XRP Builds Pressure as Holders Accumulate — Is a Break Above $2 Next?

XRP is attempting to regain upward momentum after weeks of consolidation. Recent price action suggests a potential breakout from a bullish triangle pattern.

Market conditions remain critical for confirmation. While volatility persists across the broader cryptocurrency market, XRP’s structure indicates building pressure.

XRP Holders Support The Breakout

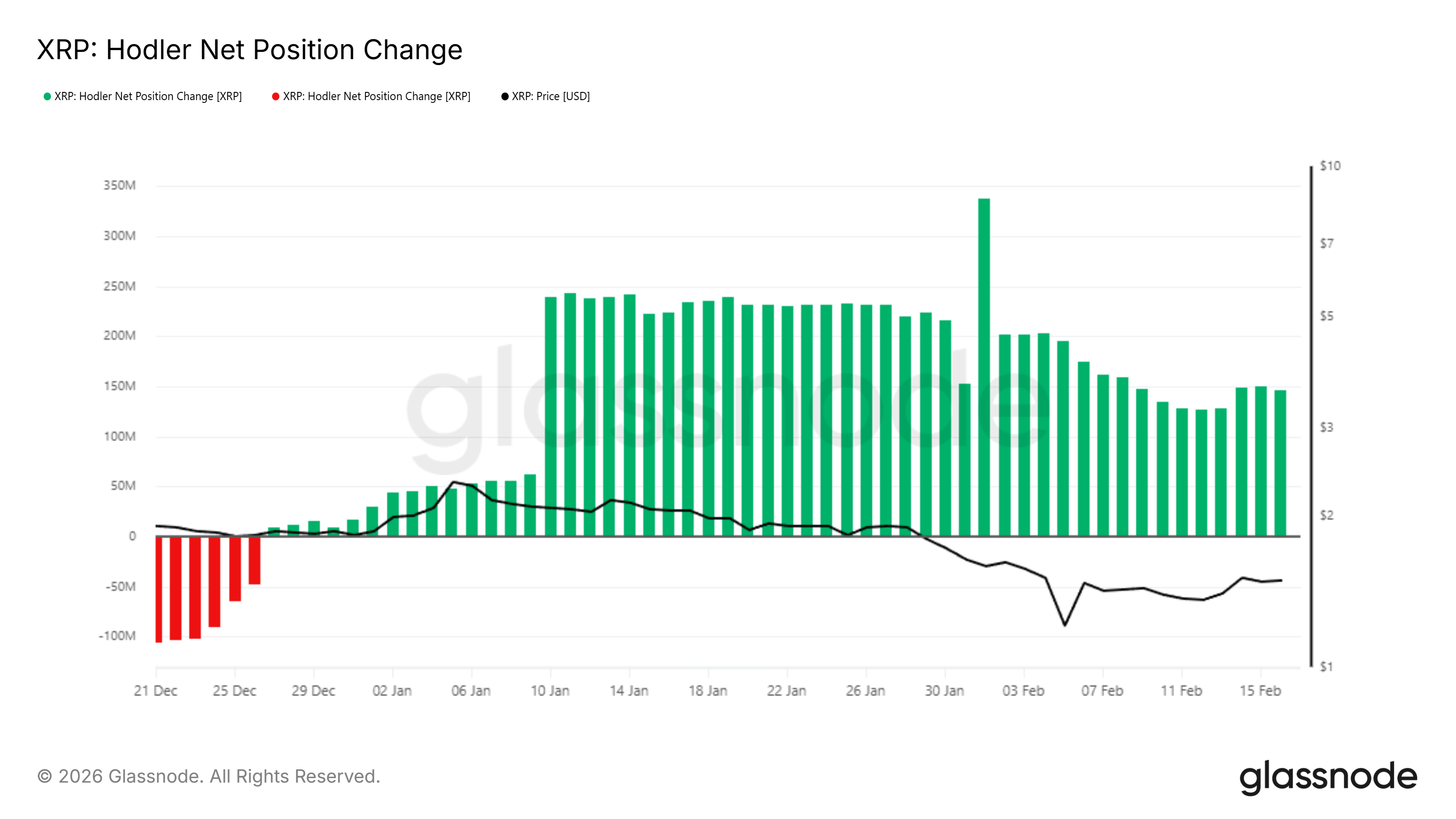

On-chain data shows steady support from long-term XRP holders. The HODLer Net Position Change metric currently reflects consistent accumulation. Green bars on the indicator signal capital inflows into long-term wallets.

