Bitcoin on verge of 20% rally as Fed leaves rates unchanged

- Bitcoin could see a 20% rally after positive CPI data and FOMC meeting.

- Over 20K BTC flowed to accumulating whale addresses in past 24 hours.

- Donald Trump told miners he wants all "remaining BTC to be made in the USA."

Bitcoin (BTC) gained over 2% on Wednesday after the Federal Reserve (Fed) left interest rates unchanged at 5.25% to 5.50%. A recent analysis also revealed that BTC could be on the verge of a 20% rally after the Fed’s meeting.

BTC could see 20% gain following Trump’s comment and FOMC meeting

Bitcoin shot above 4% in the past 24 hours before experiencing a slight correction after the headline US Consumer Price Index (CPI) data came in at 3.3% YoY, below expectations of 3.4%. Bitcoin's price quickly reacted positively to the news of declining inflation.

Also read: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bitcoin could see high volatility due to US CPI

The market had earlier priced in higher inflation ahead of the FOMC meeting, causing Bitcoin to suffer more than a 5% decline on Tuesday. However, the softer-than-expected CPI data has changed investors' sentiment, with many expecting a price rise.

The Fed also announced it would leave interest rates unchanged at 5.25% to 5.50%. Four Fed officials expect no cuts this year, seven see one cut on the horizon, and eight project two cuts.

BTC's recent move seems to align with its historical price movement during the past four FOMC events. As noted by analyst @CryptoJelleNL, "the past FOMC meetings have all marked local bottoms and triggered >20% rallies for Bitcoin." As Bitcoin is currently rising, the prediction seems to be taking shape.

Read more: Bitcoin’s 2% crash wipes $4.21 billion in OI and handicaps altcoins, what’s next?

BTC chart after FOMC

Whale activity in the past 24 hours also gives credence to the possibility of a price rise.

According to data from CryptoQuant, more than 20K BTC flowed to accumulating whale addresses during Tuesday's price decline.

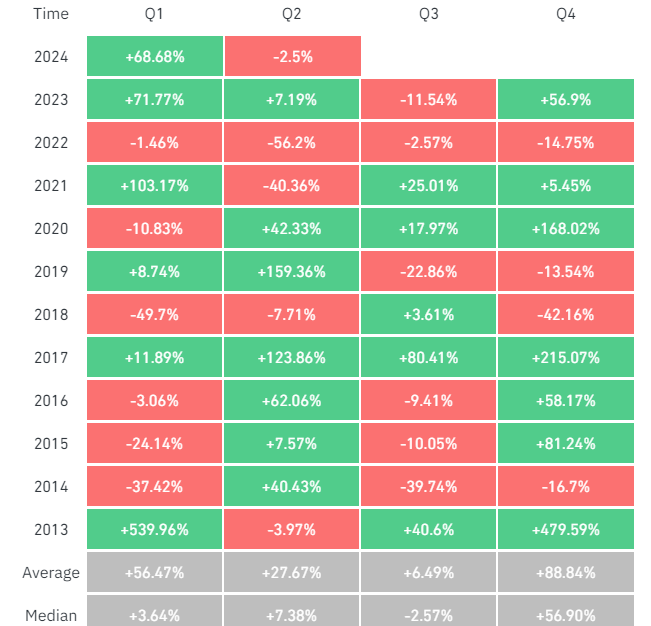

BTC Quarterly returns

However, investors must exercise caution as Bitcoin has historically struggled in Q3. BTC's Q3 average return is at 6.49% with a median return of -2.57%.

Also read: Bitcoin and entire crypto market bow into the weekend following strong NFP report

US Presidential candidate Donald Trump met with several executives of top Bitcoin mining firms in the US, according to Bitcoin Magazine, telling them he'll support BTC mining in Washington, DC and globally. The news was followed by Trump's post on his Truth Social platform, saying he wants all the "remaining Bitcoin to be MADE IN THE USA."

L.F.G. #Bitcoin pic.twitter.com/C36wReJ2S8

— Dylan LeClair (@DylanLeClair_) June 12, 2024

Trump's comment triggered a rise in the stocks of Bitcoin mining companies with TerraWulf rising by 19%, Hive Digital up by 8% and MicroStrategy seeing a 7% gain.