Is Extreme Fear a Buy Signal? New Data Questions the Conventional Wisdom

Crypto market sentiment has fallen into “Extreme Fear” territory as asset prices continue to decline amid mounting macroeconomic and geopolitical pressures.

While some investors view such periods as potential opportunities to buy the dip, one analyst suggests that extreme caution may not necessarily translate into optimal entry points.

“Bitcoin Going to Zero” Searches Reach All-Time High Amid Extreme Market Fear

According to the latest data, the Crypto Fear & Greed Index, a widely used sentiment indicator that measures market mood on a 0–100 scale, stands at 9 today. This marks a slight recovery from 8 yesterday and an extreme low of 5 last week.

Despite the modest uptick, the latest reading suggests the market remains firmly in “Extreme Fear” territory.

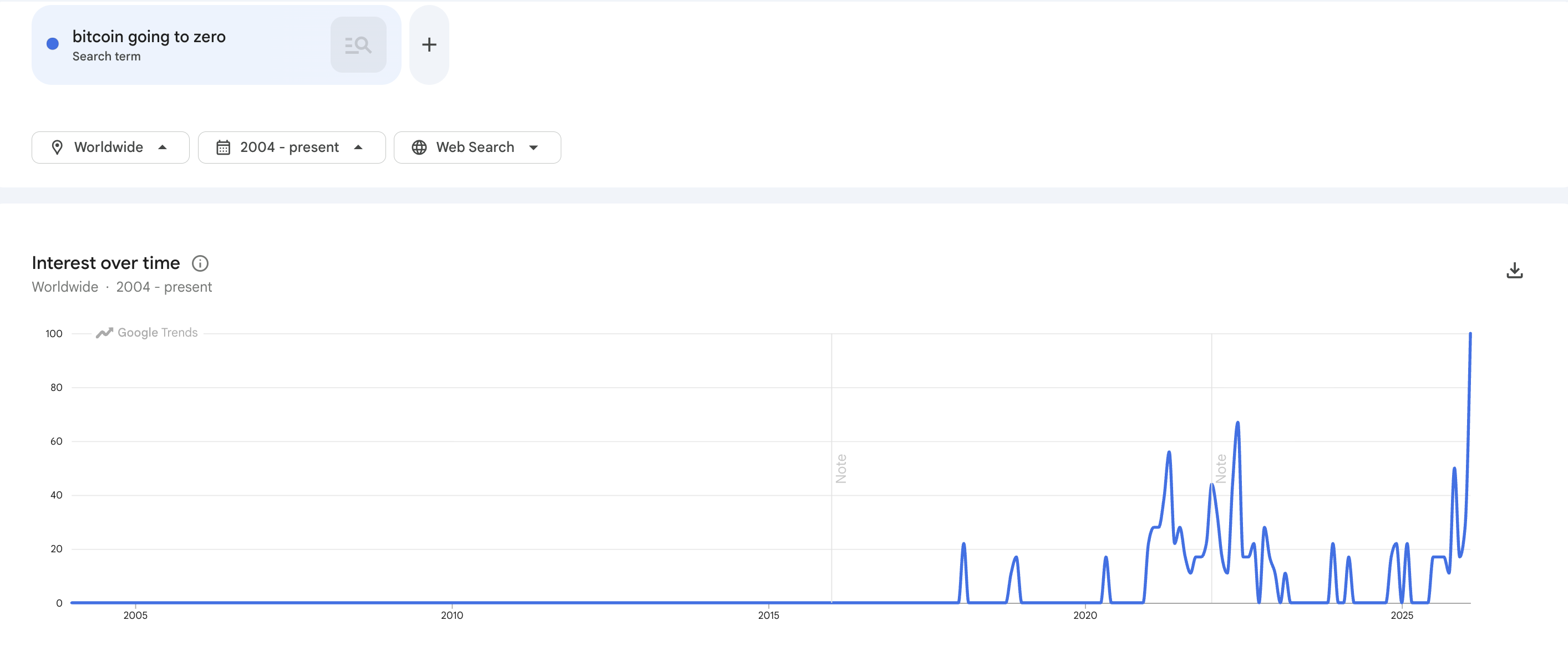

Meanwhile, investor anxiety is also reflected in search behavior. Google Trends data shows that searches for “Bitcoin going to zero” have reached their highest level on record, surpassing previous market downturns.

The search interest score hit 100, indicating peak retail curiosity and heightened concern among participants.

Search Interest for “Bitcoin going to zero.” Source: Google Trends

Search Interest for “Bitcoin going to zero.” Source: Google Trends

However, several market analysts argue that periods of extreme pessimism often represent buying opportunities.

Previously, Santiment noted that spikes in negative sentiment often occur when prices decline fast. According to the analytics firm, widespread predictions of collapse and narratives centered around terms like “down,” “selling,” or “going to $0” are often interpreted as signs of retail capitulation, when shaken confidence pushes weaker hands out of the market.

“And once you see the predictions of doom for cryptocurrency, it’s generally the best time to officially buy the dip,” Santiment stated.