This pattern suggests conviction among experienced investors. Long-term holders tend to accumulate during consolidation phases. Their support can stabilize the price during uncertainty. Sustained inflows strengthen the probability of a breakout by reducing available supply on exchanges.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP HODLer Net Position Change. Source: Glassnode

XRP HODLer Net Position Change. Source: Glassnode

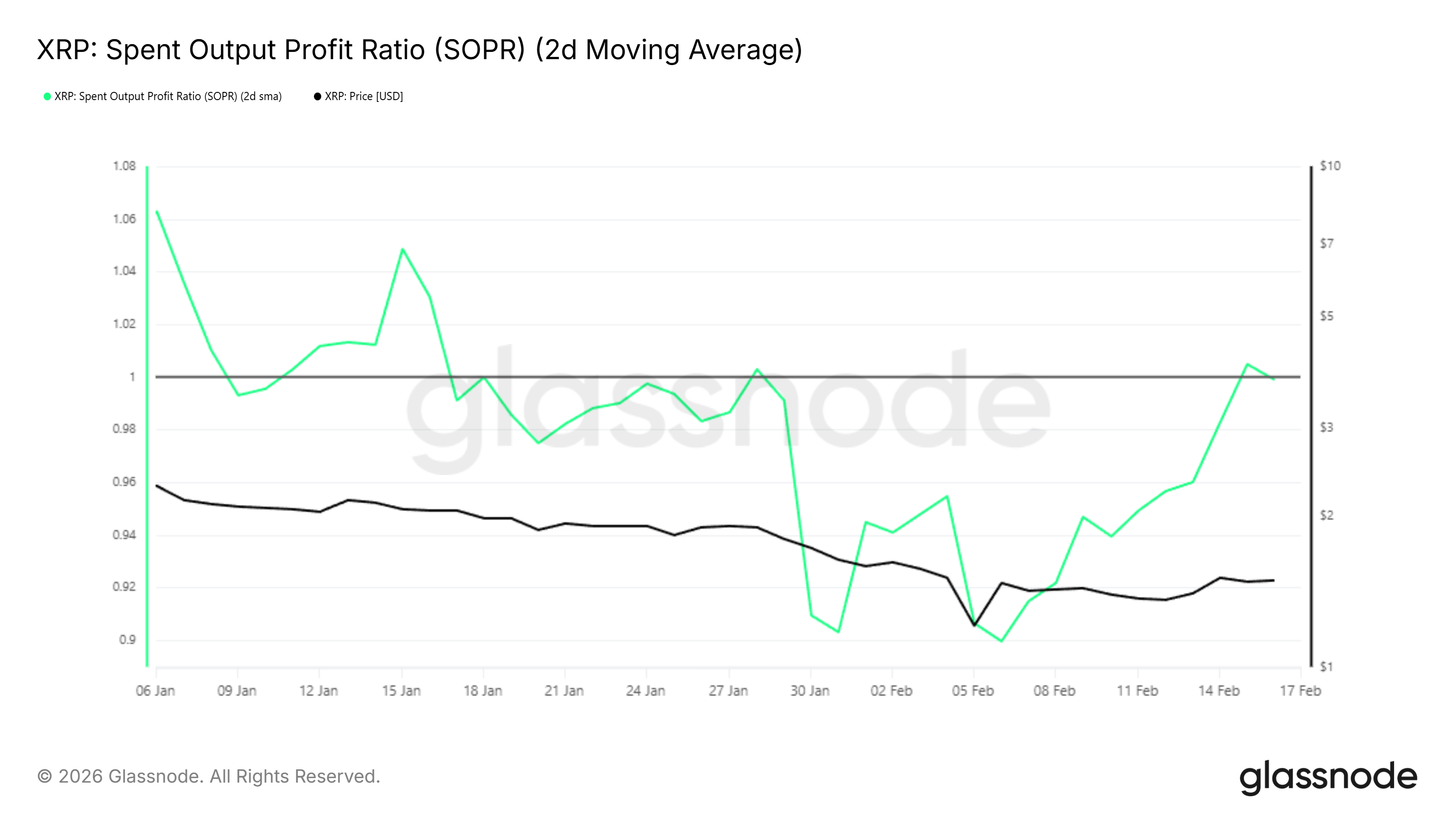

Another key indicator, the Spent Output Profit Ratio, or SOPR, provides further insight. SOPR measures whether investors are selling at a profit or a loss. A reading below 1.0 signals realized losses, while a reading above it reflects profitable selling.

XRP’s SOPR has climbed back above 1.0. This shift indicates investors are no longer capitulating at losses. Instead, they are transacting at profit levels. Improving profitability often restores confidence and encourages healthier capital rotation, which can support upward price movement.

XRP SOPR. Source: Glassnode

XRP SOPR. Source: Glassnode

XRP Price Levels To Watch

XRP is currently forming a symmetrical triangle pattern. Technical analysis projects a potential 33% breakout if resistance levels are breached. For now, confirmation requires a sustained move above $1.70. Without this breakout, the price remains within the consolidation boundaries.

