Grayscale Bitcoin Trust: Three years and a spot ETF later, GBTC discount comes to an end

- Grayscale Bitcoin Trust, better known as GBTC, recently converted to a spot ETF and emerged as the best-performing ETP in the category.

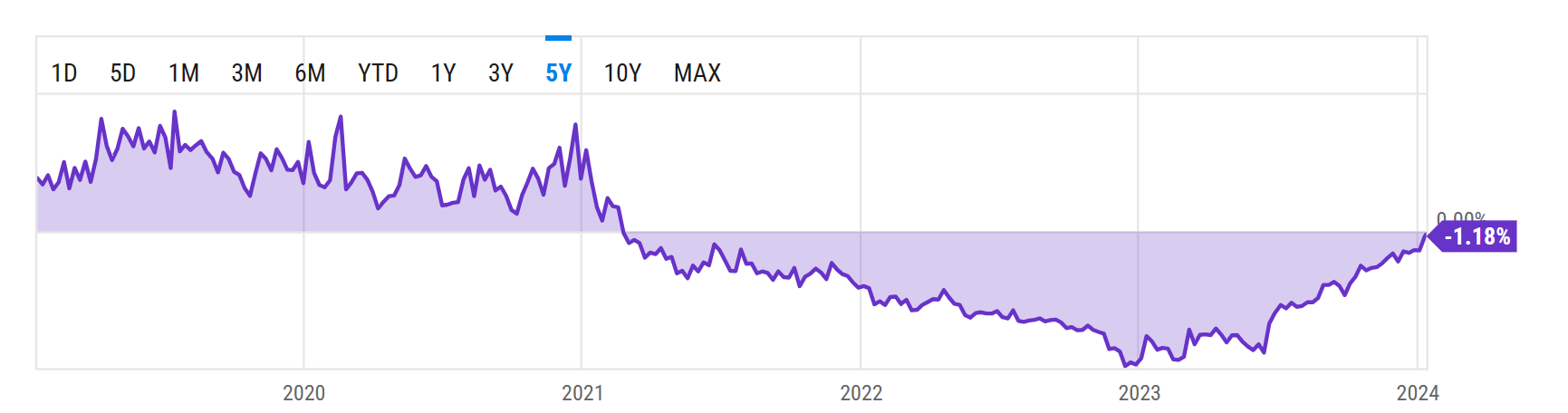

- GBTC discount to Net Asset Value (NAV) is presently at 1.18%, close to trading at a premium for the first time in three years.

- According to Bloomberg ETF analyst Eric Balchunas, GBTC bleeding is not over yet, and the discount could extend.

Grayscale was the key to achieving a spot Bitcoin ETF approval after winning the lawsuit it filed against the SEC for wrongfully denying its application to convert GBTC into a spot ETF. This was followed by the Grayscale Bitcoin Trust (GBTC) becoming the best-performing ETP post-launch and presently making a historic comeback.

