Bitcoin price rises as mainland China makes 50% attendance at Hong Kong's BTC Asia conference

- Bitcoin price gained momentum on Monday, attempting higher highs after week-long downtrend.

- A break above $63,354, previous lower high, would be a sign of strength, but $65,500 is more enticing.

- Analysts warn that Bitcoin could trigger 'panic selling’ if it falls below $60,000.

- Mainland China managed 50% attendance at Hong Kong's Bitcoin Asia conference following BTC and ETH ETF approval.

Bitcoin (BTC) price outlook remains subdued on higher periods, but lower time frames show more action. The pioneer cryptocurrency is off to a good start after a show of strength in the Asian session, but things could turn in the US session as happened last week.

Also Read: Week Ahead: Crypto market eyes a bullish turnaround

Daily digest market mover: Mainland China makes 50% attendance at Hong Kong's BTC Asia conference

The Asian session was good for the Bitcoin price on Monday, mostly attributed to the ongoing hype about the Hong Kong exchange-traded funds (ETFs). While the Chinese government prohibits sale of virtual asset-related products to mainland Chinese, a report on the South China Morning Post indicates that Mainland China managed 50% attendance at Hong Kong's Bitcoin Asia conference.

NEW: Hong Kong's #Bitcoin Asia conference saw 50% of attendance from mainland China: South China Morning Post

— Bitcoin Magazine (@BitcoinMagazine) May 13, 2024

The tides are turning pic.twitter.com/Fc6J0aDTux

Pointing to growing interest from mainland China, it fires speculation that trade agreements between China and Hong Kong could allow mainland investors to access spot BTC ETFs in Hong Kong. Given mainland China has been the biggest buyer of Hong Kong ETFs in the past three years, this is a significant move.

Besides Asia, the BTC ETF narrative continues to shape and accelerate markets in the US as well. Recent findings indicate:

- Switzerland's largest bank, UBS, owns 3,600 shares in the BlackRock ETF, filings with the US Securities & Exchange Commission (SEC) show.

- Boston-based Bracebridge Capital has reported owning $433 million worth of Bitcoin through ETFs.

- Bank of Montreal discloses spot BTC ETF holdings in new SEC filing.

As institutional players start to build positions in Bitcoin through the ETF, it suggests the next phase of adoption is underway, where both institutions and governments venture in. The El Salvadorian market is way ahead in this endeavor, launching a website to monitor their national Bitcoin treasury.

EL SALVADOR IS PUTTING ALL OTHER GOVERNMENTS TO SHAME

— Kyle Chassé (@kyle_chasse) May 13, 2024

El Salvador just launched a LEGENDARY website to monitor their national Bitcoin treasury.

I definitely don't see any other governments doing the same thing.

MAJOR TRANSPARENCY & STEP IN THE RIGHT DIRECTION FOR GOVT'S! pic.twitter.com/IGU19COOn3

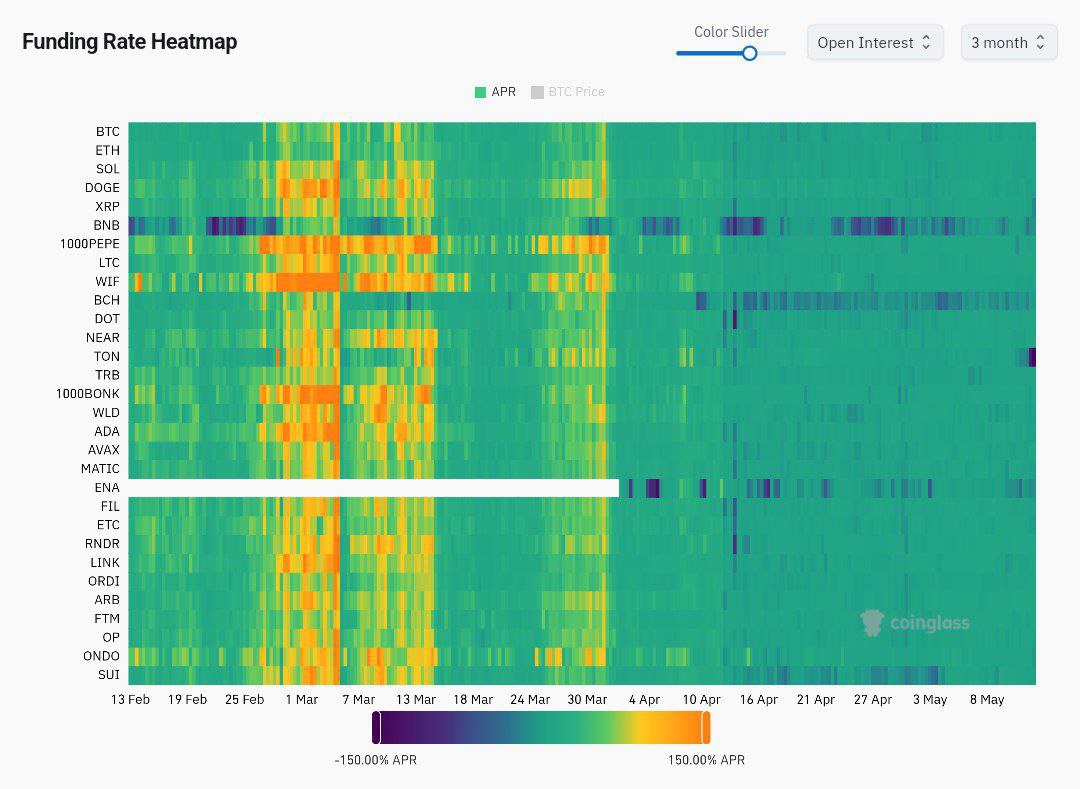

Elsewhere, funding rates continue to flash neutral, which points to a healthier market. Funding rates are the mechanism used in perpetual futures contracts to ensure that the contract price remains in line with the spot price of the underlying asset. These rates are essentially a way to balance out the trading positions between long and short traders.

Funding rate heat map

Technical analysis: Bitcoin attempts change in market structure

Bitcoin price is attempting a change in market structure after breaking above resistance due to a critical trendline. This trendline connects lower highs since April 8. With another trendline providing support since the early May bottom of $56,552, BTC could have a bullish turnaround in the works.

A break above $63,354, the previous lower high, would be a sign of strength, but $65,500 would be a better deal and could attract more bulls. The Relative Strength Index (RSI) is also climbing, pointing to growing buying strength. The Awesome Oscillator (AO) has also flipped positive after maintaining green bars, indicating burgeoning bullish sentiment.

In a highly bullish case where Bitcoin price takes back the $70,000 psychological level, it would make for a change in market structure. This would potentially lead to a move toward range highs at $72,797 again. Beyond this level, BTC could recapture the $73,777 all-time high and possibly set a new peak.

BTC/USDT 4-hour chart

However, analysts warn that Bitcoin price could trigger 'panic selling’ if it falls below $60,000. Traders must, therefore, defend the $60,630 level, below which the cliff could see BTC roll over to the depths of $57,500.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.