A move past $1.58 would signal early breakout momentum. Strong investor support could then help XRP flip $1.70 into a new support level. If sustained buying pressure continues, the altcoin may advance beyond $1.80, reinforcing bullish technical structure.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

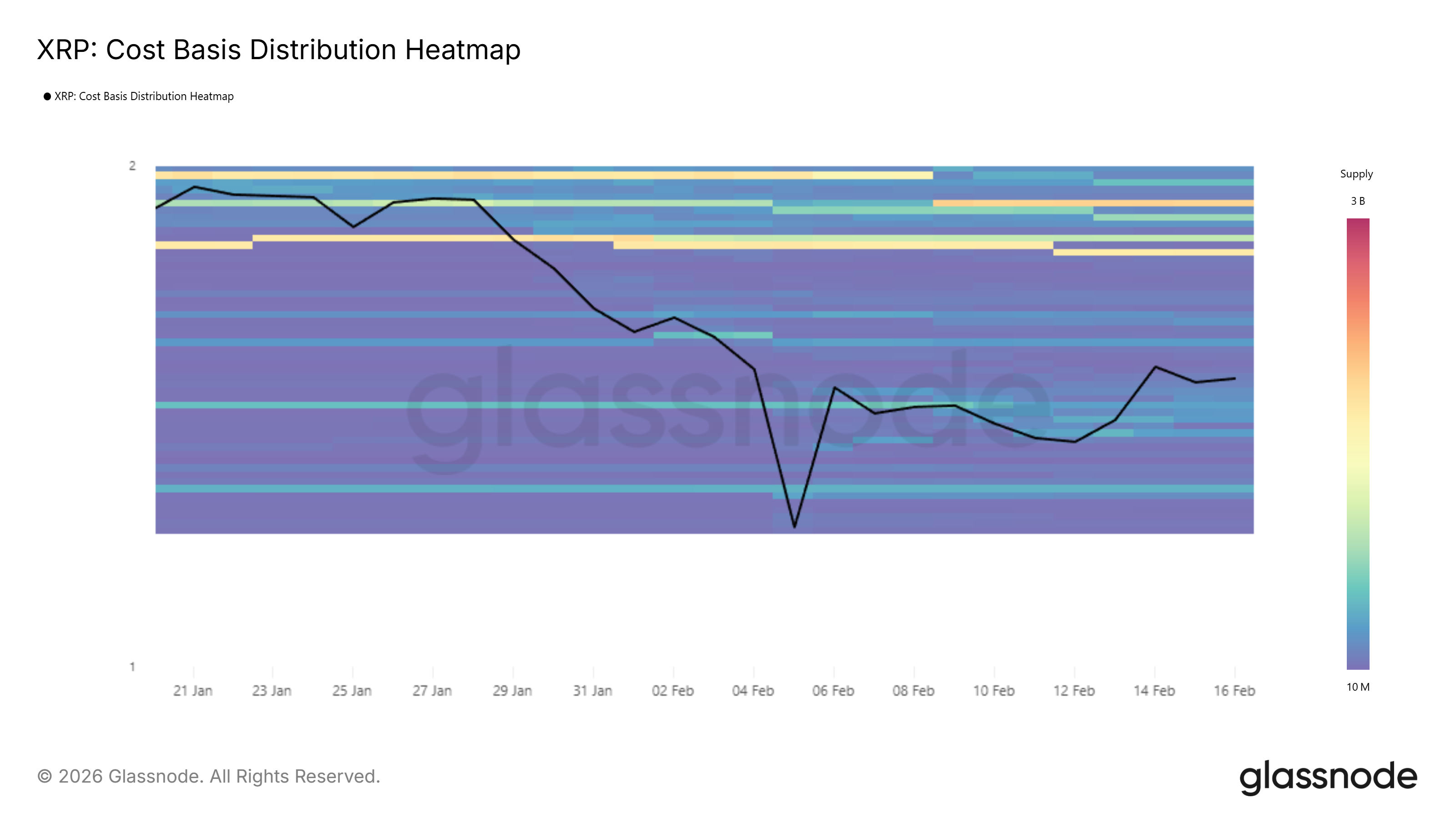

However, resistance remains a concern. The CBD Heatmap indicates notable supply concentration between $1.76 and $1.78. Many investors accumulated XRP in this range. As price revisits these levels, some may sell to offset losses, potentially limiting upward momentum.

XRP CBD Heatmap. Source: Glassnode

XRP CBD Heatmap. Source: Glassnode

If bullish momentum fails entirely, downside risk increases. A rejection could push XRP below the $1.47 support level. Such a move may lead to renewed consolidation above $1.37, similar to patterns observed in early February. This scenario would invalidate the near-term bullish thesis.