Ethereum ETFs could spark new ETH all-time high but face potential Grayscale barrier

- Grayscale's Ethereum Trust fees could spark outflows, canceling out potential inflows across Ethereum ETFs.

- Ethereum Foundation-related wallet has been dumping ETH on exchanges.

- Ethereum could see a new all-time high if it moves above a key resistance.

Ethereum (ETH) is down 0.4.% on Thursday following speculations surrounding the potential negative impact of Grayscale's Ethereum Trust fees and ETH dump from the Ethereum Foundation.

Daily digest market movers: Grayscale's fee, Ethereum Foundation dump

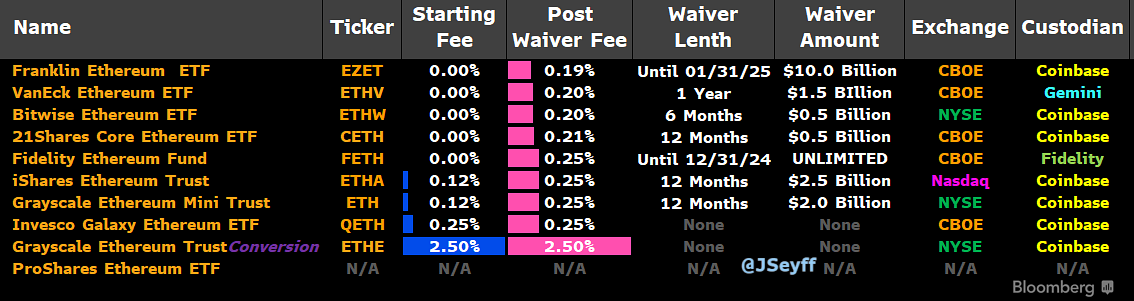

The Grayscale Ethereum Trust 2.5% fee has left many ETHE holders fuming as the asset manager maintained the high fee structure it applied to Bitcoin ETFs.

Several analysts predicted that the move may see Grayscale's Ethereum Trust suffer increased outflow similar to its Bitcoin counterpart when ETH ETFs go live. As a result, it could cancel out potential inflows in other Ethereum ETFs, reducing the upward impact on ETH's price.

Ethereum ETF issuers filed their final S-1 registration statements on Wednesday, revealing fees for their respective products. The Securities and Exchange Commission (SEC) also approved 19b-4 filings of Grayscale's Mini Trust and ProShares Ethereum ETFs, two of the latest additions to the ten funds potentially launching on Tuesday.

Bloomberg Ethereum ETFs List

Meanwhile, an Ethereum Foundation-related wallet, 0xdbe, is suspected of dumping ETH following the recent price dip after depositing 1,602 ETH worth $5.48 million to Kraken in the past few hours, according to Spot On Chain.

Since June 8, 0xdbe has been dumping ETH on exchanges, potentially selling 19,488 ETH worth about $70.6 million. As revealed in the chart below, a decline followed its three large sales.

PnL overview

ETH technical analysis: Ethereum could rally above the $4,093 yearly high

Ethereum is trading around $3,400, down 0.4% in the past 24 hours. The move has seen ETH liquidations reach $30.90 million, with long and short liquidations accounting for $22.08 million and $8.82 million, respectively.

Since the crypto market recovery, Ethereum's Taker Buy/Sell Ratio has been in an uptrend, according to CryptoQuant's data.

-638569284289800749.png)

ETH Taker Buy/Sell Ratio

The Taker Buy/Sell Ratio estimates the dominant sentiment among futures traders. Values above 1 suggest bullish pressure is dominant, while values below 1 indicate bearish pressure.

If the Taker Buy/Sell Ratio uptrend continues, ETH will likely ride the bullish wave further. And with spot Ethereum ETFs set for a potential Tuesday launch, ETH bears could see heavy liquidations.

On the upside, ETH faces resistance around $3,977, a level it has failed to overcome since descending from its yearly high of $4,093 in March. ETH options data also shows several call options with a strike price of $4,000. Hence, prices are likely to tilt towards this level in the long run.

ETH/USDT 8-hour chart

A successful move above this resistance level could see ETH rally to a new all-time high in the coming months. On the downside, ETH may find support around the $3,000 psychological level.

ETH could drop to $3,360 in the short term, where $24.39 million long positions risk liquidation.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.