PEPE Price Stagnation: Short-Term Holders Pose Risk to Recovery

PEPE price is facing mild consolidation and a potential downtrend since the investors’ tone is still moderately bearish.

While this may not lead to significant declines, it could still hamper the meme coin’s recovery chances.

PEPE Investors May Sell

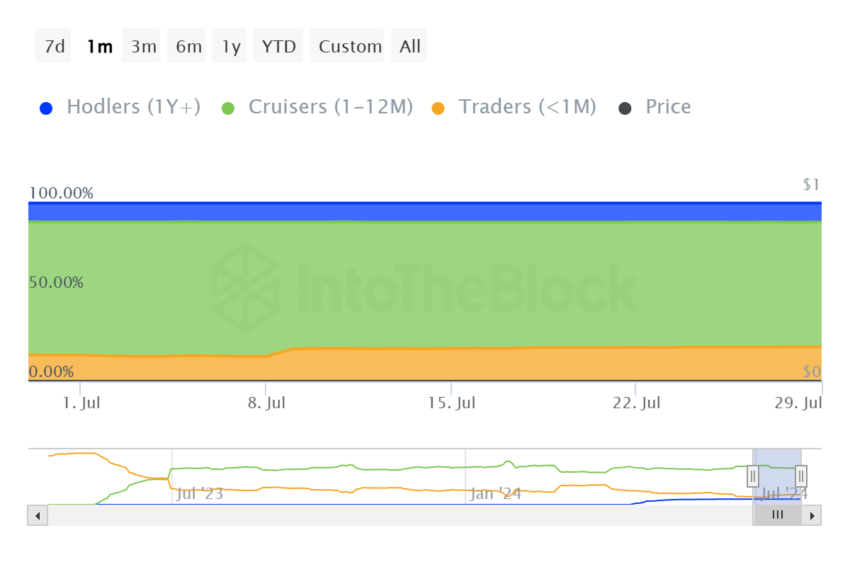

PEPE price could bear the impact of potential selling at the hands of one group of investors—the short-term holders. These investors are known to usually hold their assets for less than a month.

Currently, they dominate 20% of the entire circulating supply of PEPE, which increased following the mid-July rally from 14%. While their presence is not concerningly high, they could potentially look to sell, which could still trigger bearishness.

Read more: Pepe: A Comprehensive Guide to What It Is and How It Works

PEPE Supply Distribution. Source: IntoTheBlock

PEPE Supply Distribution. Source: IntoTheBlock

Their presence, however, contributes to the overall sentiment of selling. Upon observing the active addresses by profitability, a little over 25% of the participating investors are in profit.

These investors are usually prone to selling for profit, and a figure above 25% is a matter of concern. For the last two weeks, PEPE investors’ participation has contributed to about 25% to 29% of the investors conducting transactions on the network.

Thus, these two factors combined present a bearish signal for the meme coin.

PEPE Active Addresses by Profitability. Source: IntoTheBlock

PEPE Active Addresses by Profitability. Source: IntoTheBlock

PEPE Price Prediction: Sideways Ahead

PEPE price trading at $0.00001173 is above the support of $0.00001146, a major boon for the meme coin. However, its inability to breach $0.00001369 is keeping the profits at bay.

Breaching this line is also critical for the altcoin as it would enable PEPE to reclaim its uptrend. As long as that remains out of reach for the meme coin, recovery could be far away.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

PEPE Price Analysis. Source: TradingView

PEPE Price Analysis. Source: TradingView

On the other hand, if the selling intensifies to offset any potential losses, the price could decline. PEPE could lose the support of $0.00001146, falling to $0.00001007, invalidating the bullish-neutral thesis.