Bitcoin’s Best Returns Came During Extreme Greed, Not Fear, Data Shows

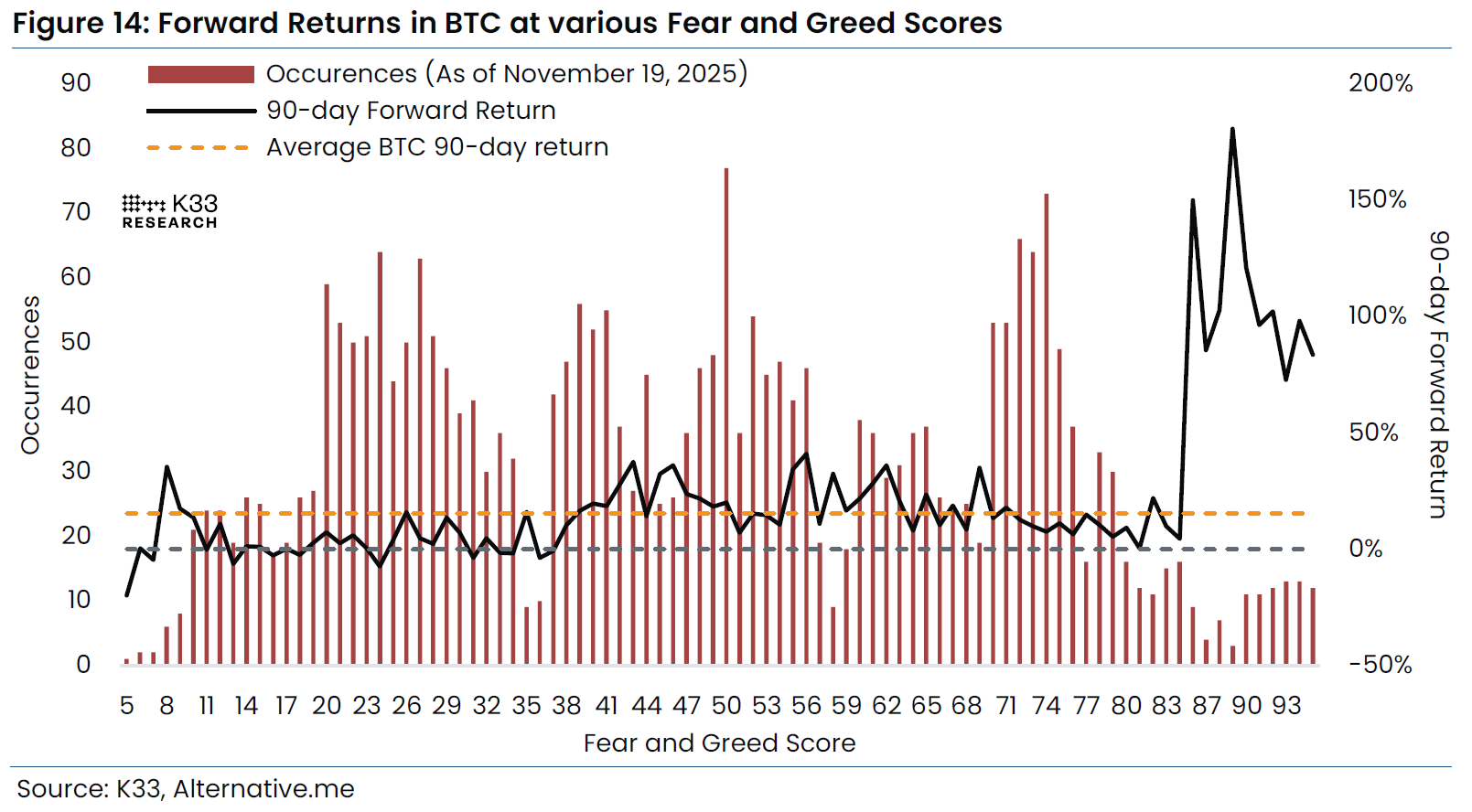

Nonetheless, Nic Puckrin, investment analyst and co-founder of Coin Bureau, questioned the traditional narrative to buy Bitcoin during extreme fear.

“Buying BTC in ‘Extreme Fear’ is NOT the best call,” he said.

Puckrin argued that the data complicates the widely held belief that extreme fear automatically signals an attractive entry point. His analysis shows that when the Fear & Greed Index drops below 25, the average 90-day forward return has historically been just 2.4%.

Bitcoin 90-Day Forward Returns Show Dramatically Higher Performance During Extreme Greed Periods. Source: X/Nicrypto

Bitcoin 90-Day Forward Returns Show Dramatically Higher Performance During Extreme Greed Periods. Source: X/Nicrypto

By comparison, buying in periods categorized as “Extreme Greed” has delivered substantially stronger performance, with average 90-day returns reaching as high as 95%. The findings suggest that momentum and sustained bullish conditions, rather than peak pessimism, have historically aligned with stronger forward returns.

“The F&G index is nothing but a backward-looking momentum indicator. It’s less relevant for predicting returns,” he added.

However, several analysts quickly questioned his choice of timeframe. Critics argue that a 90-day window is too narrow. One market watcher noted that while returns may appear modest three months after an extreme fear reading, the longer-term picture tells a different story.

“You can see that 12 months after extreme fear- Bitcoin has averaged over 300% gains historically. The F&G index isn’t a 90-day signal. It’s a 12-month accumulation alert. You’re not supposed to feel rich immediately after buying extreme fear,” a user replied.

Ultimately, whether this moment represents opportunity or risk may depend less on sentiment itself and more on an investor’s time horizon and strategy.