3 Dirt Cheap Stocks to Buy With $1,000 Right Now

Key Points

Sprouts Farmers Market aims to succeed by addressing consumers' desires for healthier food.

Progressive is faring far better than the market’s giving the insurer credit for these days.

Despite PayPal’s recent plunge, it may now be seeing the bottom of a long-lived pullback.

- 10 stocks we like better than Progressive ›

Investors have been forced to get comfortable with richly priced stocks of late. After all, they're the only ones that have been performing well. If you're willing to do a little digging though, you'll find a handful of names worth owning that have actually fallen back to dirt-cheap valuations.

Here's a closer look at three of these best bets in the market today.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

Sprouts Farmers Market

It's been a wild ride for Sprouts Farmers Market (NASDAQ: SFM) since 2024. The stock soared that year thanks to the health-minded grocery chain's growth. Since peaking in the middle of last year, SFM stock has tumbled more than 60%, reaching a two-year low just this month.

The sellers, however, have arguably overshot their target. The stock is now priced at less-than 12 times this year's very plausible, projected per-share profit of $5.74, up from 2025's likely full-year comparison of $5.27. The stock's also currently trading 60% below analysts' current consensus price target of $108.73.

The crux of the bullish argument here, of course, is the growth of its core business. While consumers tend to talk about eating healthier more than they actually do it (recent Pew Research says cost and taste are still the most important factors), industry research outfit Technavio predicts the health and wellness food business is poised to grow by nearly 10% per year through 2029.

Progressive

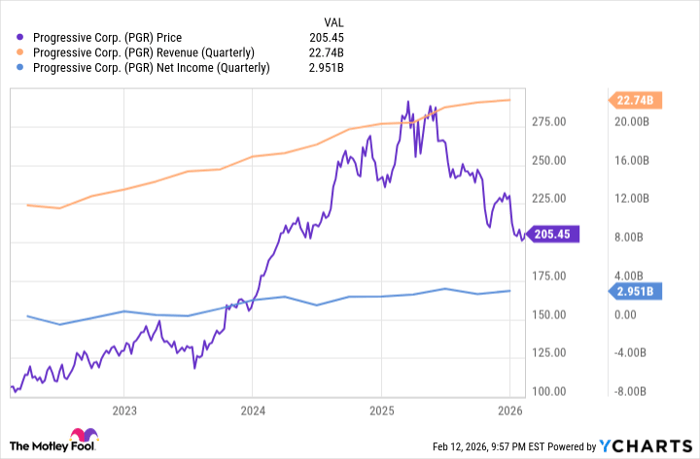

The insurance business can be a tricky one for insurers to navigate. Reimbursements are practically impossible to predict with any precision from one year to the next, while competitive and regulatory factors are forever changing. That's one of the big reasons shares of insurer Progressive (NYSE: PGR) have struggled for nearly a year now -- its revenue growth seems to be slowing.

As was the case with Sprouts, the bears may have overshot their target and done so for a misunderstood reason. You can step into this name at less-than 13 times the coming year's projected earnings. Perhaps just as compelling, you can step into it while the stock's forward-looking dividend yield stands at just under 6.7%.

And the misunderstanding? While this company's rate of revenue growth may be slowing, on a whole-dollar basis, it's making as much (no word play intended) progress as it ever has.

PGR data by YCharts.

It's also worth adding that while the insurance business can be volatile from one year to the next, for multi-year time frames, it tends to do reliably well. These companies' actuaries have gotten very, very good at the industry's mathematics.

PayPal

Lastly, while there's no denying PayPal's (NASDAQ: PYPL) growth is slowing down as the well-matured digital payment space becomes even more crowded with new competition, the market seems to be pricing in an outright collapse that just isn't in the cards. As of the latest look, PayPal stock is valued at less-than eight times this year's expected profits of $5.34 per share.

Do keep your expectations in check. Again, the digital wallet space has become fiercely competitive. Single-digit revenue growth is the new norm here.

Just respect the fact that the original powerhouse of this space still enjoys a commanding control of about 40% of the online payment market. Incoming CEO Enrique Lores -- currently CEO of HP -- will have a great foundation to start with when he takes the helm next month and brings some fresh ideas and perspective to the table. This may be exactly what PayPal's been needing for a while now.

Should you buy stock in Progressive right now?

Before you buy stock in Progressive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Progressive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 16, 2026.

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends HP, PayPal, Progressive, and Sprouts Farmers Market. The Motley Fool recommends the following options: long January 2027 $42.50 calls on PayPal, long January 2028 $75 calls on Sprouts Farmers Market, short January 2028 $85 calls on Sprouts Farmers Market, and short March 2026 $65 calls on PayPal. The Motley Fool has a disclosure policy.