FLOKI rallies 9% on Tuesday, proposal to burn over 15.2 billion tokens is in the voting process

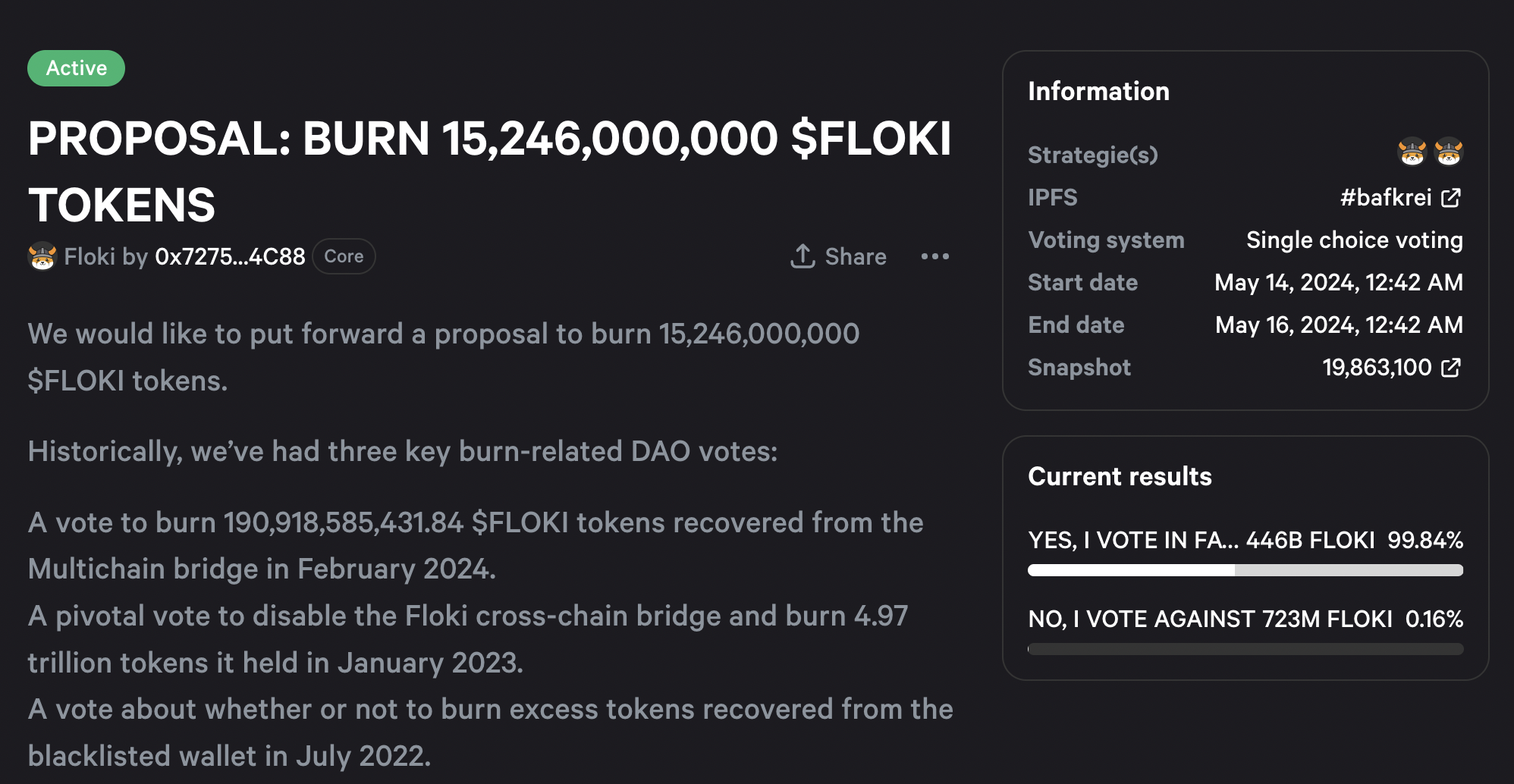

- FLOKI DAO's proposal to burn over 15.2 billion tokens is live and the community is voting.

- The proposal has received a positive response from over 99% of the voters.

- FLOKI added 9% gains on the day, climbing to $0.0001937 on Tuesday.

FLOKI holders are currently voting on a proposal to burn over 15.24 billion tokens, with 99% of the voters in favor of the event. The meme coin rallied 9% on the day on Binance.

The burn proposal is a part of continuous effort of the team to enforce decentralization in the governance of FLOKI.

FLOKI DAO collects votes on burn proposal

FLOKI ranked among trending topics on Grok, Elon Musk-led AI project, per the meme coin’s official tweet. The reason for FLOKI’s relevance among traders is likely the proposal for burning over 15.24 billion tokens worth nearly $3 million.

Typically, token burn is considered bullish for the asset since it reduces the asset’s circulating supply. The community has previously voted on three burn proposals: a burn of 190.91 billion FLOKI in February, 4.97 trillion token burns in January 2023 and July 2022.

In each case, FLOKI DAO members decided upon a burn and it was swiftly executed, reducing the circulating supply of the meme coin. Over 99% of the voters have voted positively on the proposal, per the snapshot. The vote is ongoing and will end on May 16.

FLOKI token burn proposal

The proposal is aligned with the DAO’s objective of transparency.

At the time of writing, FLOKI price is $0.000199, up nearly 9% on Tuesday on Binance. FLOKI surged to a high of $0.000205 earlier on the day before retracing to $0.000199.