BlackRock’s Bitcoin Stash Nears 350,000, Trails Only Satoshi and Binance

BlackRock’s aggressive push into Bitcoin has brought its holdings to nearly 350,000 BTC, making it the third-largest holder globally after Satoshi Nakamoto and Binance, according to on-chain data.

This substantial accumulation comes as BlackRock continues to establish itself as a dominant player in the cryptocurrency space, driven by its various ETF products and growing interest from institutional investors.

BlackRock Now Owns Nearly 350,000 Bitcoins

BlackRock’s entry into Bitcoin has been a major turning point for the industry. Historically, BlackRock CEO Larry Fink was a vocal skeptic of Bitcoin, dismissing it as a speculative and potentially dangerous asset.

However, his stance has undergone a radical transformation over the past years. Fink now sees Bitcoin as an “international asset” with transformative potential for finance. This change of heart has been a catalyst for BlackRock’s deepening involvement in the cryptocurrency market.

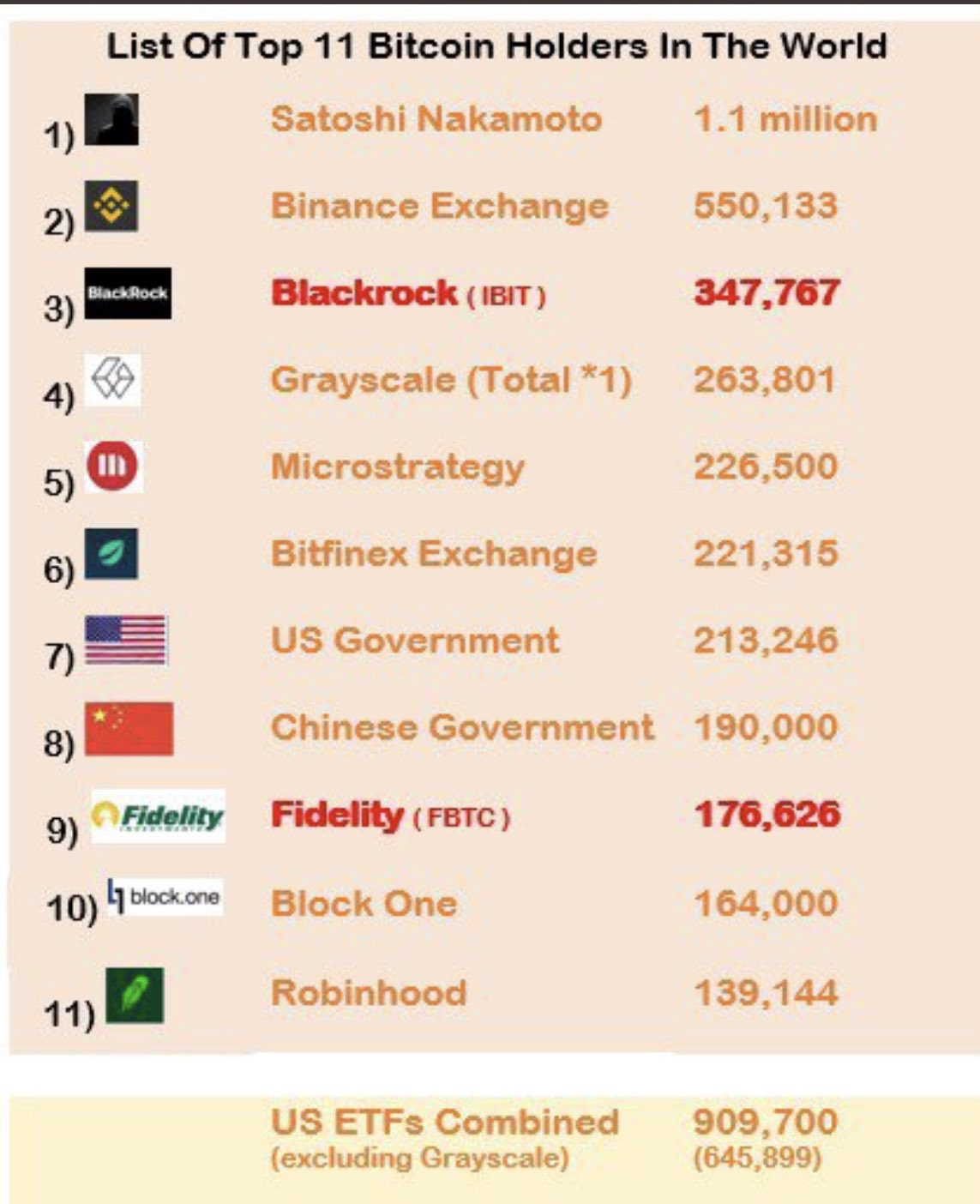

The firm’s flagship product, the iShares Bitcoin Trust (IBIT), is a central component of this strategy. Launched earlier this year, IBIT quickly gained traction among institutional investors looking for secure exposure to Bitcoin. As a result, BlackRock’s holdings have neared 350,000 BTC. For perspective, this amount is only exceeded by Satoshi Nakamoto’s estimated 1.1 million BTC stash and Binance’s holdings, which are reported to be around 550,000 BTC.

“Didn’t realize US ETFs are on track to pass Satoshi in Bitcoin held in October. BlackRock alone is already #3 and on pace to be #1 late next year, and will likely stay there for a very long time,” Bloomberg ETF analyst Eric Balchunas said.

Read more: Who Owns the Most Bitcoin in 2024?

Top Bitcoin Holders. Source: X/Twitter

Top Bitcoin Holders. Source: X/Twitter

Interestingly, the balance of power in the ETF market was very different just a few months ago. Grayscale was leading the scene, holding more Bitcoin than BlackRock.

However, the situation has now shifted, with Grayscale grappling with customer redemptions as investors pull out. The primary factor behind this exodus is Grayscale’s steep 2.5% fees, compared to the industry average of 0.25%.

BlackRock’s growing presence in the crypto space has opened the door for more traditional financial players to enter the market. Recent filings show that major institutions like Capula Management, Goldman Sachs, DRW Capital, and several investment and retirement boards have been acquiring shares of BlackRock’s iShares Bitcoin Trust.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

While ETFs have undeniably played a key role in establishing cryptocurrencies as a legitimate asset class, opinions within the crypto community remain divided. Many argue that large financial institutions increasingly contradict the principles on which Bitcoin was founded. For these critics, institutional control in the crypto space erodes this original ethos, shifting power back to the very entities Bitcoin aimed to bypass.

“Does this not defeat the whole purpose of “decentralization”? BlackRock will be the biggest hodler, it doesn’t get much more centralized than that,” one X user noted.