AAVE proposes a slew of upgrades and expansions in plan for 2030

- Aave has proposed major upgrades like Aave V4, Aave Network, cross-chain liquidity layer, and non-EVM deployments.

- Aave’s plan for 2030 and beyond is to improve users’ experience and enhance protocols to come at par with competitors.

- AAVE price added nearly 2% to its value in the past 24 hours as holders digest the news.

Aave (AAVE) has proposed a Unified Liquidity Layer, V4, and solutions to enhance and compete with zero-knowledge (ZK) networks in its plan for 2030 and beyond. The proposal states that Aave aims to implement its plan together with the community within the next three years.

AAVE price surges as traders digest new plans

According to a temperature check governance proposal on AAVE, the DeFi project has plans to improve and push the protocol at par with zk-based competitors, while improving the experience for users. Aave has lined up several changes and proposed to implement them within a three year timeline since Aave Labs is confined to this time period.

The proposal is likely met with enthusiasm in the community, AAVE price added nearly 2% to its value in the past 24 hours. The community has responded to the proposal, calling it “an epic advancement”, “great proposal.” It has also poised some questions, pushing for granular details in the plan.

Introducing Aave 2030 pic.twitter.com/ZncA5YqHaT

— Aave Labs (@aave) May 1, 2024

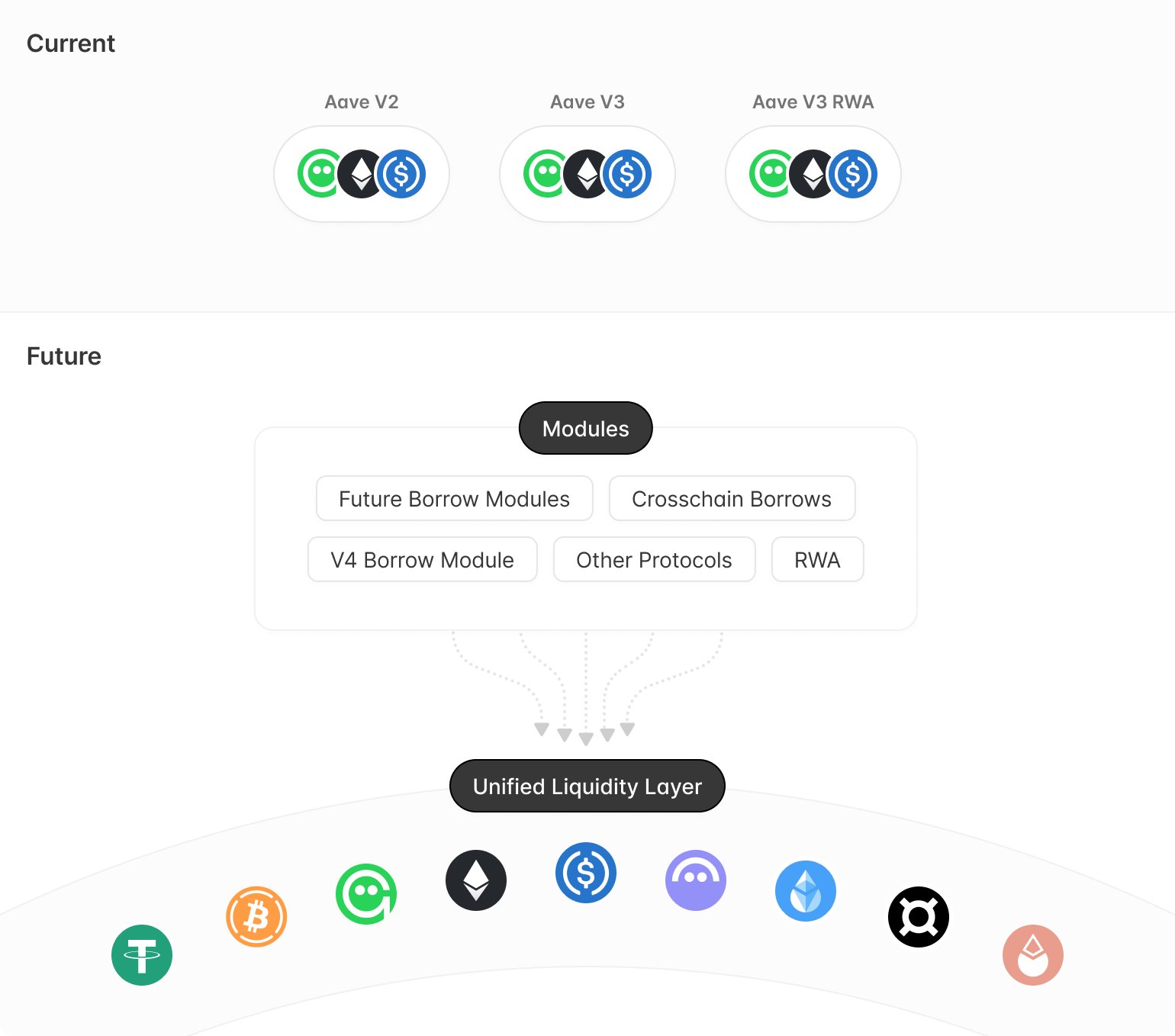

AAVE 2030 and beyond proposes a Unified Liquidity Layer, among other key features. This makes liquidity management more efficient and enables the migration of liquidity, making it easier on users.

Unified Liquidity Layer

Aave’s version 4 would implement automated interest rate adjustments based on market conditions, optimizing the experience for both borrowers and liquidity suppliers. Aave proposes to achieve this using Chainlink’s feeds, and V4’s liquidity premiums would adjust borrowing costs to ensure fair pricing for all.

Aave has proposed a three-year timeline and no further details have been provided. A detailed plan is expected once the temperature check is complete.