Avalanche Price Forecast: AVAX slips below $9 as record ETF inflow fails to lift sentiment

- Avalanche price slips below $9 on Wednesday, extending its correction over the past four days.

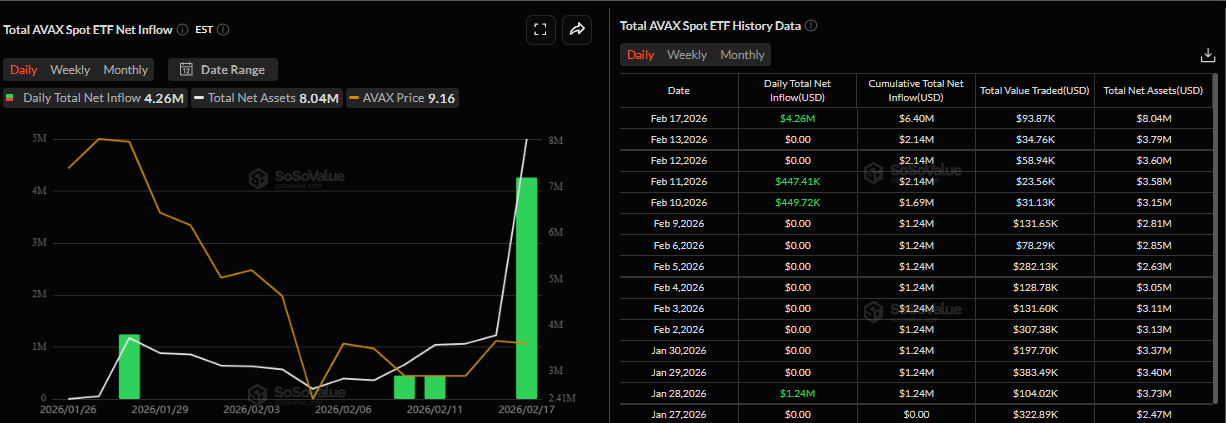

- VanEck’s spot ETF VAVX recorded an inflow of $4.26 million on Tuesday, the highest single-day inflow since its launch.

- Mixed signals from on-chain and derivatives continue to weigh on AVAX price recovery.

Avalanche (AVAX) price trades below $9 at the time of writing on Wednesday, printing its fourth consecutive daily loss. The drop comes despite VanEck’s spot Exchange Traded Fund (ETF) VAVX recording its highest single-day inflow on Tuesday since launch in January, highlighting a disconnect between institutional flows and short-term price action. Meanwhile, mixed signals from on-chain and derivatives metrics continue to weigh on AVAX’s price recovery.

Institutional demand fails to support AVAX price

The SoSoValue chart below shows that VanEck's spot ETF, VAVX, recorded a $4.26 million inflow on Tuesday, marking its highest single-day inflow since its launch in January. Despite this institutional demand, AVAX price action failed to respond positively, underscoring persistent selling pressure and limited conviction among traders.

Mixed signals cap recovery

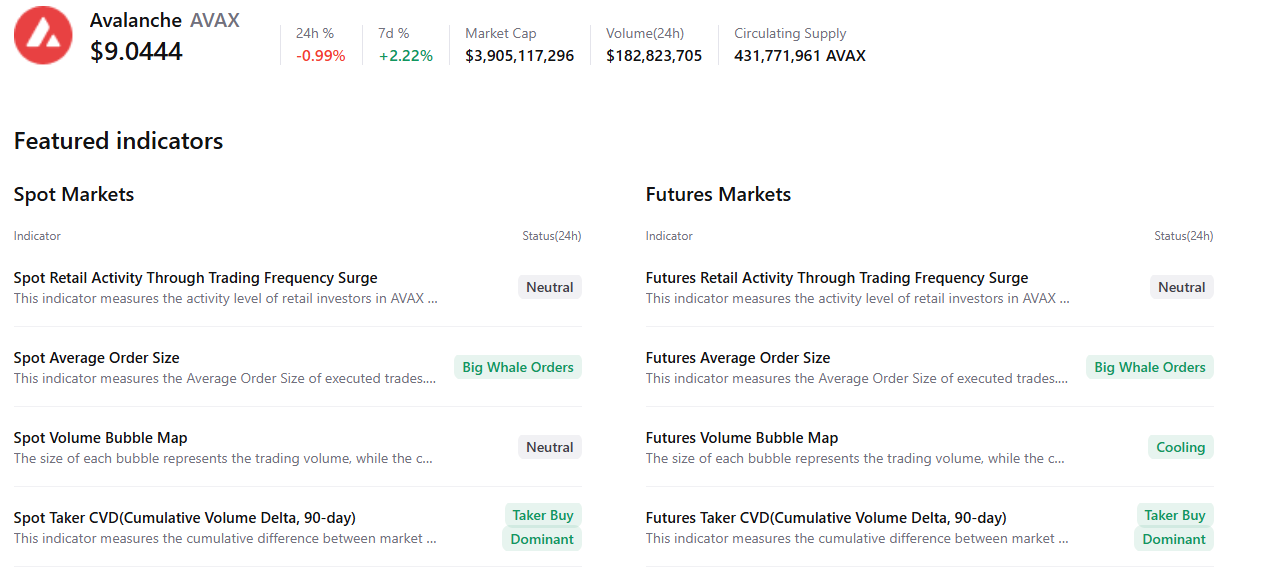

CryptoQuant summary data indicate early signs of bullishness, with large whale orders, cooling conditions and buy-side dominance across both spot and futures markets. All these factors support a potential price recovery for Avalanche.

On the derivatives side, Avalanche futures Open Interest (OI) falls to $397 million on Wednesday, having declined steadily since mid-January, and it is nearing the February 11 low of $378 million. This drop in OI reflects waning investor participation and projects a bearish outlook.

However, the funding rates for AVAX support a positive outlook. The metric turned positive on Monday and stands at 0.0052% on Wednesday. The positive rates suggest that longs are paying shorts, suggesting bullish sentiment toward AVAX.

This combination of on-chain and derivatives suggests indecision among investors and limits the chances of a sustained recovery.

Avalanche Price Forecast: AVAX could revisit the $7.55 low

Avalanche price found support around the daily support at $8.78 on Feburary 11 and recovered over 11% in the next three days. However, on Sunday, AVAX failed to sustain the recovery and has since declined nearly 5% through Tuesday. As of writing on Wednesday, AVAX is trading at $9.08.

If AVAX continues its correction, it could extend the decline toward the daily support at $8.78. A close below this level could extend losses toward the February 6 low at $7.55.

The Relative Strength Index (RSI) reads 37, below the neutral level of 50 and points downward, indicating bearish momentum gaining traction. However, the Moving Average Convergence Divergence (MACD) showed a bullish crossover on Friday, which remains in place, suggesting that upside bias has not been invalidated yet.

If AVAX recovers, it could extend the advance to the key psychological level at $10.