Bitcoin Falls, Dollar & Bonds Rally On Hawkish Fed Minutes

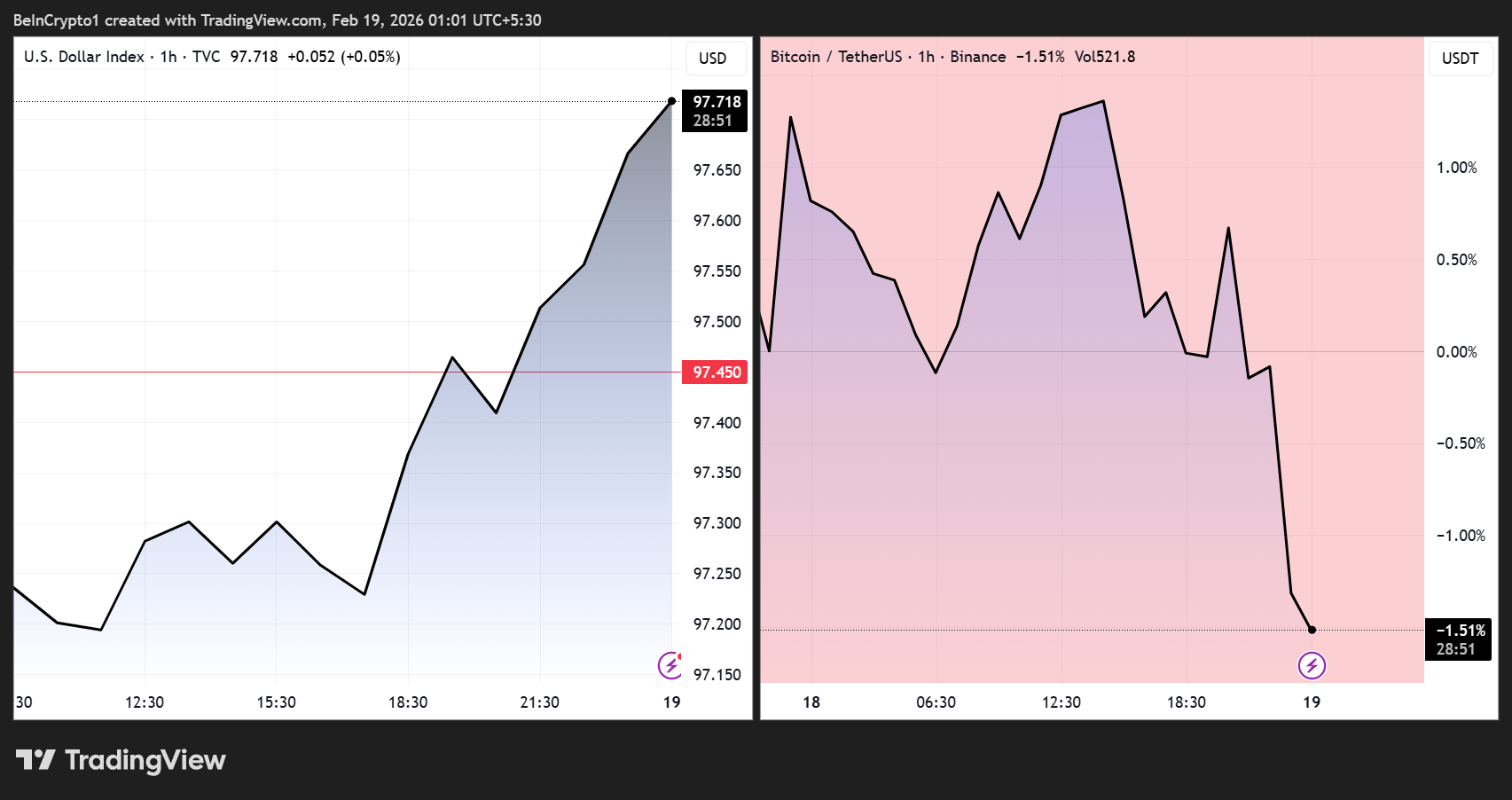

Bitcoin has emerged as the biggest underperformer since the release of the FOMC minutes for the January 28 meeting, while the US dollar index and bonds rally.

The January FOMC meeting, which saw two dovish dissents, reflected a deeply divided Federal Reserve (Fed).

