Bitcoin could see higher volatility spike if a new all-time high is reached

- Bitcoin long-term holders are still holding onto a large portion of unrealized profit.

- Glassnode data suggests long-term holders could cause heavy selling if Bitcoin reaches a new all-time high.

- Galaxy Digital CEO predicts Bitcoin could reach $100K by year-end.

Bitcoin (BTC) traded around $70,400 on Tuesday following key insights from Glassnode, which suggested that the largest digital asset could be primed for increased volatility if it reaches a new all-time high in the coming days.

Long-term holders could dictate Bitcoin's price action in the coming days

According to key metrics from Glassnode, most Bitcoin long-term holders are holding onto a huge pile of unrealized profits.

Firstly, the coin age metric of Bitcoin shows coins younger than three months old account for 41% of the network's wealth. Coin age indicates how long a coin has been in the possession of an address and helps measure the percentage of liquidity distribution between short-term and long-term holders.

While < 3-months old coins at 41%, shows that the percentage of liquidity held by new demand is beginning to grow, it usually increases above 70% in historical bull market highs, "suggesting that a comparatively smaller volume of supply has been spent and sold by longer-term investors."

Read more: Veteran trader sets target for next Bitcoin bull market high

Another key age constituent is the single cycle holders (coins aged six months to three years). According to Glassnode, all members of this group began holding large unrealized profits after the price of BTC crossed the $40K region but began to sell after BTC's rally to the $73K all-time high. "We can expect that this cohort's incentive to sell more supply will grow should prices climb high and elevate their unrealized profit further," noted Glassnode analysts.

Additionally, the number of long-term holders (LTHs) in profit is over 85%, with only 0.3% in loss, indicating this may still be the beginning of the euphoria phase. At the top of the euphoria phase, the holdings of LTHs fall significantly after heavy profit-taking, as indicated in the chart below.

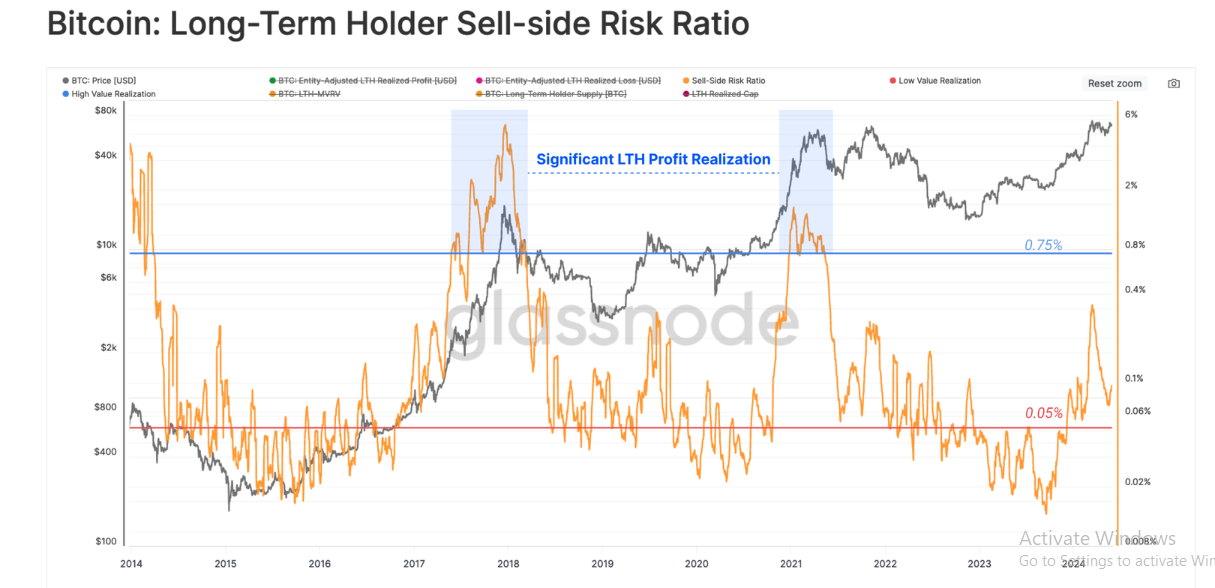

BTC LTH Sell-side Risk Ratio

Despite large unrealized profits, their sell-side risk ratio is at a lower level compared to new ATHs in previous cycles. Although it saw a brief surge as investors booked profits at the 73K level, it's still far behind the higher levels seen in previous market cycles.

Also read: Bitcoin sets the stage for a potential “destruction of fiat currency“

The sell-side risk ratio measures the absolute realized profits and losses in relation to their realized capitalization. A higher ratio means investors' spending at a profit/loss is high, while a lower ratio indicates that the majority of coins are spent close to their break-even price.

The lower sell-side risk ratio "suggests this cohort is waiting for higher prices before ramping up their distribution pressure," said Glassnode.

That said, Bitcoin's exchange netflow is at -7,883 BTC, which aligns with the corresponding price rise, according to data from CryptoQuant. However, BTC could see a temporary profit taking if it rises to around $72K as over 150K BTC will be in profits around that price.

Read more: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bitcoin’s momentum poise to propel crypto market

Also, Galaxy Digital CEO Mike Novogratz believes Bitcoin's risk is getting skewed to the upside and could end the year at $100K if it overcomes the $73K all-time high around next week. He mentioned that more regulatory clarity and the Senate potentially approving the FIT21 bill could serve as a major catalyst to bring in more prominent traditional players into the ecosystem and, in turn, boost Bitcoin's price.

Meanwhile, the Securities and Exchange Commission of Thailand has approved its first spot Bitcoin ETF—by One Asset Management—in the region. However, the fund's investment will be limited to wealthy and institutional investors.