Historical Study Predicts Bitcoin To Hit $164,000—Here’s When

Bitcoin has continued to see a blend of bulls and bears without any major high achieved since its renewed peak above $73,000 in March. So far, the asset has ranged below $60,000 in the past week, as it appears to face resistance whenever it reaches that price mark.

However, several analysts and experts share their optimistic outlook on top crypto despite this. Sminston With, a prominent Bitcoin researcher, recently offered an interesting forecast on BTC based on a detailed examination of the asset’s price trajectory over past bull cycles.

Decoding Bitcoin’s ‘Decaying Peaks’

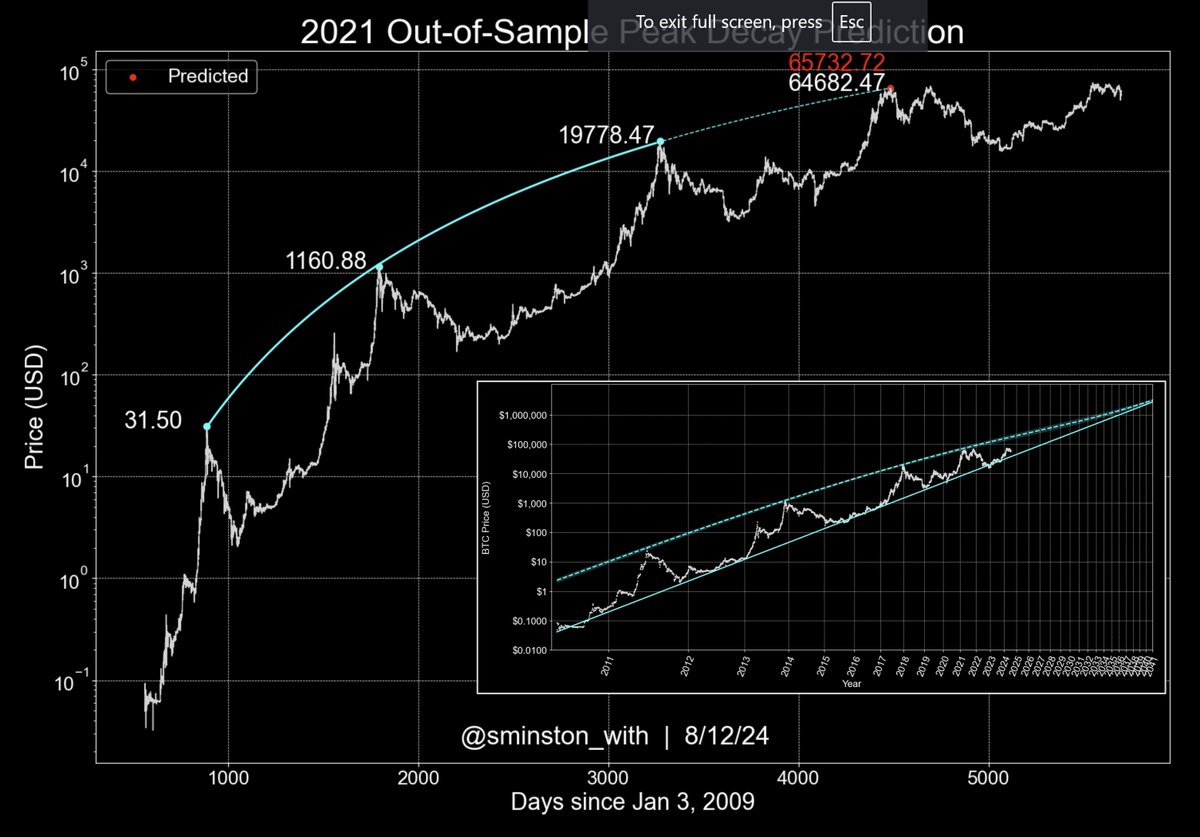

Shared in a post on Elon Musk’s social media platform, X, With’s analysis draws from the peak periods of Bitcoin in 2011, 2013, and 2017 to project future possibilities for this leading cryptocurrency.

The concept used in the analysis, “decaying peaks,” refers to the progressively lower returns seen in successive Bitcoin bull runs as the market matures and gains wider acceptance.

This phenomenon is captured through an analysis known as the “exponential decay fit,” which Is employed to evaluate the peaks of Bitcoin’s past bull cycles by aligning the historical data points of 2011, 2013, and 2017, With aimed to delineate a pattern that could suggest future price movements.

I wanted to highlight a study looking at the decaying peaks of the #BTC price residuals from each cycle (this is what is used to build the Decay Channel and also the Oscillator).

Here I simply did an exponential decay fit of the max residuals (price / .05 quantile power law… pic.twitter.com/dKv60ajL1j

— Sminston With (@sminston_with) August 12, 2024

In his study, the analyst applied this model to the 2021 cycle peak, yielding a forecast close to market behavior. The model predicted a peak of $65,732.72, closely shadowing the actual peak of $64,682.47, highlighting the potential reliability of this analytical approach.

Towards A $164,000 Bitcoin By 2025?

Now extending his analytical framework to the upcoming cycles, he ventured a bold prediction for the 2024-2025 period.

The estimation of the decaying peaks model sketches an ambitious trajectory that could see Bitcoin reaching as high as $164,000. This projection is based on continuing patterns observed in BTC’s past market behaviors.

However, caution is required to consider these predictions with skepticism due to the limited data set—only four market cycles have been analyzed to date. The analyst noted:

The precise exponential decay of the tops (against the power law support) is worth taking with a big grain of salt (we only have 4 data points now), but this is definitely worth paying attention to as we move through the current cycle.

Featured image created with DALL-E, Chart from TradingView