What’s New in DePin? Hivemapper Pauses Rewards, Deutsche Telekom Joins XDC, Filecoin Announces Major Update

Decentralized Physical Infrastructure Networks (DePin) are transforming the tech by enabling decentralized projects in real-world infrastructure.

Here’s what happened recently in the DePIN sector: Hivemapper paused Buzz rewards system for improvements, Deutsche Telekom MMS has joined the XDC Network as an infrastructure provider, Filecoin announced a major network update called “Waffle,” set to launch on August 6, 2024.

Hivemapper Pauses Buzz Rewards System

Hivemapper is a platform that utilizes a community-driven approach to create maps. Users contribute data by reporting incidents such as accidents or construction via the Hivemapper app, available on iOS and Android.

The platform initially included a rewards system, called Buzz, to incentivize these contributions. However, this system was recently paused to address issues related to quality control and spam.

“Buzz was launched as an innovative way to crowdsource information and reward our community for their contributions. It was an ambitious idea, and we’ve learned a lot from this initial phase. However, the reality is that the rewards program was not delivering the quality needed,” Hivemapper team shared.

Read more: What Is DePIN (Decentralized Physical Infrastructure Networks)?

According to the recent blog post, many contributions, such as road construction alerts, lacked impact, while others exploited the system by creating multiple accounts. Hivemapper aims to improve its verification processes and will relaunch the rewards with improvements based on community feedback.

Deutsche Telekom Expands Web3 Services with XDC Partnership

Deutsche Telekom’s subsidiary, Deutsche Telekom MMS, has joined the XDC Network as an infrastructure provider. The XDC Network is a blockchain that focuses on tokenizing real-world assets and decentralized physical infrastructure.

Deutsche Telekom MMS will manage a standby masternode, which activates if the number of validator nodes falls below the required 108. This partnership enhances Deutsche Telekom’s blockchain presence, which already includes involvement in Bitcoin, Ethereum, Polkadot, and Polygon networks.

“This addition utilizes our enterprise-grade infrastructure to enable secure blockchain-based applications, with a focus on the finance sector,” said Dirk Röder, head of Deutsche Telekom MMS’s Web3 unit.

Read more: Top 9 Web3 Projects That Are Revolutionizing the Industry

The XDC Network, compatible with the Ethereum Virtual Machine (EVM), offers fast transaction speeds and low gas fees. It hosts stablecoins in euro and US dollars, along with tokenized versions of assets like gold and US Treasuries.

Filecoin Announces Major Network Update

Filecoin has unveiled a major network update called “Waffle,” set to launch on August 6, 2024. This update includes key improvements like FIP-00068, which introduces F3 testing and lays the groundwork for faster finality. It also adds support for Legacy Ethereum Transactions through FIP-91 and introduces a new proof of replication method, FIP-0092, streamlining the sector-sealing process.

“This upgrade is set to enhance Filecoin’s capabilities, efficiency, and integration with the broader blockchain ecosystem,” Filecoin team stated in the blog post.

