Ripple developer proposes change in XRP Ledger governance to increase transparency

- Ripple developer published a proposal for updating the governance structure of the XRP Ledger Foundation.

- David Fuelling intends to bring democracy to the XRP Ledger and calls for a decentralized member-driven governance.

- XRP price recovered slightly after yielding nearly 4% losses in the past week.

XRP Ledger developer David Fuelling published on Sunday a proposal to update the governance structure of the XRPL Foundation with the goal of increasing transparency and decentralization in XRPL governance systems.

XRP price lost nearly 4% on week and almost 16% on month, but recovered slightly from recent lows.

Also read: Bitcoin price sustains above $42,000 while wallets holding less than 1 BTC drop

Proposal aims for decentralized, democratized XRP Ledger’s governance

David Fuelling, an XRP Ledger developer, published a proposal to update the governance structure of the XRP Ledger Foundation. This is a significant development since Fuelling calls for the governance to be decentralized and member-driven.

Ripple CTO David Schwartz acknowledged Fuelling’s proposal. Schwartz noted that the proposal is a “straw man,” and is designed to open dialogue in the XRPL community. It offers an opportunity for developers to collaborate and refine the governance of the Ledger and make it more transparent and democratic, in line with the community’s input, he said.

The developer proposes that there is increased representation of stakeholders in the XRPLedger community and they are able to formally influence the affairs of the foundation. A more formalized membership could help facilitate the same and increase the participation of stakeholders. Higher contribution in the form of time, money and resources could help further XRPLedger foundation’s success.

XRP price recovers slightly after slump

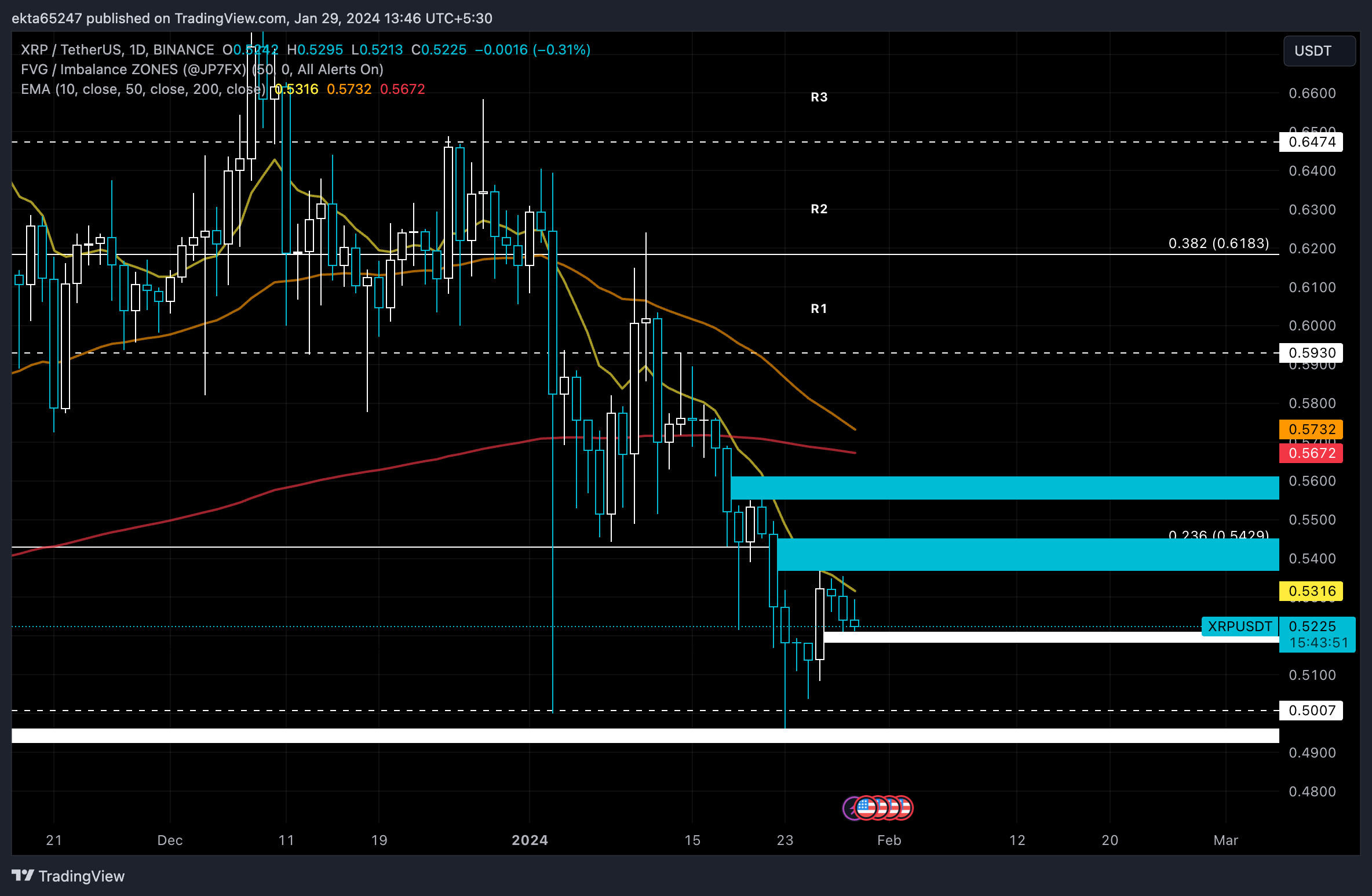

XRP price is at $0.5225 at the time of writing. The altcoin has recovered slightly, by 0.21%, after yielding nearly 4% weekly losses. XRP price recovered from its 2024 low of $0.4962 observed on January 23.

The altcoin is currently above the bullish imbalance zone between $0.5182 and $0.5211. XRP price could climb towards the bearish imbalance zone, which is placed between $0.5369 and $0.5450, in the event of a recovery.

XRP/USDT 1-day price chart

If XRP price sees a daily candlestick close below the bullish imbalance zone, $0.5007 could act as support for the altcoin.