Artificial Superintelligence Alliance (FET) Holders Turn Profit, but a 16% Price Drop Remains on the Horizon

Holders of the Artificial Superintelligence Alliance (FET) token have seen profitable returns this week. On-chain data indicates that most transactions over the past seven days have ended with gains.

However, with bearish sentiment prevailing in the market, the altcoin faces a potential 16% decline in value.

Artificial Superintelligence Alliance Holders Smile to the Bank

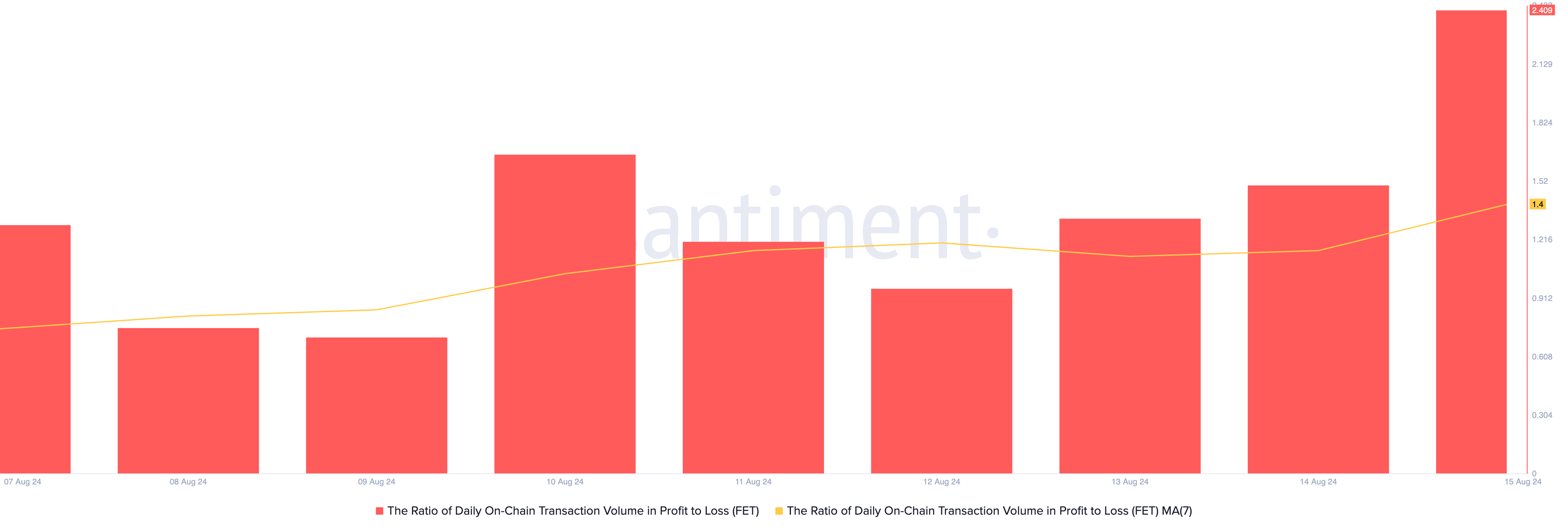

As of this writing, FET trades at $0.84, marking a 3% increase over the past seven days. Analysis of the token’s daily on-chain transaction volume ratio in profit versus loss reveals that most traders have secured gains during this period. On Thursday, the metric reached 2.40, its highest level since July 27.

FET Ratio of Daily On-Chain Transaction Volume in Profit to Loss. Source: Santiment

FET Ratio of Daily On-Chain Transaction Volume in Profit to Loss. Source: Santiment

This metric tracks the proportion of an asset’s daily on-chain transaction volume that ends in profit compared to those that result in a loss. A value of 2.40 indicates that for every FET transaction ending in a loss on Thursday, 2.4 transactions concluded in profit.

When this ratio is elevated alongside a surge in trading volume, it typically signals accumulation by large investors. The recent increase in FET’s supply distribution over the past week further supports this trend.

Read more: How Will Artificial Intelligence (AI) Transform Crypto?

FET Supply Distribution. Source: Santiment

FET Supply Distribution. Source: Santiment

Santiment’s data shows a 16% uptick in the number of FET whales that hold between 10,000 and 10,000,000 tokens in the past seven days. This cohort of FET investors holds over 37,000% of the altcoin’s circulating supply of 2,520,000,000 tokens.

FET Price Prediction: The Profits May Soon Turn to Losses

While FET holders are enjoying short-term profits, caution remains essential as bearish sentiment lingers. This is evident from the Elder-Ray Index, which has consistently shown negative values since July 23. As of now, the indicator sits at -0.097.

The Elder-Ray Index measures the balance of power between buyers and sellers. Negative values indicate that sellers are in control, reflecting bearish dominance in the market.

Additionally, FET is currently trading below its 20-day exponential moving average (EMA), which tracks its average price over the last 20 trading days. Trading below this level signals a short-term downtrend, indicating that recent price action is weaker than the 20-day average — a bearish signal for traders.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

FET Price Analysis. Source: TradingView

FET Price Analysis. Source: TradingView

If FET’s decline continues, its price may drop to $0.70. It last traded at this level on August 5, during the general market downturn. However, if market sentiment turns bullish, the token’s price could rebound and rally above $1, potentially reaching $1.35.