Telegram Bot Banana Gun (BANANA) Nears All-Time High

Telegram Coin Banana Gun (BANANA) is inching closer to establishing a new all-time high (ATH).

Substantiated by the broader market cues, the altcoin seems prepared for something that goes down.

Banana Gun Takes a Shot

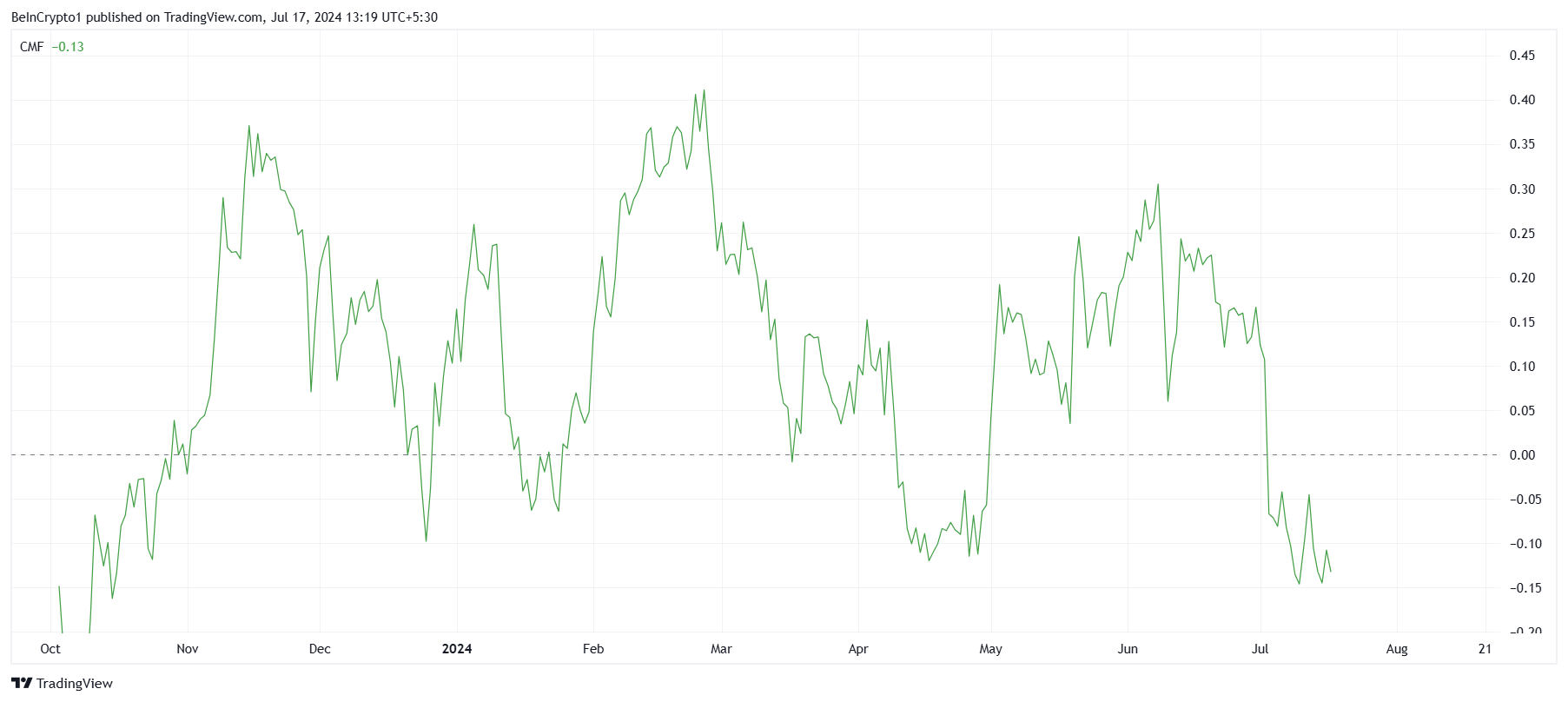

BANANA’s price is rallying owing to the Chaikin Money Flow (CMF) indicator, which shows a notable increase in outflows. This pattern suggests that, despite the ongoing rally, significant capital is leaving the market.

However, this outflow trend does not necessarily mean the rally will end soon. Instead, it indicates that strong underlying factors might support the current upward momentum, and the rally could persist for a while.

