Donald Trump’s Bitcoin Strategy Plan Faces Mixed Reactions from Industry Experts

Former President Donald Trump’s Bitcoin (BTC) policy plan has sparked diverse reactions from industry experts.

While some see potential benefits, others raise significant concerns.

Crypto’s Rising Political Clout: Experts Weigh In on Trump’s Bitcoin Plan

Anthony Scaramucci, founder of SkyBridge Capital, expressed his support for Donald Trump’s Bitcoin policy unveiled at the Bitcoin 2024 Conference. He praised Trump for pushing Bitcoin into the political spotlight. Moreover, he emphasized the need for bipartisan support for it.

“I agree with every single thing that Trump said related to Bitcoin,” Scaramucci remarked.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

However, Scaramucci also raised concerns about the broader implications of Trump’s approach. He acknowledged the risks associated with Trump’s policies, despite his agreement on the crypto front.

“But I am not a single-issue voter, and I understand the danger that he represents,” Scaramucci added.

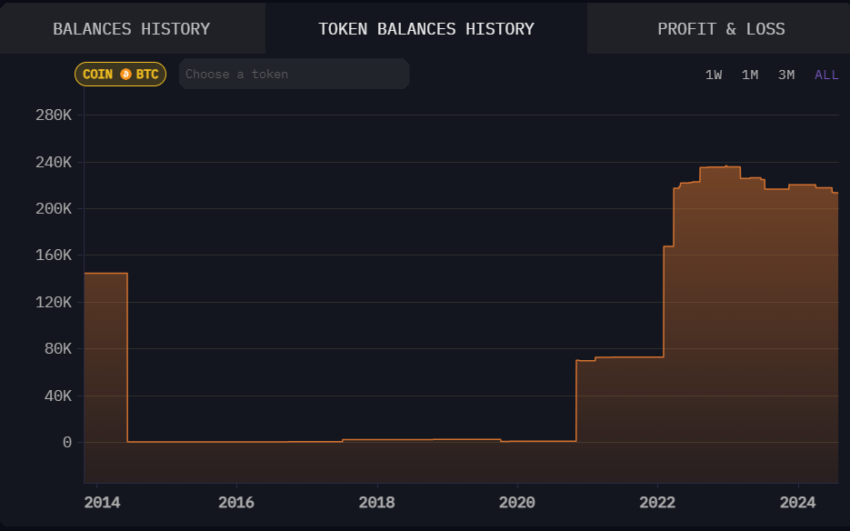

BeInCrypto reported that during the Bitcoin 2024 Conference, Trump stated his intention to prevent the US government from selling its Bitcoin holdings if he returns to the presidency. According to on-chain data from Arkham Intelligence, the government’s Bitcoin holdings include approximately 213,000 BTC worth roughly $15.1 billion.

The US Government’s Bitcoin Holdings. Source: Arkham Intelligence

The US Government’s Bitcoin Holdings. Source: Arkham Intelligence

Despite the optimism, renowned economist Peter Schiff criticized the ‘never sell your Bitcoin’ ideology promoted by prominent figures. Schiff questioned the practicality of retaining Bitcoin without ever selling it, drawing parallels to living in poverty while holding a valuable asset. He argued that such a strategy could be economically flawed.

“If that’s true and no one who buys Bitcoin ever sells any, what’s the point of owning it? What’s the appeal of living in poverty, dying with a big stack of Bitcoin, with successive generations of heirs repeating the process?” he opined.

Trump has repeatedly backed Bitcoin and the broader crypto community throughout this election cycle. In May, he was reportedly considering using Bitcoin to address the US’s $35 trillion national debt issue.

His excitement for Bitcoin hasn’t waned—Trump has voiced his ambition to secure “all the remaining Bitcoin” within the US. He believes that by adopting this approach, the country could establish itself as a leader in energy.

However, it is important to note that Trump’s stance toward cryptocurrencies has evolved over time. In 2019, Trump openly criticized Bitcoin and other digital currencies, labeling them as “not money” and highlighting their volatility.

In a recent tweet, Mike Novogratz, CEO of Galaxy Digital, offered a critical perspective on Trump’s newfound support for Bitcoin. He pointed out the political motivations behind Trump’s stance, suggesting that it aimed to win over single-issue voters.

“If [Vice President Kamala] Harris, who has had no control over policy from her seat, does the same, is it pandering? C’mon. We want both parties on our side!!! Like I said yesterday, that was a spectacular endorsement for our industry!! And it is forcing the Democrats to get on board! We want both parties supporting us!!” Novogratz added.

Earlier this month, Arthur Hayes, founder of the BitMEX crypto exchange, shared a critical perspective on Trump’s shifting position in a blog post. Hayes argued that Trump’s stance has political motives. It aims to influence the young, politically active, and financially influential crypto voter base in key swing states.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Despite the differing opinions among these experts, this debate showcases the growing influence of the crypto industry in politics. In a recent video, Marshall Beard, COO of Gemini, noted that one in five Americans owns digital currency, stressing the need for politicians to collaborate with industry providers to develop regulations that support innovation.

“Every year, more and more adoption occurs. The candidates talking and having a pro-crypto stance is obviously bringing more people into the ecosystem as well. But the issue has been the current administration over the last four years has been kind of hostile to the industry. […] Politicians, they should work with providers like a Gemini. They should work with constituents. They should work with policymakers to craft thoughtful regulation that doesn’t stifle innovation and supports an industry that we all know is not going anywhere,” Beard elaborated.