Cardano (ADA) Holders Prepping to Cash Out After Chang Hard Fork Delay

Cardano’s (ADA) price reclaimed $0.38 for the first time since August 2, which resulted from an 18% increase in the last seven days.

Interestingly, this price increase coincides with a disclosure that could drive ADA holders to sell off some of their holdings.

Cardano Holders Set to “Sell the News”

On Friday, August 23, Cardano founder Charles Hoskinson announced on X that the much-anticipated Chang hard fork had been postponed. According to Hoskinson, the development was necessary because some tier-1 centralized exchanges, including Binance, are not ready to upgrade.

“It looks like Binance and a few others need more time to get their houses in order, so the rocket is going to wait on the pad, another epoch for the weather to get better. Next Chang Hard Fork window, September 1,” Hoskinson added.

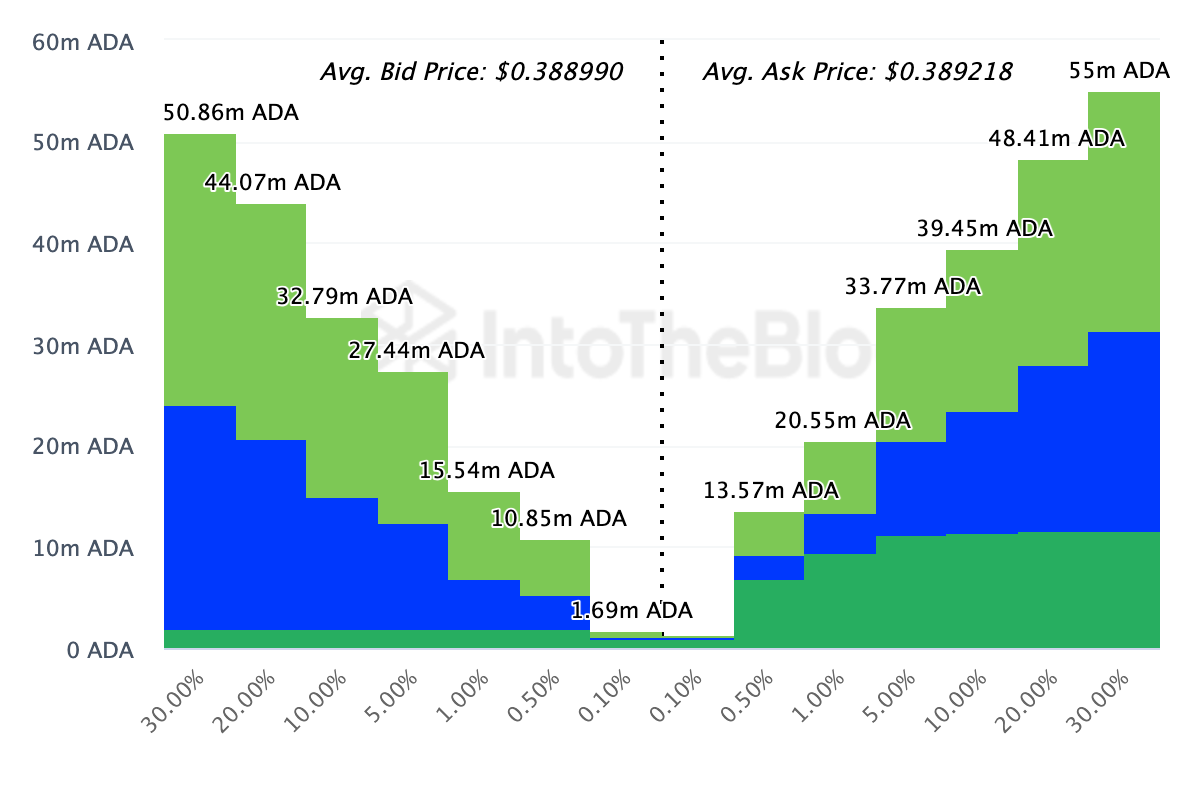

Following the announcement, IntoTheBlock data shows that ADA holders look prepared to sell off. BeInCrypto found out after examining the order books on the top 20 exchanges.

As shown below, market participants are ready to bid (buy) about 172 million coins. Meanwhile, on the other side of the divide, some participants are looking to sell over 200 million. At the token’s current price, this will amount to nearly $80 million. If the sale goes through, ADA’s price could briefly decline.

Read more: Who Is Charles Hoskinson, the Founder of Cardano?

