Google announces search engine version powered by generative AI, sector tokens fail to rally

- Google has revealed a search engine version powered by generative AI.

- Astra uses phone cameras and AI for real-time object recognition, finding items, identifying sounds and more.

- While project Astra represents a significant leap in AI integration, AI coins are still bleeding.

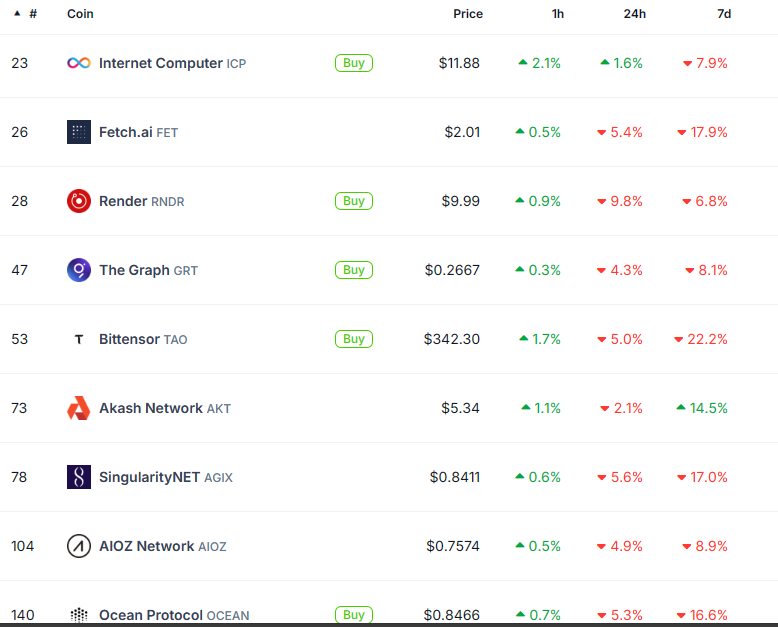

AI and big data crypto projects and tokens are bleeding, data from CoinGecko shows, with the sector bearing the brunt of a market that is devoid of directional bias. The broader altcoin community is in a disarray as traders watch for the next Bitcoin cue.

Also Read: AI crypto coins rally ahead of ChatGPT creator OpenAI plans to announce Google search competitor on Monday

Google announces Astra

Google has revealed Astra, a new search engine version that is powered by generative AI. The tool uses a phone camera and AI for real-time object recognition, finding items, identifying sounds and more. Specifically, the AI assistant uses camera input to identify objects, recognize sounds and recall previous observations. This advancement aims to integrate AI more seamlessly into everyday life.

Project Astra is a prototype from @GoogleDeepMind exploring how a universal AI agent can be truly helpful in everyday life. Watch our prototype in action in two parts, each captured in a single take, in real time ↓ #GoogleIO pic.twitter.com/uMEjIJpsjO

— Google (@Google) May 14, 2024

Beyond Google, OpenAI, the company behind ChatGPT is also set to announce a new market competitor against Google, Reuters reports, citing sources close to the matter. Bloomberg reported that the new search engine tool would be an extension of ChatGPT, adding that it will make it possible for ChatGPT to pull in direct information from the Web and include citations.

Despite the Google announcement, however, AI crypto coins refuse to rally, with CoinGecko data showing sector tokens in the red. However, the Artificial Intelligence (AI) market capitalization today is $29.8 billion, a 14.8% change in the last 24 hours.

AI crypto coins