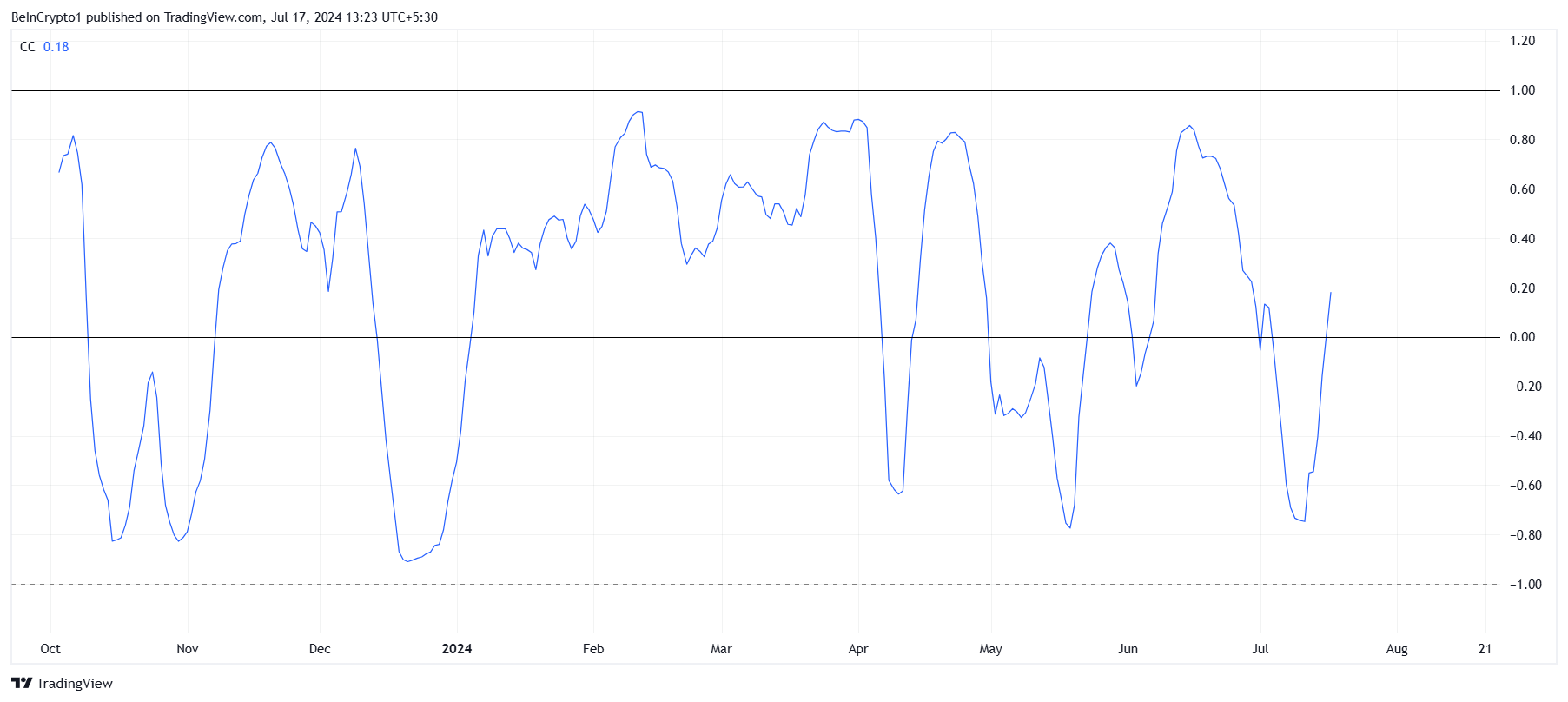

Moreover, BANANA’s correlation with Bitcoin has recently turned positive. This shift is significant as it implies that BANANA and Bitcoin are now moving in tandem.

Read More: What Are Telegram Bot Coins?

Banana CMF. Source: TradingView

Banana CMF. Source: TradingView

When assets exhibit a positive correlation, it means that when one asset’s price rises, the other is also likely to rise. In this case, as Bitcoin continues its upward trend, BANANA is expected to follow suit, benefiting from Bitcoin’s recovery.

Given the positive correlation between BANANA and Bitcoin, BANANA stands to gain from Bitcoin’s ongoing recovery. As Bitcoin has recently surpassed the $66,000 mark, it sets a strong precedent for other cryptocurrencies.

Banana Correlation with Bitcoin. Source: TradingView

Banana Correlation with Bitcoin. Source: TradingView

By leveraging this momentum, BANANA could see substantial gains as it mirrors Bitcoin’s performance. Investors in BANANA may find this correlation promising, as it suggests potential growth opportunities tied to Bitcoin’s success.

BANANA Price Prediction: New ATH in Sights

The BANANA price, at $57, is close to forming a new all-time high, as the former lies at $62. The Telegram Coin should be open to the other side, and failure could keep it subdued at $62. This result is anticipated to be bullish.

Read More: Crypto Telegram Groups To Join in 2024

Banana Price Analysis. Source: TradingView

Banana Price Analysis. Source: TradingView

However, if the breach fails and the Telegram coin cannot rise further, a drawdown against the market cues is likely. The decline could keep it slipping below the support of $54$54 and $47$47, resulting in sideways movement.