Cardano Exchange On-chain Market Depth. Source: IntoTheBlock

Cardano Exchange On-chain Market Depth. Source: IntoTheBlock

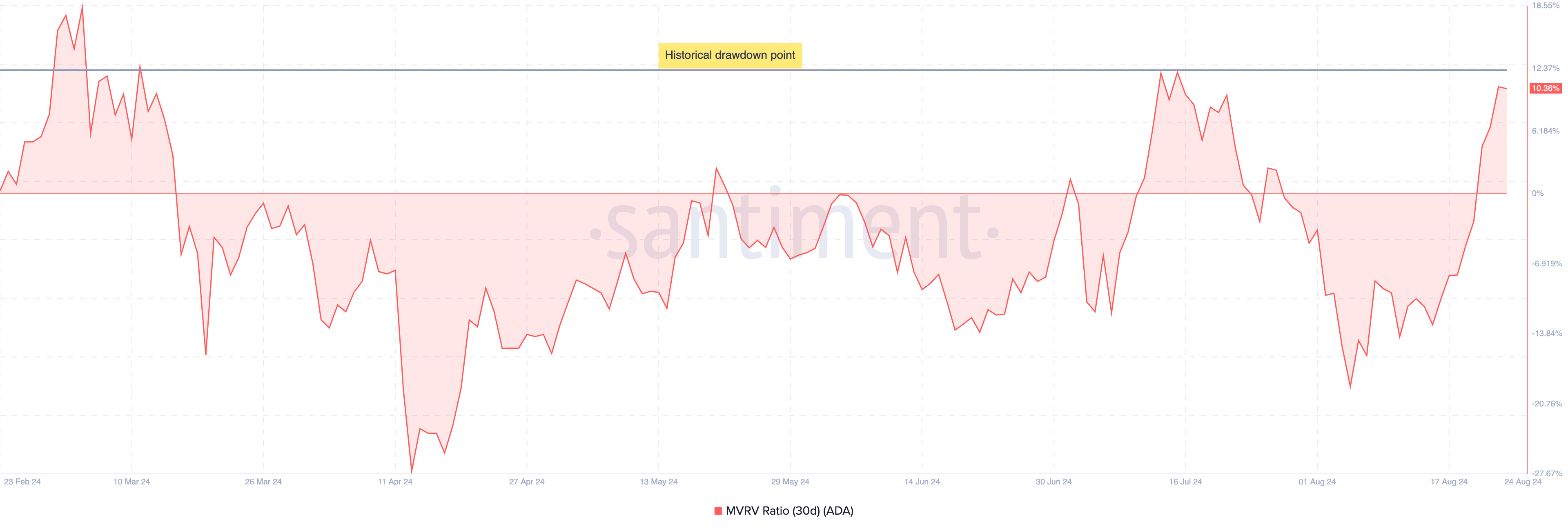

The recent price surge has also impacted Cardano’s Market Value to Realized Value (MVRV) ratio, a metric that provides insights into holders’ profitability, buying behavior, and the potential for market tops or bottoms. On August 20, ADA’s 30-day MVRV ratio stood at 0.32%, signaling that the average holder was at a loss.

However, as of now, the ratio has climbed to 10.36%, meaning that if all holders sell at the current price, they would turn a profit. While this rise reflects a healthier market, it also puts ADA’s price at risk.

Historically, when the MVRV ratio reaches levels between 12.20% and 18.35%, holders tend to realize profits, leading to a price pullback. If ADA’s value approaches $0.40, a retracement could occur, potentially erasing some of the recent gains.

Cardano 30-Day Market Value to Realized Value Ratio. Source: Santiment

Cardano 30-Day Market Value to Realized Value Ratio. Source: Santiment

However, a pseudonymous analyst, XForceGlobal, opined that ADA could be close to its bottom.

“Cardano did an 18,000% run in its last bull run, but it also did one of the strongest pullbacks during the bear market. Structure looks very similar to when $SOL was creating a bottom as well for a 1-2 sequence. Wave 3 targets would be around $3,” he said.

ADA Price Prediction: Rise to $0.42 Still Possible

On the daily chart, ADA has broken above the critical support at $0.31 and the descending trendline, indicating strong bullish momentum. Furthermore, the price, which is $0.39 as press time, trades above the 20 (blue) and 50 (yellow) Exponential Moving Averages (EMAs).

EMAs track the price trends of cryptocurrencies over time and help forecast potential movements. Typically, when the price is above the EMA, it signals a bullish trend, whereas a price below the EMA suggests a bearish outlook.

Given these conditions, ADA appears to be in a bullish phase. If this trend continues, the cryptocurrency could break the $0.40 psychological resistance and target $0.42. However, market participants should be cautious of the lingering death cross.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

Cardano Daily Analysis. Source: TradingView

Cardano Daily Analysis. Source: TradingView

A death cross occurs when the longer EMA crosses above the shorter one, signaling a bearish trend. Conversely, a golden cross forms when the shorter EMA crosses above the longer EMA.

As seen, Cardano has not yet exited the death cross, suggesting that bearish pressure could still impact the token. If buying momentum fades and bears regain control, ADA’s price could retrace to $0.37.