Bitcoin Weekly Forecast: Is BTC ready for a new all-time high?

- Bitcoin whales have increased buying activity to the highest level in two months.

- Investors show no signs of FOMO despite BTC’s recent tussle with the $70,000 mark.

- US spot Bitcoin ETFs experienced a notable uptick in activity, reflecting growing market interest.

Bitcoin (BTC) price is showing a positive outlook despite recent stabilization at around $71,000. According to on-chain data, whales are returning with strong buying power, US spot Bitcoin ETFs are increasing, and the absence of FOMO among investors suggests that Bitcoin is poised to set new all-time highs.

Bitcoin whales accumulating

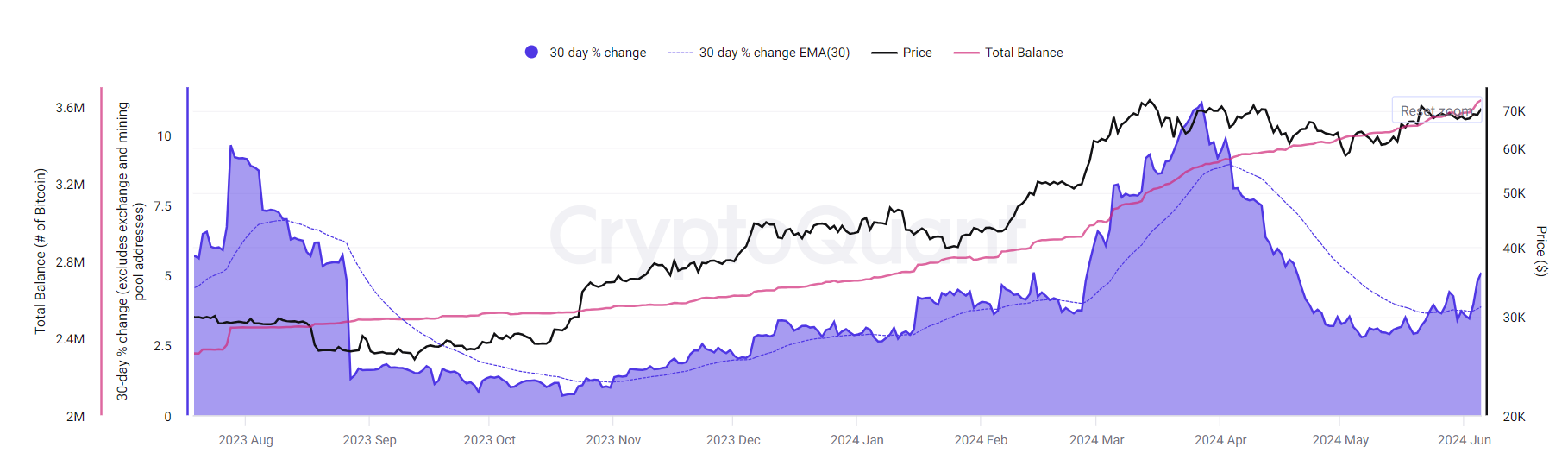

Data from CryptoQuant Total Whale Holdings and Monthly Percentage Change refers to the combined amount of Bitcoin held by large investors or institutions, often known as whales, due to their substantial influence on the cryptocurrency market.

The Monthly percentage Change reflects the percentage shift in these holdings over a one-month period. This metric is closely observed to assess market sentiment and potential future market movements, as the actions of these major holders can significantly impact Bitcoin's price through their buying or selling activities.

In Bitcoin’s case, the 30-day percentage change increased from 2.79% to 5.08% from May 6 to June 6, the highest in two months. This 2.29 percentage point increase indicates that the whales are returning with strong buying power once again.

BTC Total Whale Holdings and Monthly Percentage Change chart

According to CryptoQuant data for Bitcoin ETFs, Historical Bitcoin Holdings Trend (Aggregated) shows a historical overview of the total amount of Bitcoin held by all ETF issuers combined. Increases or decreases in the aggregated Bitcoin holdings of ETFs may indicate shifts in institutional demand for Bitcoin exposure or changes in investment strategies.

US spot Bitcoin ETFs have also seen a significant uptick, with holdings increasing from 819.02K on May 2 to 875.5K on June 6, signaling growing confidence in Bitcoin's long-term prospects among investors.

-638533418836088584.png)

BTC Etfs Historical Bitcoin Holdings Trend (Aggregated) chart

Santiment's BTC Social Volume data offers valuable insights into the level of discussion and mentions of Bitcoin across diverse social media platforms, forums, and online communities. It tracks the volume of posts, comments, tweets, and other interactions related to Bitcoin over a specific period.

According to BTC’s Social Volume indicator, recent observations suggest that the significance of Bitcoin price reaching $70,000 is not nearly as substantial for investors as it was three months ago, on March 11, when it crossed $70,000 for the first time. This lack of FOMO (Fear of Missing Out) is generally perceived as a positive sign because it indicates more sustainable and rational market behavior and reduces the risk of speculative bubbles and price crashes. Thus Bitcoin may have the potential to break through with less crowd euphoria than what previously marked market tops.

[09.44.04, 07 Jun, 2024]-638533419376923056.png)

BTC Social Volume chart

The combination of increasing whale buying power, the uptick in US spot Bitcoin ETFs, and the decreasing Social Volume collectively indicate the robustness of Bitcoin bulls, suggesting their ability to support the pricer in the current bull market towards the all-time high registered in March.