Fed Minutes Reveal Hawkish Divide as Bitcoin Struggles

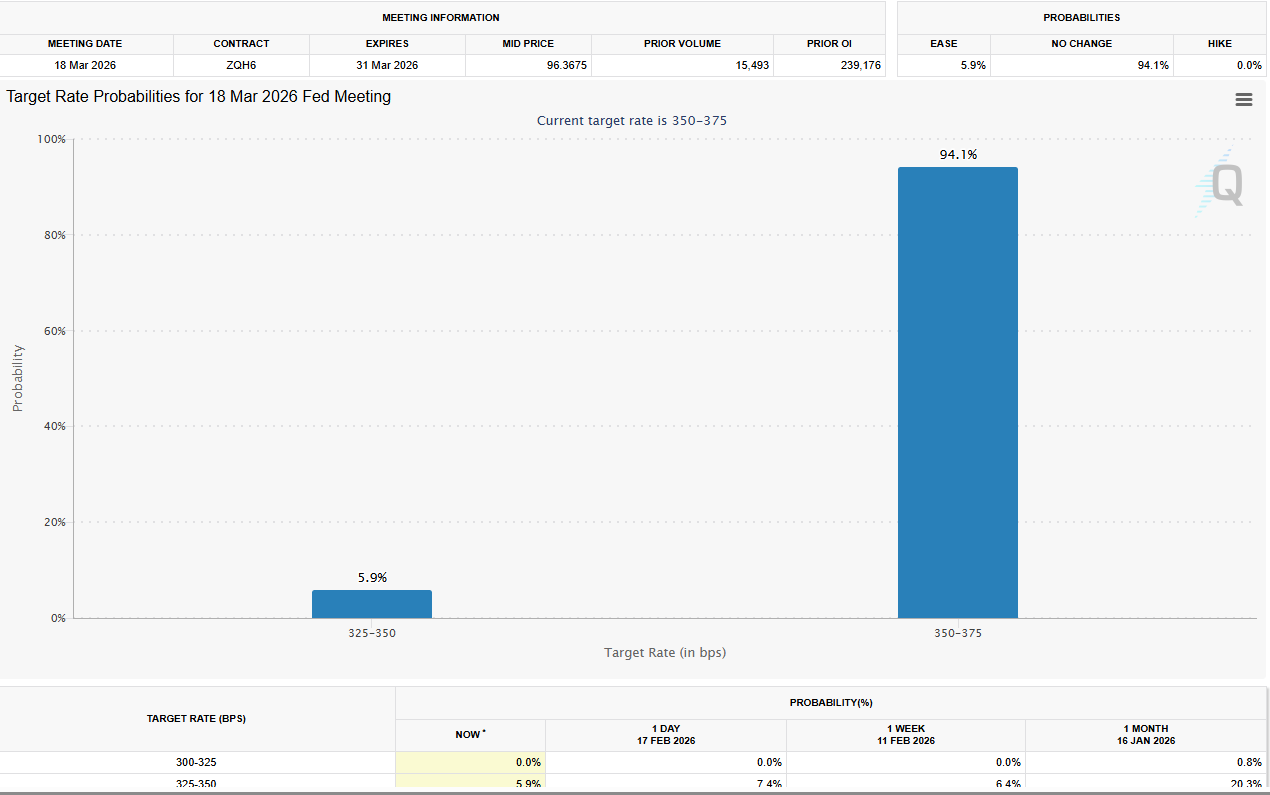

Almost all policymakers supported maintaining the federal funds rate at 3.50–3.75%, though a couple preferred a 25-basis-point cut, citing restrictive policy and labor market risks.

Several officials indicated that further rate cuts could be warranted if inflation declines as expected. Meanwhile, others cautioned that easing too early amid elevated inflation could compromise the Fed’s 2% target.

Some advocated for “two-sided” guidance, highlighting that rates might need to rise if inflation remains above target.

Recent macroeconomic data have reinforced Fed Chair Jerome Powell’s cautiously optimistic outlook.

Growth has surprised to the upside, inflation appears to be drifting lower, and the job market shows signs of steadying.

These developments have pushed 2026 rate-cut expectations higher, though a move in March is effectively off the table following last week’s stronger-than-expected payroll report.

Interest Rate Cut Probabilities. Source: CME FedWatch Tool

Interest Rate Cut Probabilities. Source: CME FedWatch Tool

Market vulnerabilities were also a focal point, with multiple participants noting risks in private credit and the broader financial system.

Analysts suggest that these concerns, combined with the Fed’s hawkish undertones, have contributed to safe-haven buying in bonds and the dollar, while Bitcoin continues to face downward pressure.

Dollar Index (DXY) and Bitcoin Price Performance. Source: TradingView

Dollar Index (DXY) and Bitcoin Price Performance. Source: TradingView

Equities showed modest gains, with the Dow Jones Industrial Average up 0.24%, the S&P 500 up 0.59%, and the NASDAQ up 1.00%, reflecting cautious optimism in markets amid signals from the Fed.

“The minutes show a Fed still divided but attentive to both inflation risks and growth momentum,” said a senior market strategist. “Bitcoin’s underperformance is partly a reflection of risk-off sentiment and the dollar’s continued strength.”

Investors will now watch for any further commentary from Fed officials as markets digest these minutes, weighing the balance between hawkish vigilance and dovish optimism in shaping 2026’s monetary policy trajectory.