Grayscale Bitcoin Trust discount nears an end

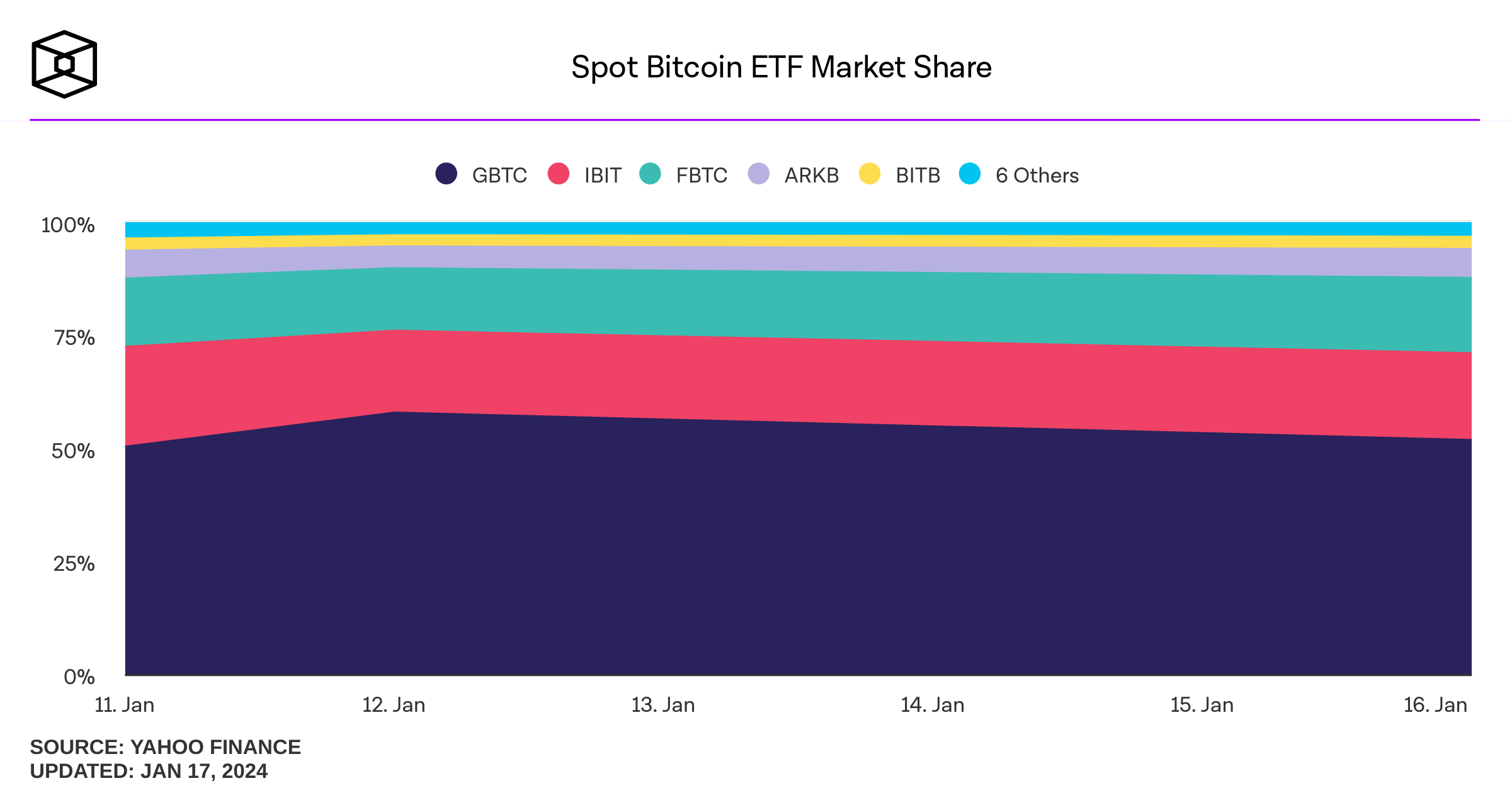

Grayscale dominates the Bitcoin ETF space, accounting for more than 52% of the market share. This growth has made one of the biggest crypto asset fund managers a huge name in the exchange-traded fund (ETF) space, and the results show that this could be getting better.

Spot Bitcoin ETF market share

According to the contraction observed in the charts, GBTC’s discount to Net Asset Value (NAV) has contracted to 1.18%. Discount to NAV basically highlights how much lower the asset is relative to the underlying. Similarly, premium suggests the contrary.

Grayscale Bitcoin Trust discount

For the past three years, the GBTC premium has always been trading at a discount. At the time of writing, this discount has contracted to nearly hitting the zero line. Once GBTC crosses above this line, it would be noting premium to its NAV for the first time in nearly three years. The last time GBTC observed premium was back in February 2021.

However, according to Bloomberg ETF analyst Eric Balchunas, this may not be the end for GBTC discount as, according to him, the fund could bleed more. Given that it has been less than a week of trading and the spot Bitcoin ETF market has already traded over $11 billion in volume, the likelihood of an extension of the discount is unlikely.

Plus, considering the impact of GBTC on the existence of spot ETFs, the possibility of Grayscale witnessing outflows from its exchange-traded product is low.