Bitcoin price holds above $65.5K threshold as world’s largest futures exchange plans to launch BTC trading

- Bitcoin price breached $65,500 on Wednesday with a god candle after US April CPI data.

- Bullish momentum continues to grow with higher lows on daily RSI chart.

- Futures exchange CME plans to launch Bitcoin trading, platform could boost mainstream adoption.

Bitcoin’s (BTC) price rally on Wednesday was shocking, steered by the April Consumer Price Index (CPI) data release in the US. Speculation and market sentiment inspired the surge as traders and investors interpreted the news of softened inflation as a signal that central banks may maintain loose monetary policy, which could benefit riskier assets like Bitcoin.

Also Read: Bitcoin Price Outlook: Will CPI report showing inflation eased in April push BTC to $70K?

Daily digest market movers: World’s largest futures exchange plans to launch Bitcoin trading

The World’s largest futures exchange, CME Group, is planning to launch Bitcoin trading on its platform, Financial Times reports.

The Chicago-based financial services company is looking to capitalize on the burgeoning demand for BTC this year among Wall Street institutions. The money managers are progressively looking to gain exposure to the cryptocurrency sector through the recently approved exchange-traded funds (ETFs).

Citing people familiar with the matter, the report reveals that the CME Group has been in talks with traders looking to buy and sell Bitcoin on a regulated marketplace.

While the plan is still in the works, actualization would have bullish implications for crypto, including promoting mainstream adoption. Other value additions include investors being able to place basis trades easily.

JUST IN: CME Group, the world's largest futures exchange to launch #Bitcoin trading. pic.twitter.com/bKWyapiWUS

— Bark Media (@barkmediax) May 16, 2024

This is a strategy where an investor seeks to profit from the price difference between a cryptocurrency and its corresponding futures contract. Notably, the CME Group already hosts trading in BTC futures. Basis trading, therefore, involves borrowing money to sell futures while buying the underlying asset and extracting gains from the small gap between the two.

The allure of BTC comes courtesy of ETFs with some of the world’s largest financial institutions already turning from Bitcoin skeptics into advocates. Among them:

- Wells Fargo now holds Grayscale's spot Bitcoin ETF, joining the trend of institutional adoption.

- Susquehanna International Group holds $1.8 billion in Bitcoin ETFs.

- State of Wisconsin Investment Board (SWIB) invested $162 million in Bitcoin ETFs, making it the first state institution to go public with spot BTC ETF holdings.

- JPMorgan, the largest bank in the US, has disclosed holdings in spot Bitcoin ETFs, per SEC filing.

- Millennium Management discloses $2 billion spot Bitcoin ETF portfolio.

However, based on reported 13F disclosures, BlackRock’s IBIT holders have set a record. It boasts 414 institutional holders.

$IBIT ended up with 414 reported holders in its first 13F season, which is mind boggling, blows away record. Even having 20 holders as a newborn is bfd, highly rare. Here's a look at how the btc ETFs compare to other ETFs launched in Jan (aka the Class of 2024) in this metric. pic.twitter.com/ngicEdbaTq

— Eric Balchunas (@EricBalchunas) May 16, 2024

Meanwhile, Bitcoin ETFs continue to shape and accelerate the market. Reports indicate that the investment product saw up to $303 million in inflows on Wednesday, following a slow few weeks.

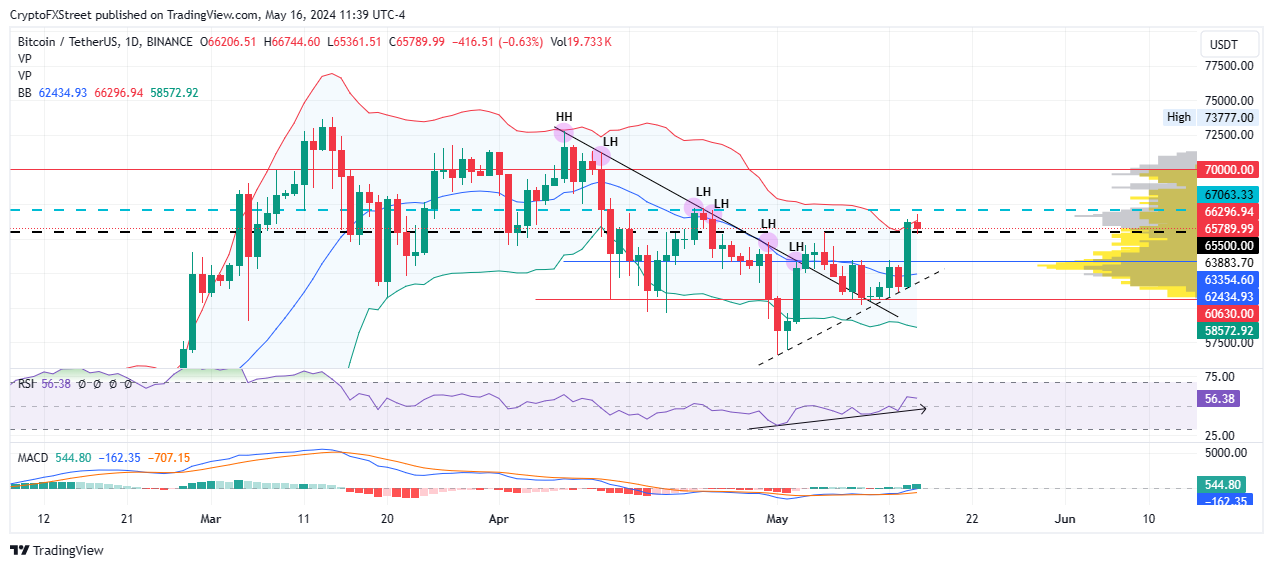

Technical analysis: A flip of $67,063 into support could send Bitcoin price to $73,777 ATH

Bitcoin price bullish bias remains intact as it continues to hold above the $65,500 threshold. The odds continue to favor the upside, but this will only be realized if the bulls can overcome selling pressure near the $67,063 level.

Based on the volume profile, a lot of bearish hands wait to interact with Bitcoin price near the aforementioned level, shown by the gray spikes on the volume profile.

A decisive candlestick close above the $67,063 level on the one-day time frame would set the pace for a continuation to the $70,000 psychological level. In a highly bullish case, the gains could see BTC ascend to clear the $73,777 all-time high.

The Relative Strength Index (RSI) is also recording higher lows, holding well above the mean level of 50. A higher high above the current RSI position could send the BTC price higher. Notably, the Awesome Oscillator (AO) has also moved into positive territory.

The green AO bars signal that the most recent market momentum is bullish. As it has climbed into positive territory, it suggests that the bullish momentum is strengthening. A stable move above the current support level would signify a change in market structure for the pioneer cryptocurrency.

BTC/USDT 1-day chart

Conversely, profit booking could see Bitcoin price drop below $65,500. If the correction extends, only a candlestick close below $57,500, and effectively a lower low below the May 1 bottom would invalidate the bullish thesis.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.