Expert Says Bitcoin Price Has Topped And Is In Exponential Decay, Why This Is Not A Bad Thing

Crypto expert Peter Brandt has boldly claimed that the Bitcoin top for this market cycle may already be in. He made this conclusion based on his “exponential decay” thesis, which he noted may actually be good for the Bitcoin ecosystem.

Why Bitcoin’s Price Has Topped

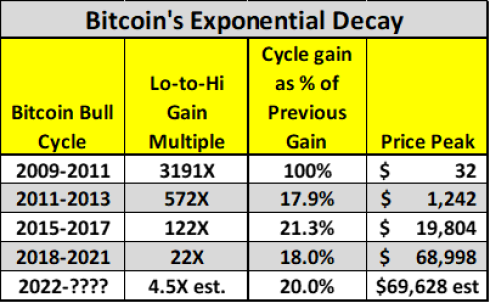

Brandt explained that historical data suggests that Bitcoin’s price has topped. He further alluded to an “exponential decay,” which he noted could be used to describe Bitcoin. Brandt’s exponential decay thesis is based on the fact that Bitcoin’s percentage gain has significantly reduced in every subsequent bull cycle.

For context, Bitcoin, according to the crypto expert, recorded a 122x increase from its market low to market high between 2015 and 2017. However, that was only 21.3% of Bitcoin’s price gain in the previous cycle (between 2011 and 2013).

Source: X

Brandt further noted that the same thing happened between 2018 and 2021. Despite a 22x increase from its market low to market high, Bitcoin only recorded 18% of the price increase it saw in the previous cycle. Having laid this premise, the crypto expert concluded that this market cycle shouldn’t be any different as Bitcoin will likely see about 20% of the price gain recorded in the previous cycle.

Taking $15,473 as the market low for this cycle, he noted that 20% of the previous cycle’s gain would mean that the market high for this cycle was supposed to be $72,723, a price level that Bitcoin already hit on its way to a new all-time high (ATH) of $73,750.

Meanwhile, the crypto expert acknowledged that Bitcoin historically records its most price gains after the Bitcoin halving, which just recently occurred. However, he added that the crypto community has to deal with the fact of the exponential decay, which has made him believe there is a 25% chance that Bitcoin has already topped this cycle.”

Why The Exponential Decay Might Be Bullish For Bitcoin

Brandt mentioned that Bitcoin would likely drop to the mid $30,000 or its 2021 lows if it has indeed topped. He, however, added that this decline could be the “most bullish thing that could happen from a long-term view.”

Related Reading: Brace For Price Impact: Dogecoin Whales Move Massive 456 Million DOGE To Exchanges

From a “classical charting point of view,” the crypto expert hinted that Bitcoin was still primed for major parabolic moves to the upside, even though it doesn’t happen now.

He also shared an example of what Bitcoin’s chart could look like when this move happens with the crypto token rallying above $100,000. Brandt also alluded to Gold’s chart from August 2020 to March 2024 as an example of what Bitcoin’s price action could look like soon enough. Interestingly, he recently predicted that Bitcoin will soon be “King over Gold.”