Uniswap founder hopes SEC doesn't pursue enforcement as on-chain data shows price spike is on the horizon

- Uniswap has responded to SEC's Wells notice, according to its founder, Hayden Adams.

- Adams hopes the SEC will reconsider its enforcement action against Uniswap after recent regulatory wins for the crypto industry.

- UNI's on-chain data suggests it needs a 50% rally before seeing significant profit-taking amid signs of potential price spike.

Uniswap (UNI) gained nearly 3% on Thursday as its founder revealed the decentralized exchange (DEX) has responded to the Securities & Exchange Commission's (SEC) Wells notice. Meanwhile, UNI's on-chain data also suggests a price spike may be on the horizon.

Uniswap responds to Wells Notice

Uniswap founder Hayden Adams revealed in an X post on Wednesday that the protocol has responded to SEC's Wells notice. This follows a crypto community member asking if his recent positivity surrounding Democrats becoming allegedly pro-crypto solves the Wells Notice issue.

Uniswap Labs received a Wells notice from the SEC on April 10, in which the regulator accused the decentralized exchange of facilitating unregistered securities trading.

A Wells Notice is a document from the SEC issued upon the conclusion of an investigation stating its intention to take enforcement action against a prospective respondent who can submit a written response to the securities regulator.

Read more: Uniswap price could crash 12% as investors take profits

According to Adams, 80% of the time, the SEC proceeds with an enforcement action one month after a Wells notice. Considering the SEC has yet to take enforcement actions against Uniswap more than six weeks after the Wells notice, Adams hopes the regulator has pivoted.

"I hold out some hope they realize consumers are much better off if they focus on constructive rule making and enforcements against scams (vs enforcement against legit companies building useful tech) - and decide not to proceed," said Adams. He further highlighted that a change in SEC leadership would be the most impactful thing Biden can do to build trust with the crypto industry.

Adams also mentioned he's "preparing for the worst" as the Wells notice still looms over Uniswap.

Considering the SEC's approval of spot Ethereum ETFs on May 23 — which many believe removes potential security status from ETH — and the House of Representatives approving the FIT21, many expected the SEC to wind down on previous legal actions targeted at crypto firms.

UNI may need a 50% rally before seeing significant profit-taking

UNI is up nearly 3% on Thursday as the Uniswap DAO will begin another voting round on "fee switch" proposal on Friday. The "fee switch" proposal will see UNI holders who participate in protocol governance earn a portion of Uniswap's revenue. However, many have also raised concerns that such a move could intensify the SEC's action against the DEX.

Also read: Uniswap to conduct on-chain voting on May 31 despite SEC Wells notice, UNI could extend gains over 20%

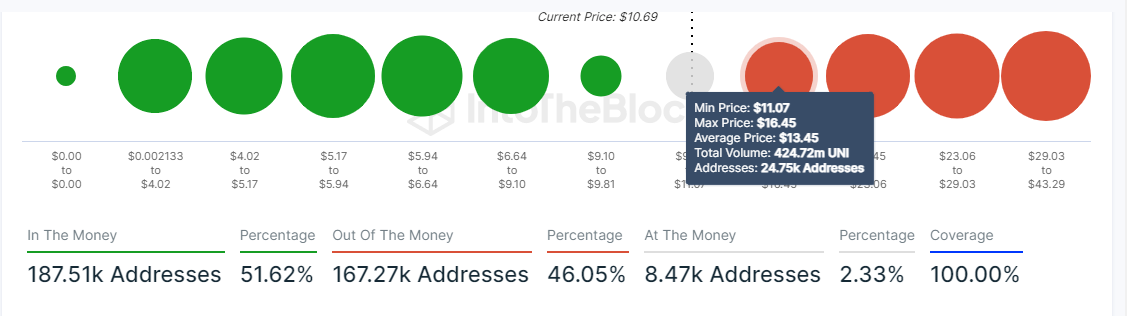

Data from IntoTheBlock shows that 51.6% of UNI addresses are in the money, 2.3% are at the money, and 46% are out of the money.

In/Out of the Money reveals the total number of addresses in profit or loss based on their average cost of purchase. An address is in the money if its current price is higher than its average cost and vice versa if it is lower.

Global In/Out of the Money

UNI's holder's composition also shows that 82% of addresses are long-term holders (1 year plus), 17% bought within the last 12 months, and 2% bought within the past month.

Considering nearly half of UNI's supply was bought at an average price of $13.45, investors/whales are likely to hold onto their positions.

A combination of both metrics and UNI's historical price shows UNI needs to rise over 50% to around $16.45 before it may see significant profit-taking.

[23.39.11, 30 May, 2024]-638527083384283606.png)

UNI 30-day MVRV

In the short term, UNI could see a spike as it often sees a price rise whenever the 30-day average MVRV movement retraces briefly after reaching around 21-26%, according to data from Santiment.

The 30-day MVRV calculates the average profit or loss of addresses that acquired an asset within the previous 30 days.