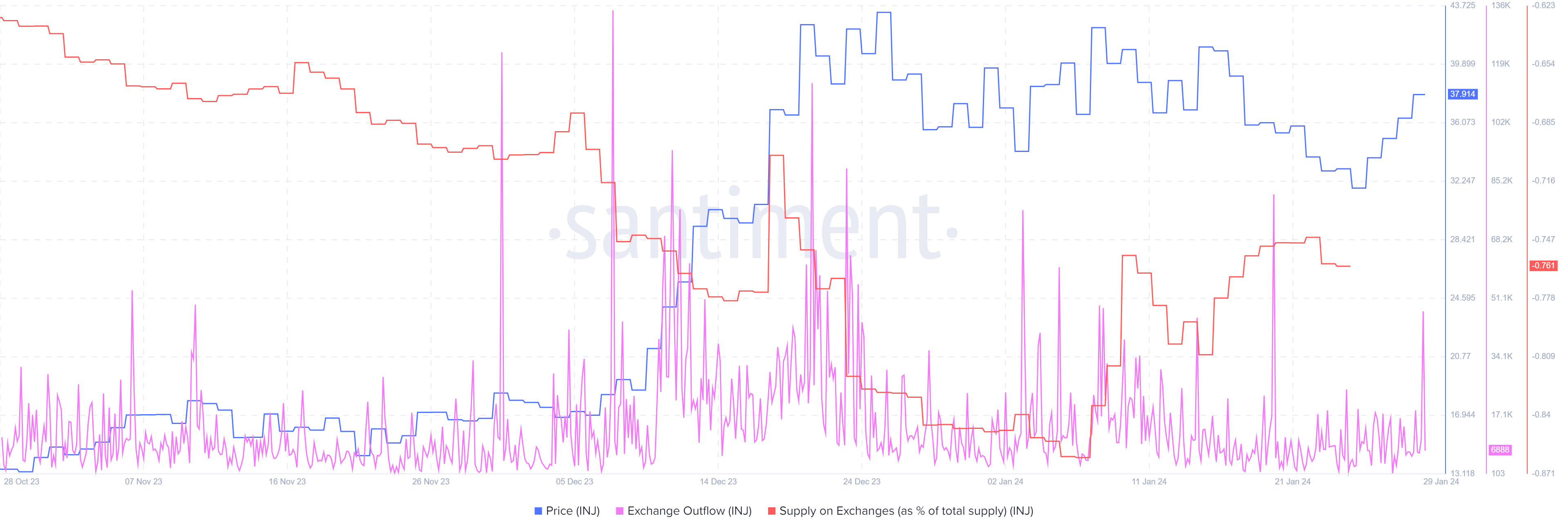

There is also a significant rise in exchange outflow, reducing the effective short-term sell pressure on Injective price. This is accentuated by the supply on exchanges as a percentage of total supply, which appears subdued, moving horizontally at $-0.76 to show reducing sell pressure.

INJ Santiment: Exchange outflow, Supply on exchanges

On the other hand, if traders give in to their profit appetite and prematurely cash in on the gains made, Injective price could pull south, slipping below the 50-day SMA to retest the $34.00 support. A break and close below this level would invalidate the bullish thesis, with Injective price likely to extend the fall to the $31.00 psychological level.