2 Lesser-Known Indicators Predict Dogecoin (DOGE) Price Fall Under $0.10

As market sentiment swings sideways, two subtle but important metrics signal a potential drop in the price of Dogecoin (DOGE). Last month, DOGE hit $0.11.

However, the meme coin has been trading below this level since the beginning of September. These indicators reveal how the cryptocurrency’s current trend might impact the price.

Dogecoin Sees Low Traction, High Sell-Offs

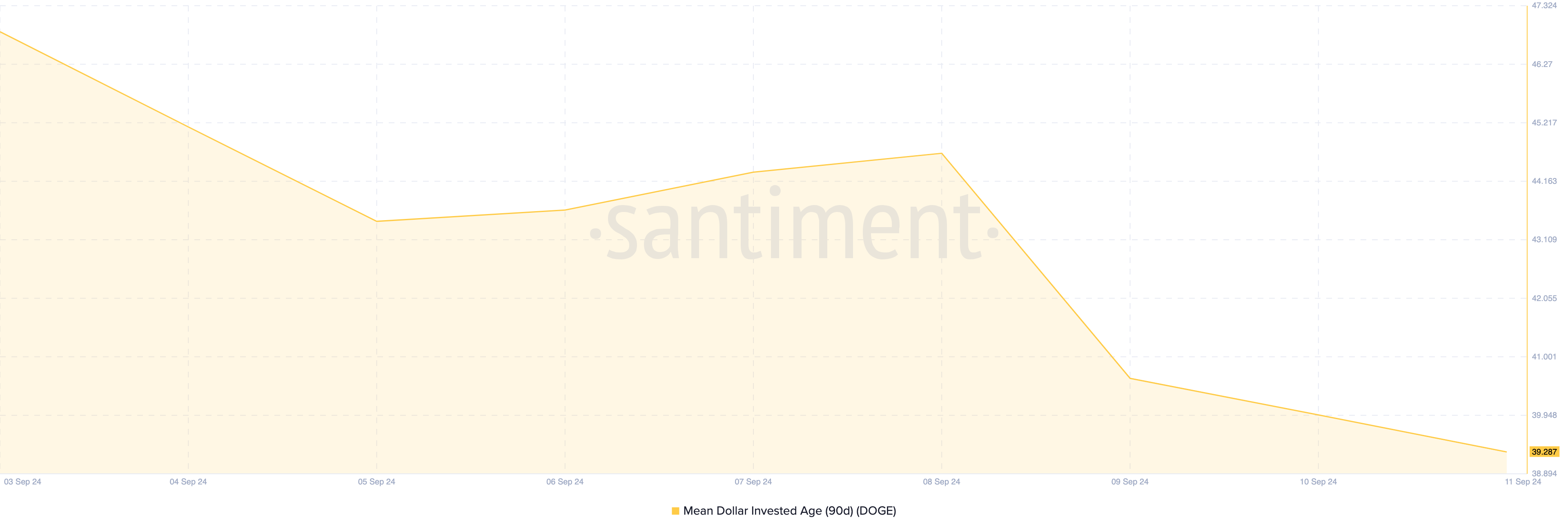

Dogecoin’s Mean Dollar Invested Age (MDIA) is the first key metric to watch. MDIA measures the average age of every dollar invested in the coin. A rising MDIA suggests long-term holding, meaning holders are not selling. Conversely, a declining MDIA indicates that more participants are trading their coins, often signaling significant sell-offs.

As shown in the chart, MDIA has dropped sharply since September 8, implying that less capital is being invested in Dogecoin. This could make Dogecoin’s price vulnerable to a drop below its current level of $0.10.

Dogecoin Mean Dollar Invested Age. Source: Santiment

Dogecoin Mean Dollar Invested Age. Source: Santiment

The second vital but rarely used indicator is the Address Birth-Death ratio. As the name implies, the ratio measures the rate at which new addresses are adopting a cryptocurrency compared to the rate at which other addresses are selling all of their coins.

A high Birth-Death ratio indicates that a cryptocurrency is seeing more adoption than exits. However, as of this writing, the ratio is down to 0.11%, suggesting that a higher proportion of retired DOGE wallets compared to the newly created ones.

Read more: How To Buy Dogecoin (DOGE) and Everything You Need To Know

Dogecoin Address Birth-Death Ratio. Source: IntoTheBlock

Dogecoin Address Birth-Death Ratio. Source: IntoTheBlock

DOGE Price Prediction:Breakout Invalidated

According to the daily chart, Dogecoin broke above the descending triangle three days ago. Typically, a break above this technical pattern is a bullish sign — evident as DOGE’s price attempted to appreciate further.

However, the coin encountered rejection, as it aimed at $0.11. Based on the image below, DOGE’s price is on the brink of falling below the 61.8% Fibonacci retracement level.

Read more: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

Dogecoin Daily Analysis. Source: TradingView

Dogecoin Daily Analysis. Source: TradingView

As soon as this happens, the bearish outlook could be confirmed, potentially driving the price down to $0.091. However, if bulls manage to hold the price above this level, the bearish prediction could be invalidated, and Dogecoin might rise to $0.12.