Binance effect fades, less than 20% tokens are profitable six months after listing

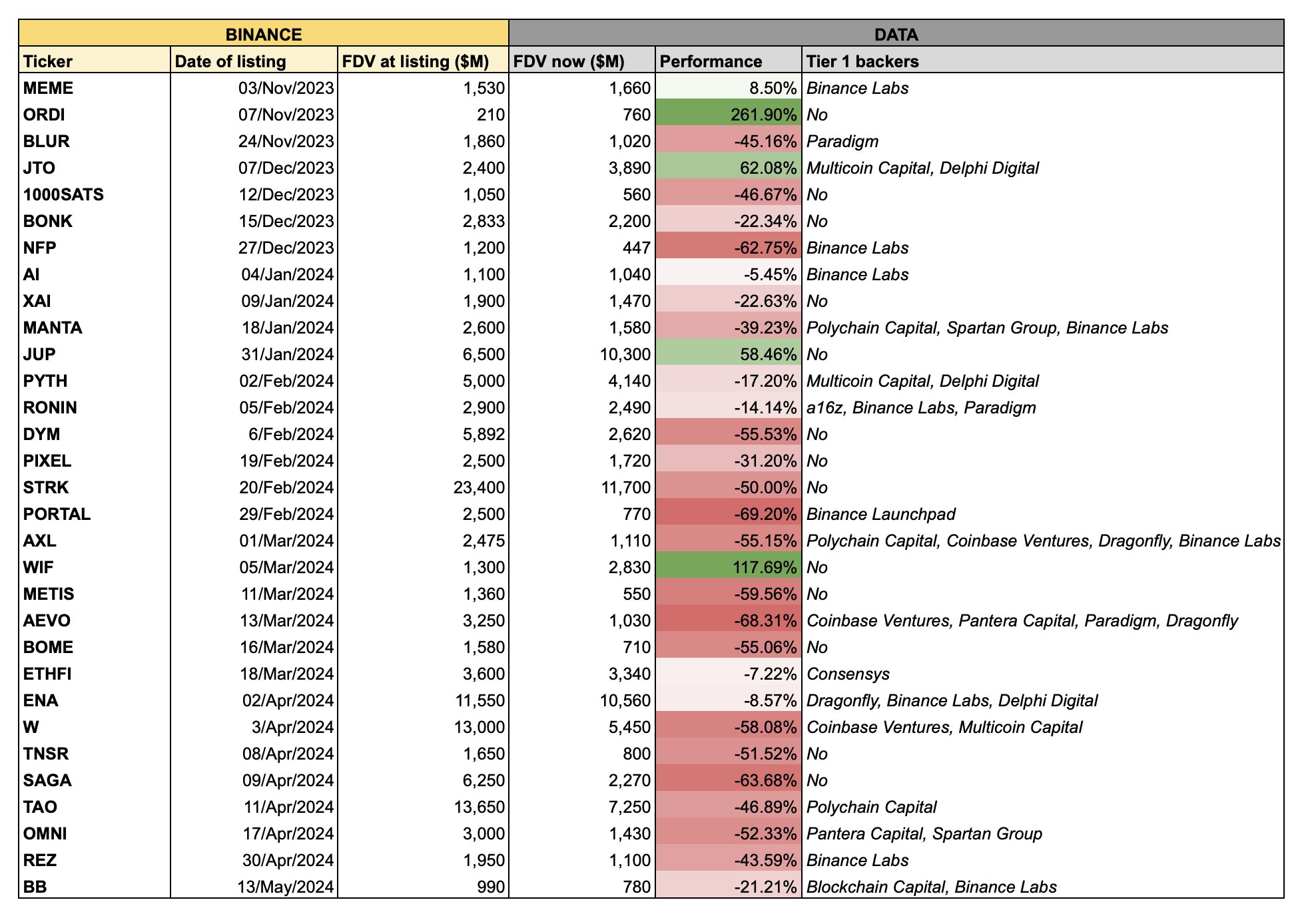

- Crypto researcher Flow analyzed thirty-one crypto tokens listed on Binance in the past six months to determine their profitability.

- Five out of the list, a mere 16%, trade above their listing price, per his analysis.

- Gainers are ORDI, JTO, JUP, WIF and MEME, while biggest losers include BOME, W and NFP.

Being listed on the centralized exchange Binance previously influenced token prices and pushed them higher after the event. However, this phenomenon has changed in the recent past. Crypto researcher Flow (@tradetheflow_) analyzed the price trends of thirty-one cryptocurrencies listed on Binance six months after their listing and shared insights.

Binance listing alone may not help sustain higher prices for longer

In previous crypto market cycles, being listed in Binance has catalyzed immediate and long-term gains for assets. However, in the ongoing cycle, despite listing on the exchange has an immediate positive impact on the price, assets fail to sustain the newfound gains.

Flow’s research shows that out of 31 crypto tokens listed on the exchange in the past six months, only five have seen a sustained price increase.

The 5 coins that sustained their gains are:

- Memecoin (MEME)

- ORDI

- Jupiter (JUP) and Jito (JTO)

- Dogwifhat (WIF)

The Solana-based meme coins JUP, JTO and, WIF , on the list have likely sustained their gains in line with the meme narrative and capital rotation from Bitcoin, Ethereum and GameStop to memes like WIF.

31 tokens analyzed on Binance

The research suggests that if investors bought assets listed on Binance on the day of listing, they would suffer a drawdown of over 18% in six months. Flow notes that the tokens represent “exit liquidity” for Venture Capitalists (VCs), rather than investment potential for traders.

The path to exchange listing, higher Fully Diluted Valuations (FDV) during the Binance listing process is unsustainable for the asset in the long run. FDV is the maximum value of a crypto project assuming all tokens in the supply are in circulation. The metric is used to identify overvalued and undervalued assets in trading circles.

According to Flow's research, the three biggest losers ion the six-month timeframe are PORTAL (down 69%), AEVO (,down 68%) and SAGA (down 63%).

Every one is talking about the VC + CEX cartel where teams are pushed to launch at the highest possible FDV on tier-1 CEX and provide exit liquidity for VC and insiders

— flow (@tradetheflow_) May 17, 2024

The result: New coins are not great investment anymore

But how real is this? I crunched the number for you