Bitcoin Reserve Bill Advances in US Congress With Bipartisan Support

Senator Cynthia Lummis has introduced the Strategic Bitcoin Reserve bill to the US Congress, marking the start of a legislative process with significant potential impacts on the cryptocurrency market and US economic policy.

On August 3, Senator Lummis announced that the Senate Committee on Banking, Housing, and Urban Affairs received the Bitcoin Act of 2024 (S.4912).

US Bitcoin Reserve Bill Begins Legislative Process

The Congress website shows that the bill was read twice before being assigned to the committee. It is now at the introduction stage, the first of five steps to become law. The bill must still pass both Senate and House votes before reaching the President for final approval.

First proposed at the Bitcoin 2024 Conference, the bill aims to create a reserve BTC fund for the US. It proposes acquiring 1 million BTC, approximately 5% of the total supply, funded by surplus funds from the US Treasury. The Wyoming lawmaker emphasized the bill’s importance in the context of rising inflation and national debt.

“For my grandkids, I hope to leave things better than I find them today. A Strategic Bitcoin Reserve is for them. Low-time preference policy is required to win the future,” she said.

Read more: Who Owns the Most Bitcoin in 2024?

Notably, Republican candidate Donald Trump has expressed similar intentions to establish a US Bitcoin reserve if elected. He suggested that the flagship asset could be used to address the soaring national debt.

Meanwhile, the bill has garnered significant support from the crypto community.

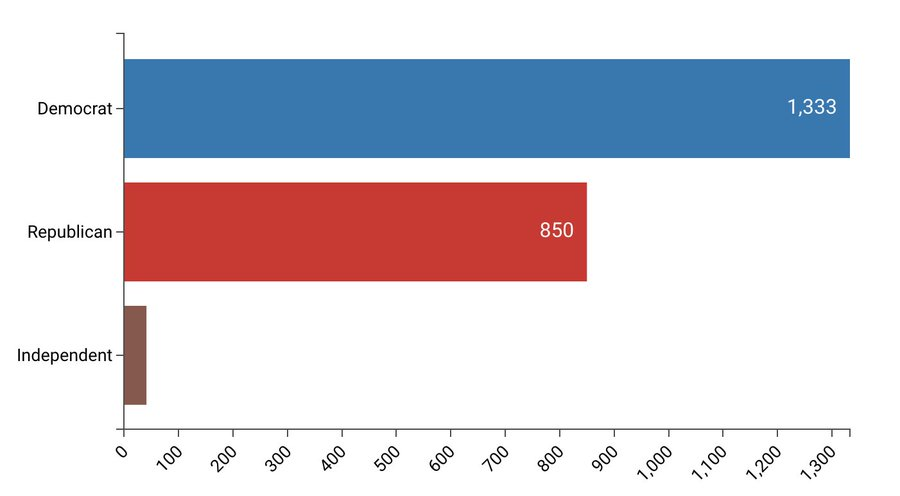

Dennis Porter, founder of the Satoshi Action Fund, reported that bipartisan members sent around 2,500 letters to lawmakers. 1,333 letters went to Democratic senators, 850 to Republican senators, and 41 to Independents.

Read more: How Can Blockchain Be Used for Voting in 2024?

Crypto Community Letters in Support of the Bitcoin Bill. Source: X/Dennis Porter

Crypto Community Letters in Support of the Bitcoin Bill. Source: X/Dennis Porter

Market analysts highlight that this bipartisan outreach underscores significant interest in Bitcoin’s value as establishing a Strategic Bitcoin Reserve could influence both US and global cryptocurrency markets. Moreover, this move would grant official recognition to Bitcoin in the US and might prompt other countries to adopt similar measures.

“Bitcoin is the only credible asset that can outperform the national debt over 20 years. There is no other option,” Will Cole, the head of product at Zaprite, stated.