BlackRock, Microsoft Launch $30 Billion Fund to Build AI Data Centers for High Energy Needs

BlackRock and Microsoft have partnered to form a new group that aims to create a $30 billion investment fund dedicated to artificial intelligence (AI) data centers.

This move comes as demand for AI technology continues to surge, requiring vast computing power and energy to operate efficiently.

AI Energy Demands Spark New Opportunities for Bitcoin Miners

The fund aims to raise $30 billion in equity investments through BlackRock’s infrastructure unit, Global Infrastructure Partners (GIP). This will enable it to leverage an additional $70 billion in debt financing.

Meanwhile, Microsoft, Abu Dhabi’s MGX, and chipmaker Nvidia will lead the project. They will ensure the facility’s design and implementation incorporate the latest technologies to meet AI’s high computational needs. The new fund will focus on building data centers capable of handling the energy-intensive operations of generative AI tools.

Read more: AI in Finance: Top 8 Artificial Intelligence Use Cases for 2024

This investment initiative comes as the energy and infrastructure sectors become increasingly intertwined. Artificial intelligence, especially models like OpenAI’s ChatGPT, is straining current digital infrastructure with its massive computing needs. These models require significantly more energy than earlier technologies, creating a bottleneck in building the necessary AI infrastructure.

This growing demand has become a major hurdle to further AI development. However, such a situation can benefit several parties.

For instance, Nvidia, known for its AI-processing GPUs, will be crucial in developing the factories for these data centers. Additionally, given their expertise in energy management, Bitcoin miners are emerging as key players in this new segment.

This phenomenon is evident in some investments and initiatives from Bitcoin miners in this area. BeInCrypto reported that Core Scientific, one of the major Bitcoin mining companies, signed a $3.5 billion contract with Nvidia-backed CoreWeave in June. This contract aims to upgrade its facilities for AI and high-performing computer (HPC) tasks.

Another Bitcoin mining company, Hut 8, has also made strides in entering the AI data center market. With a $150 million investment from Coatue Management, Hut 8 can leverage its energy expertise and existing infrastructure to support the growing need for AI computing power. Eventually, this move will further expand Hut 8’s operations beyond traditional Bitcoin mining.

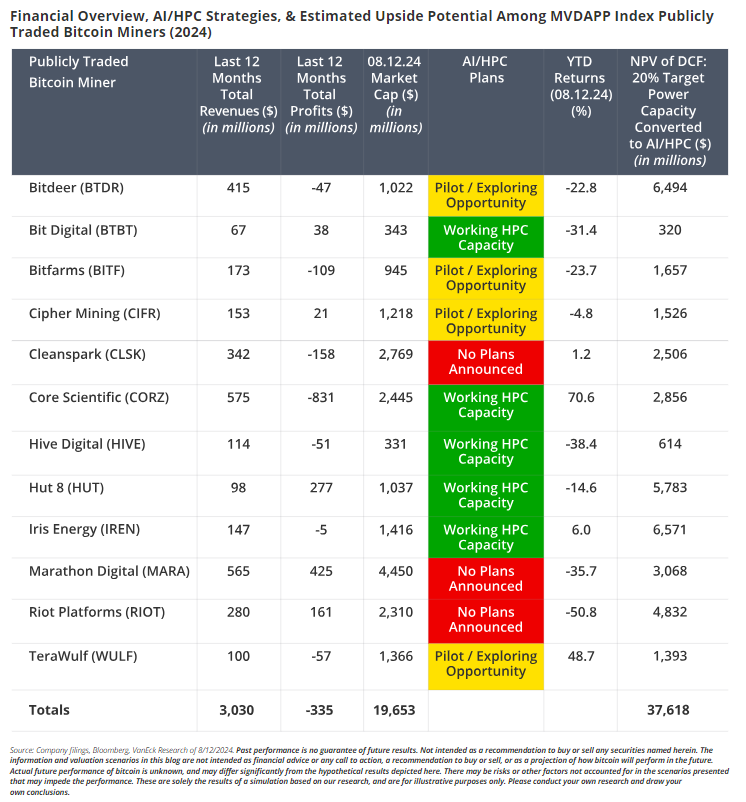

The integration of AI infrastructure into Bitcoin mining operations has also become increasingly attractive to investors. According to a report from asset management firm VanEck, Bitcoin miners are in a unique position to meet AI’s energy demands. This is due to their existing energy-intensive operations.

“The synergy is simple: AI companies need energy, and Bitcoin miners have it. As the market values the growing AI/HPC data center market, access to power—especially in the near term—is commanding a premium. […] Suitable Bitcoin mining sites can energize GPUs for AI in less than a year, compared to the 4+ years required for greenfield AI data center developments to go online. […] If properly equipped with power, bandwidth, and cooling systems, Bitcoin mining sites are ideal for capturing this value for AI/HPC cloud services,” the report reads.

Read more: How Will Artificial Intelligence (AI) Transform Crypto?

Bitcoin Miners Potential AI Earnings. Source: VanEck

Bitcoin Miners Potential AI Earnings. Source: VanEck

VanEck’s research suggests that by 2027, Bitcoin miners who allocate a portion of their energy capacity to AI and HPC tasks could see a significant increase in profitability. Furthermore, the report estimates that miners could generate an additional $13.9 billion in profits annually by pivoting just 20% of their energy resources toward AI infrastructure. This shift could also lead to a doubling of their market capitalization over the next few years as demand for AI computing power continues to rise.