Bitcoin price tags $63K as Grayscale’s GBTC ETF experiences first inflow after nearly three deadlock months

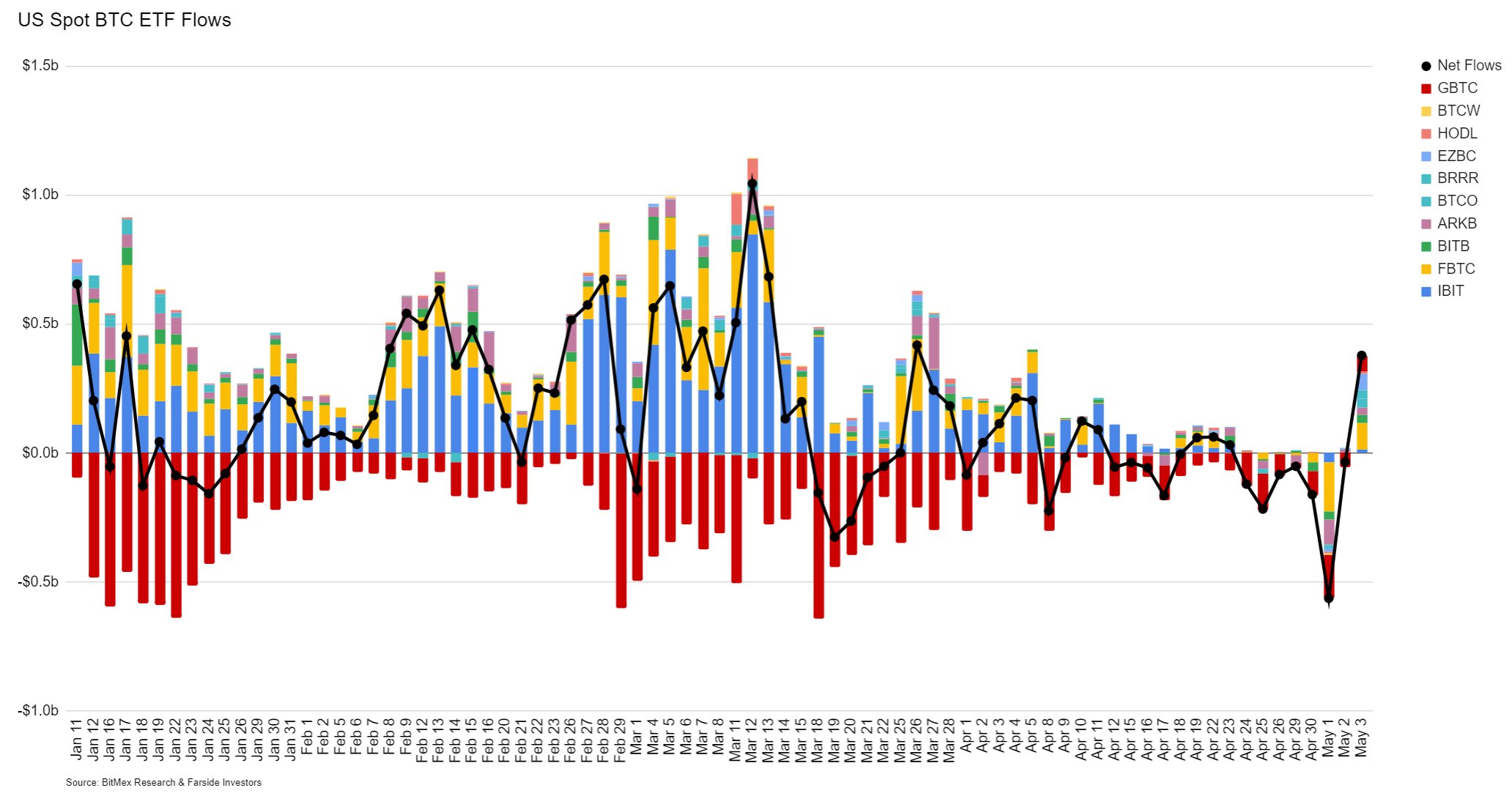

- Grayscale has recorded the first inflow, reaching $63 million after seventy seven consecutive outflow days.

- Spot BTC ETFs had a net inflow of $378.5 million, marking the largest influx in two months.

- Bitcoin price has nicked $63K threshold amid growing positive sentiment for BTC.

Bitcoin (BTC) price has broken above the $63,000 threshold, steadily holding above it despite the weekend lull, as trading volume soars 10%. It comes as spot BTC exchange-traded funds (ETFs) continue to drive demand, shaping and accelerating price action.

Also Read: Bitcoin price back above $60K, whales scoop up BTC as Hong Kong asset managers claim exposure to US spot ETFs

Grayscale records $63 million in inflows

It is a watershed moment for Grayscale trading counters, after their spot BTC ETF, IBIT, recorded the first inflow since the product went live on January 11. Reports indicate that the investment manager recorded inflows of up to $63 million on Friday.

ETF inflows

Since January 11, it is nearly 80 days of spot Bitcoin ETFs trading on Wall Street, with Grayscale only joining the march now. Pointing to a growing interest among institutions, this new capital influx into Grayscale brought the net inflows to $378.5 million on Friday.

Some ascribe the surge in Grayscale’s trading corridors to its upcoming Bitcoin Mini Trust. This is a new mini-fund spot Bitcoin ETF with a significantly lower fee relative to the existing GBTC. The new offering came on the back of increased competition in the Bitcoin ETF market and aims to provide investors with a more cost-effective way to gain exposure to Bitcoin. It will trade under the BTC ticker symbol on the New York Stock Exchange (NYSE).

Markets are still impressed with the inflows into the GBTC ETF, considering the extremely high fees that may have contributed to the absence of investment. Even so, Grayscale continues to market hard, a strategy that could bode well for the GBTC.

Other BTC ETF numbers on Friday

- Blackrock recorded $12.7 million, which marked one of the lowest inflows, but then again they only had one outflow day, unlike others.

- Fidelity recorded $102.6 million.

- Franklin did $60.9 million, marking their best day yet.

These numbers have inspired bullish sentiment in the market, hence the ongoing price recovery as Bitcoin now ranges between $62,000 and $64,000 despite the low trading volumes as is expected in a weekend. If the optimism extends into the new week, the market could lean more toward $70K to 80K than the current expectation of a retracement to $52K.

At the time of writing, Bitcoin price is trading for $63,040, a climb of nearly 6% in the past 24 hours.

BTC/USDT 1-day chart

Read More: Bitcoin Weekly Forecast: Should you buy BTC here?

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.