All Eyes on Bitcoin as US Dollar Index Hits 2024 Lows

All eyes are on Bitcoin (BTC) after it reclaimed the $61,000 mark, following the release of the Federal Open Market Committee (FOMC) minutes. The recent price movement has reignited interest in the cryptocurrency, especially given Bitcoin’s correlation with global liquidity.

This correlation also draws attention to the US dollar index (DXY), as changes in the DXY can impact BTC. Typically, when the dollar weakens, Bitcoin strengthens due to investors seeking alternative assets.

DXY Records New 2024 Lows: a Look at Macro Drivers

The U.S. Dollar Index (DXY) has formed lower highs since June, hitting fresh lows in 2024. After breaking below the January 1 low of $101.340, the DXY dropped further, bottoming at $100.923 on Wednesday.

At the time of writing, it’s trading at $101.311. A falling DXY is bullish for risk assets like Bitcoin and other cryptocurrencies.

DXY and Money Supply Charts. Source: TradingView

DXY and Money Supply Charts. Source: TradingView

On the other hand, global liquidity (M2) is trending upward. M2 measures the total amount of money circulating in the global economy, including checking accounts, savings accounts, and other liquid assets that can be quickly converted into cash.

Risk assets, including Bitcoin, typically correlate with rising liquidity. The relationship between Bitcoin’s price and M2 expansion reflects broader market sentiment and economic conditions. A higher M2 expansion indicates a loose monetary policy and an increased money supply, which often boosts risk assets like cryptocurrencies.

“BTC is the most sensitive asset to liquidity. Historically, a 10% increase in global liquidity has corresponded in a 40% increase in Bitcoin’s price,” wrote Cryptonary.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

The Federal Reserve is likely to ease monetary policy at its next meeting, according to the FOMC minutes released on Wednesday. However, this depends on data continuing to align with expectations. The minutes also indicated that some policymakers supported a 25-basis-point (bps) rate cut during the July meeting. Despite this, the Fed chose to keep rates unchanged, as BeInCrypto reported.

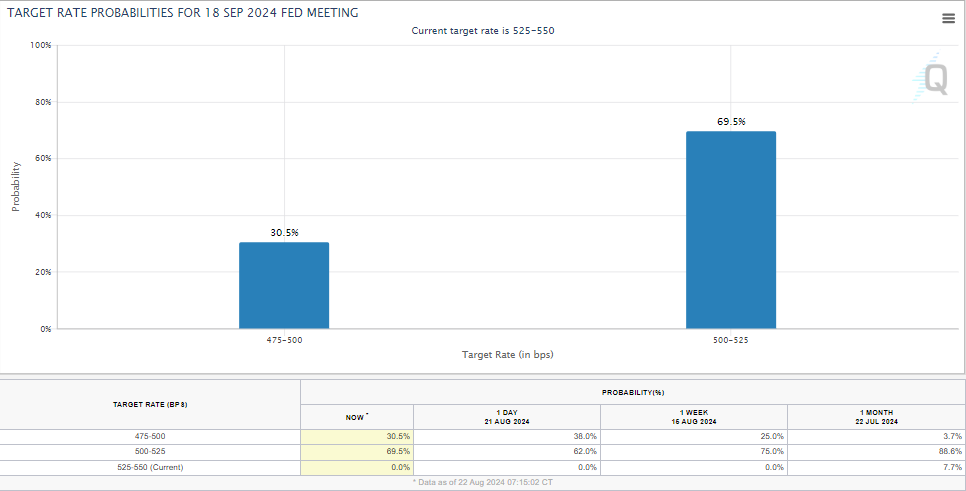

Based on the CME FedWatch Tool, the probability of a 50 bps rate cut in September has increased to 30.5%, reflecting growing market sentiment toward a potential easing of policy.

Fed Rate Cut Probabilities. Source: CME Fed Watchtool

Fed Rate Cut Probabilities. Source: CME Fed Watchtool

However, it’s important to note that Fed Chair Jerome Powell has consistently urged caution, highlighting that cutting rates too soon remains a major concern. Even so, the FOMC minutes often provide critical insights into policymakers’ evolving views on interest rates. This is particularly relevant if there’s a shift in their stance.

All eyes will be on Powell’s upcoming speech on Friday at the Jackson Hole symposium, as markets look for more clues about the Fed’s next steps. As BeInCrypto reported, Powell’s remarks could trigger market volatility, especially in risk-on assets like Bitcoin.

The prospect of lower interest rates generally benefits risk assets, which aligns with Bitcoin’s recent move above $61,000. The price has broken above the symmetrical triangle, but confirmation of this breakout is still pending. Markets will closely monitor Powell’s comments for further direction.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

BTC/USDT 1D Chart. Source: TradingView

BTC/USDT 1D Chart. Source: TradingView

A stable candlestick close above $60,000, supported by the Relative Strength Index (RSI) holding above 50, would confirm the continuation of Bitcoin’s uptrend. For further upside, Bitcoin must break through the supply zone between $65,777 and $68,424. If this resistance is flipped into support, known as a bullish breaker, it could pave the way for a push toward a new all-time high.

On the flip side, Bitcoin could fall back below $60,000, breaching the upper trendline of the symmetrical triangle. In a worst-case scenario, further selling pressure could drive BTC below the triangle’s lower trendline and into the demand zone.

If buying pressure within the support zone between $53,485 and $57,050 fails to counteract the sellers, Bitcoin’s price could drop even further, potentially targeting the liquidity residing below $52,398. This would mark a downside move, indicating a possible reversal in trend.