Read more: The Economics of Decentralized Storage Protocols

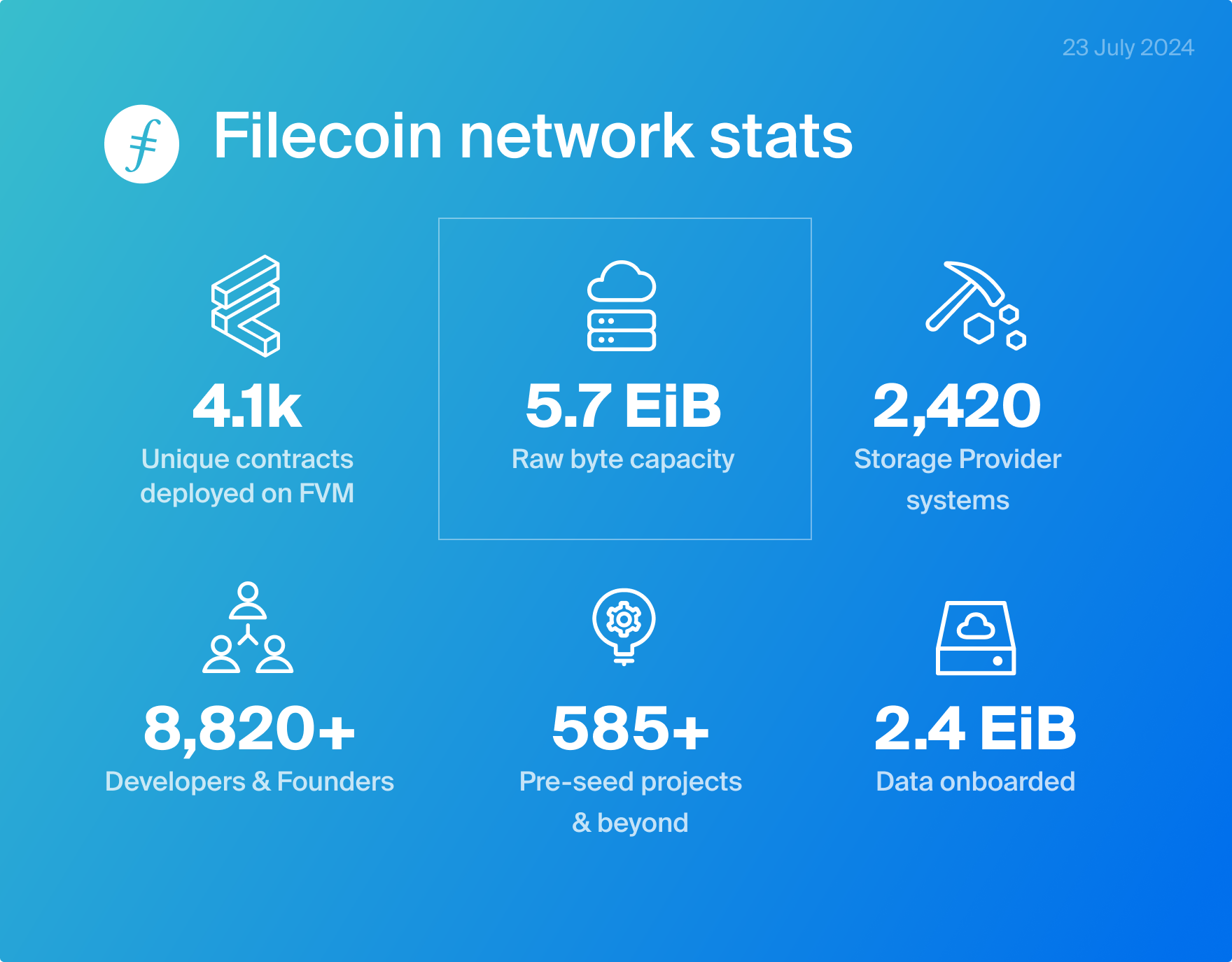

Filecoin Network Stats. Source: Filecoin

Filecoin Network Stats. Source: Filecoin

Additionally, Filecoin announced a new partnership with SingularityNET to enhance AI data storage through “secure and verifiable model training.” Filecoin is positioning itself as a leading decentralized physical infrastructure (DePIN) project for AI, attracting projects like Bagel and Nuklai.

“By leveraging Filecoin’s robust decentralized network, these collaborations aim to enhance AI development, emphasizing the network’s growing influence and importance in the AI and blockchain sectors,” the statement continued.

These developments indicate a promising future for DePIN, with more prominent players entering the sector and new solutions emerging. While DePIN is still in its early stages and has some flaws, it allows for the exchange of tokens between synthetic and real-world assets. This supports traditional infrastructure by providing last-mile coverage in areas where conventional models are not economically feasible.